- Hong Kong

- /

- Hospitality

- /

- SEHK:1180

Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets grapple with uncertainties surrounding trade policies and inflation, Asian economies are navigating these challenges with a focus on growth and stability. Amidst this backdrop, dividend stocks in Asia can offer investors potential for steady income streams, providing a cushion against market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.63% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.82% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.09% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.07% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| PAX Global Technology (SEHK:327) | 9.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.32% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

Click here to see the full list of 1139 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Paradise Entertainment (SEHK:1180)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paradise Entertainment Limited is an investment holding company that primarily offers casino management services in Macau, the People’s Republic of China, and the United States, with a market capitalization of HK$2.76 billion.

Operations: Paradise Entertainment Limited generates revenue through three main segments: Gaming Systems (HK$121.46 million), Casino Management Services (HK$681.22 million), and Innovative and Renewable Energy Solutions Business (HK$10.15 million).

Dividend Yield: 3.8%

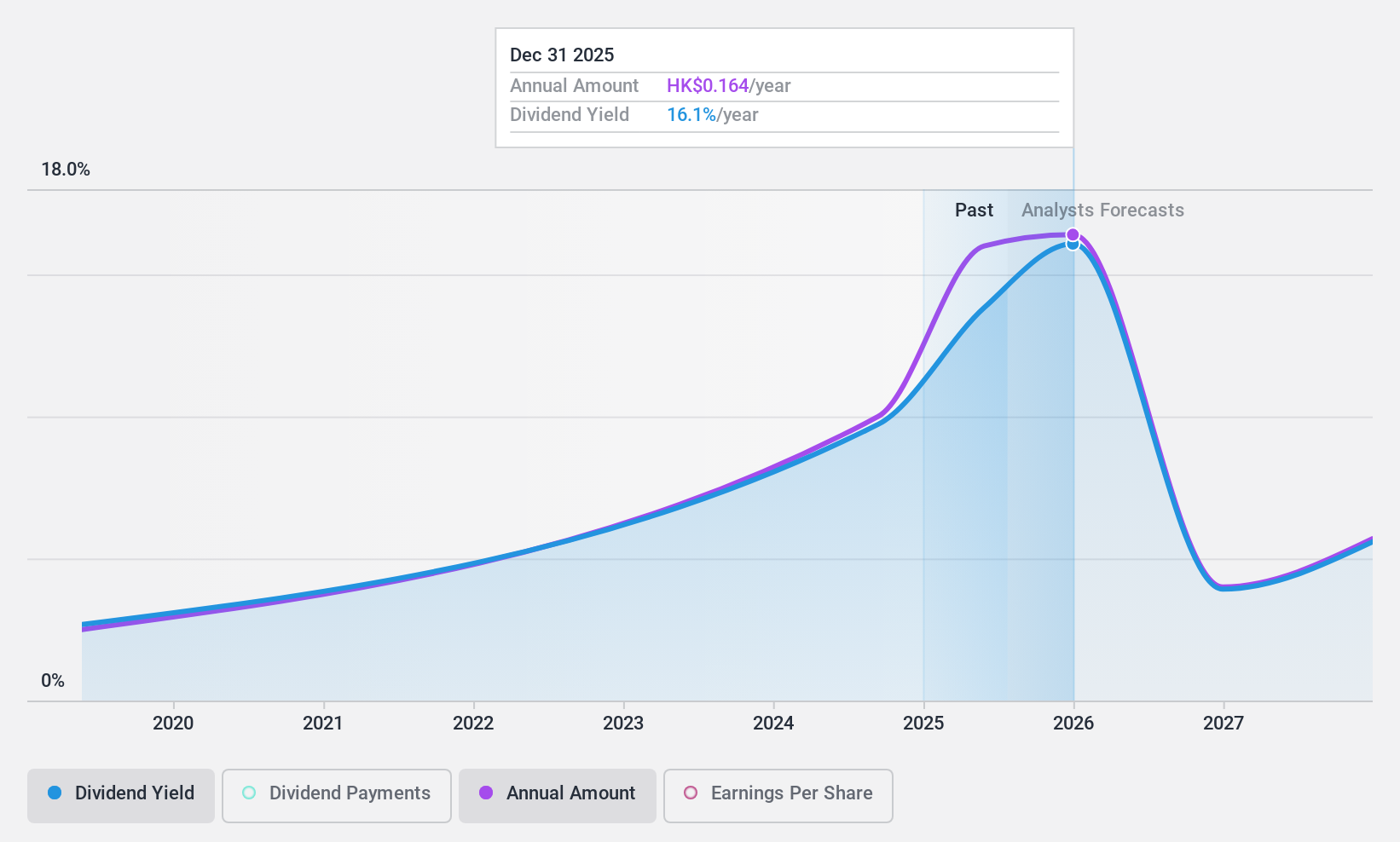

Paradise Entertainment's dividend payments have been volatile over the past decade, reflecting an unstable track record. Despite this, its dividend is well-covered by earnings and cash flows with a payout ratio of 29% and a cash payout ratio of 65.4%. Although its current yield of 3.82% lags behind top-tier payers in Hong Kong, recent profitability improvements—driven by increased revenue from casino management and electronic gaming equipment sales—may enhance future dividend stability.

- Click to explore a detailed breakdown of our findings in Paradise Entertainment's dividend report.

- Upon reviewing our latest valuation report, Paradise Entertainment's share price might be too pessimistic.

China Nonferrous Mining (SEHK:1258)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Nonferrous Mining Corporation Limited is an investment holding company involved in the exploration, mining, ore processing, leaching, smelting, and sale of copper products such as cathodes and anodes, with a market cap of HK$20.64 billion.

Operations: China Nonferrous Mining Corporation Limited generates revenue from its leaching operations, contributing $1.04 billion, and smelting activities, which account for $2.77 billion.

Dividend Yield: 4.4%

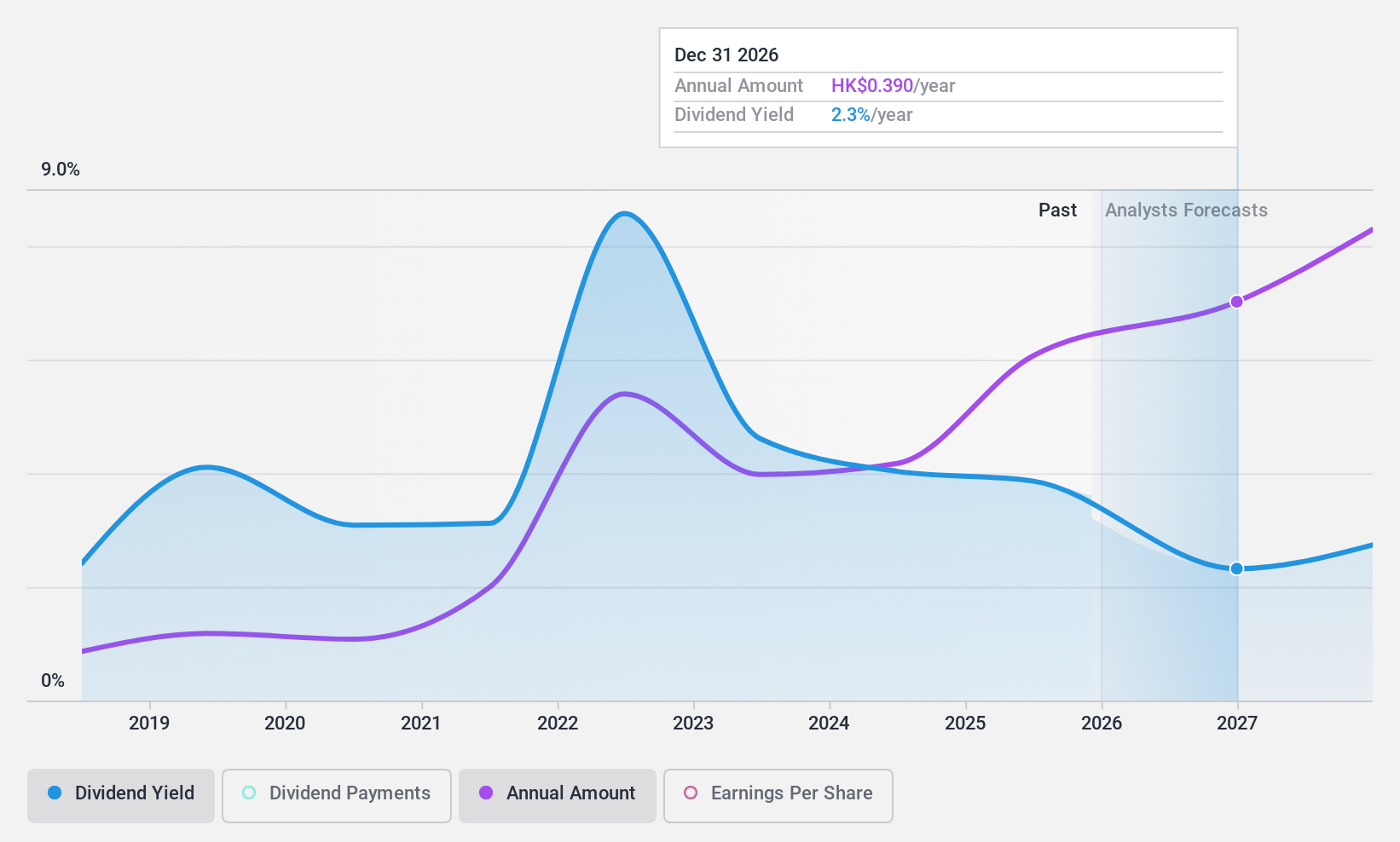

China Nonferrous Mining's dividend yield of 4.36% is lower than top-tier payers in Hong Kong, yet its dividends are well-covered by a payout ratio of 36% and a cash payout ratio of 30.3%. Despite an unstable dividend track record with past volatility, the company has increased dividends over the last decade. Recent guidance indicates significant profit growth to US$400 million for 2024, potentially supporting future dividend stability amid rising copper prices.

- Unlock comprehensive insights into our analysis of China Nonferrous Mining stock in this dividend report.

- In light of our recent valuation report, it seems possible that China Nonferrous Mining is trading behind its estimated value.

Johnson Electric Holdings (SEHK:179)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Johnson Electric Holdings Limited is an investment holding company that manufactures and sells motion systems globally, with a market cap of HK$15.34 billion.

Operations: Johnson Electric Holdings Limited generates revenue primarily through its Auto Parts & Accessories segment, which accounts for $3.73 billion.

Dividend Yield: 3.7%

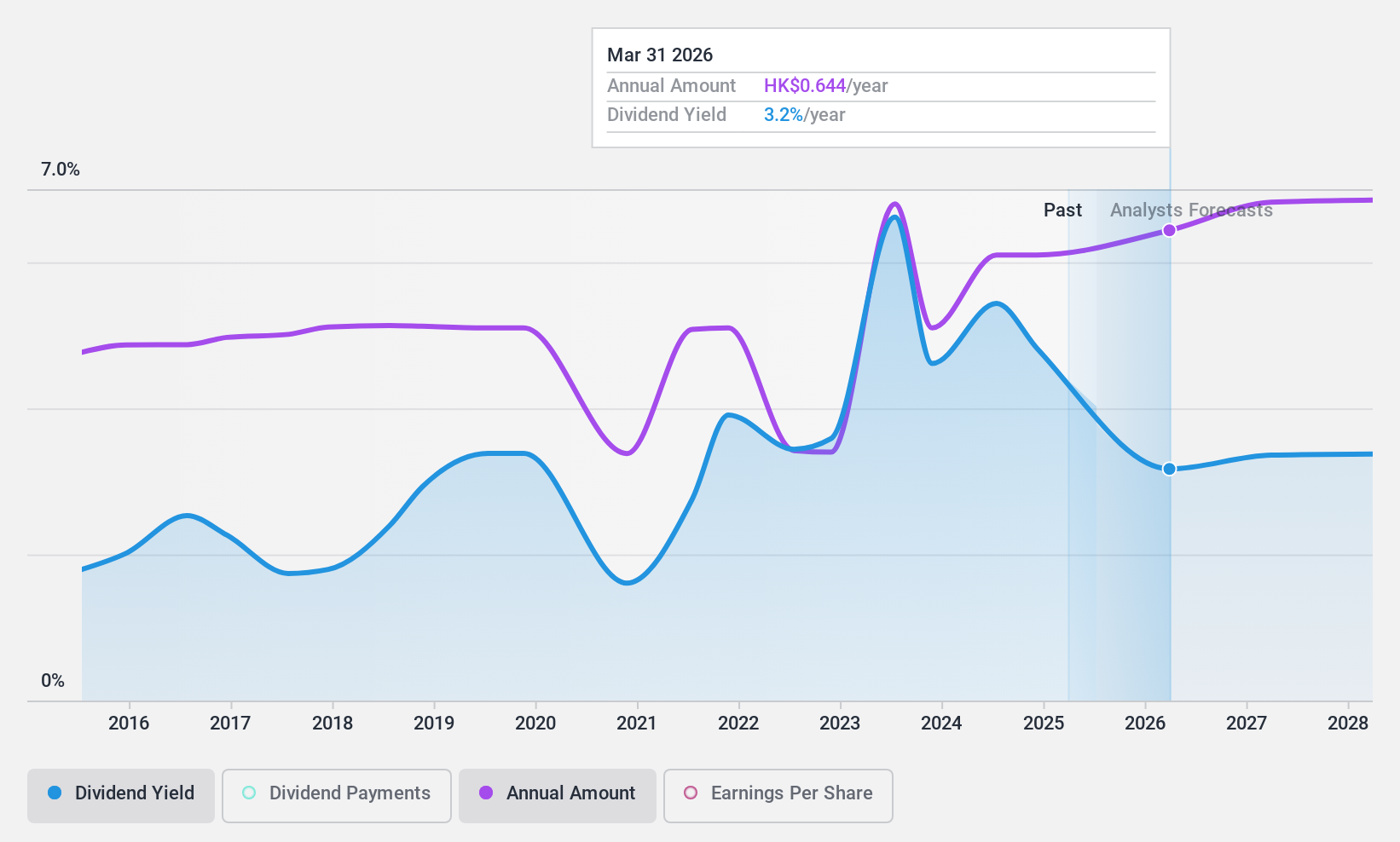

Johnson Electric Holdings' dividend yield is modest compared to top-tier Hong Kong payers, yet its dividends are well-covered with a payout ratio of 30.3% and a cash payout ratio of 22.6%. Despite past volatility in payments, dividends have grown over the last decade. Recent sales results show a decline to US$2.73 billion for the nine months ended December 2024, impacted by unfavorable exchange rates, which could affect future dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Johnson Electric Holdings.

- The valuation report we've compiled suggests that Johnson Electric Holdings' current price could be quite moderate.

Turning Ideas Into Actions

- Discover the full array of 1139 Top Asian Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1180

Paradise Entertainment

An investment holding company, primarily provides casino management services in Macau, the People’s Republic of China, the Philippines, the United States, and internationally.

Outstanding track record, undervalued and pays a dividend.

Market Insights

Community Narratives