- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1335

Sheen Tai Holdings Group Company Limited's (HKG:1335) Shares Leap 102% Yet They're Still Not Telling The Full Story

Sheen Tai Holdings Group Company Limited (HKG:1335) shares have continued their recent momentum with a 102% gain in the last month alone. The last month tops off a massive increase of 129% in the last year.

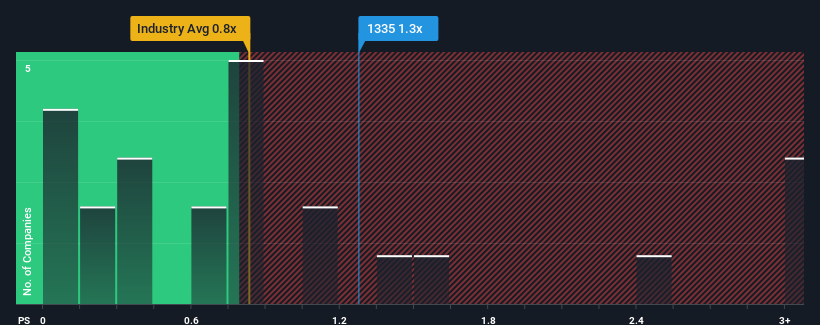

Although its price has surged higher, you could still be forgiven for feeling indifferent about Sheen Tai Holdings Group's P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Packaging industry in Hong Kong is also close to 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Sheen Tai Holdings Group

How Has Sheen Tai Holdings Group Performed Recently?

With revenue growth that's exceedingly strong of late, Sheen Tai Holdings Group has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Sheen Tai Holdings Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Sheen Tai Holdings Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Sheen Tai Holdings Group's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sheen Tai Holdings Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 34% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 20%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Sheen Tai Holdings Group's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Sheen Tai Holdings Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Sheen Tai Holdings Group's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Plus, you should also learn about these 2 warning signs we've spotted with Sheen Tai Holdings Group (including 1 which is potentially serious).

If you're unsure about the strength of Sheen Tai Holdings Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1335

Sheen Tai Holdings Group

An investment holding company, engages in the trading of semi-conductors in Hong Kong and Mainland China.

Flawless balance sheet low.

Market Insights

Community Narratives