- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1258

3 Dividend Stocks Offering Yields Up To 4.5%

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration, investors are closely watching policy shifts that could impact various sectors, from deregulation in financials and energy to potential challenges in healthcare. Amidst this backdrop of fluctuating economic indicators and rising interest rates, dividend stocks offering yields up to 4.5% present an appealing option for those seeking steady income streams. In such a dynamic environment, selecting dividend stocks with strong fundamentals can provide a measure of stability and potential income growth for investors looking to balance risk with reward.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.59% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.15% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.59% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.49% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

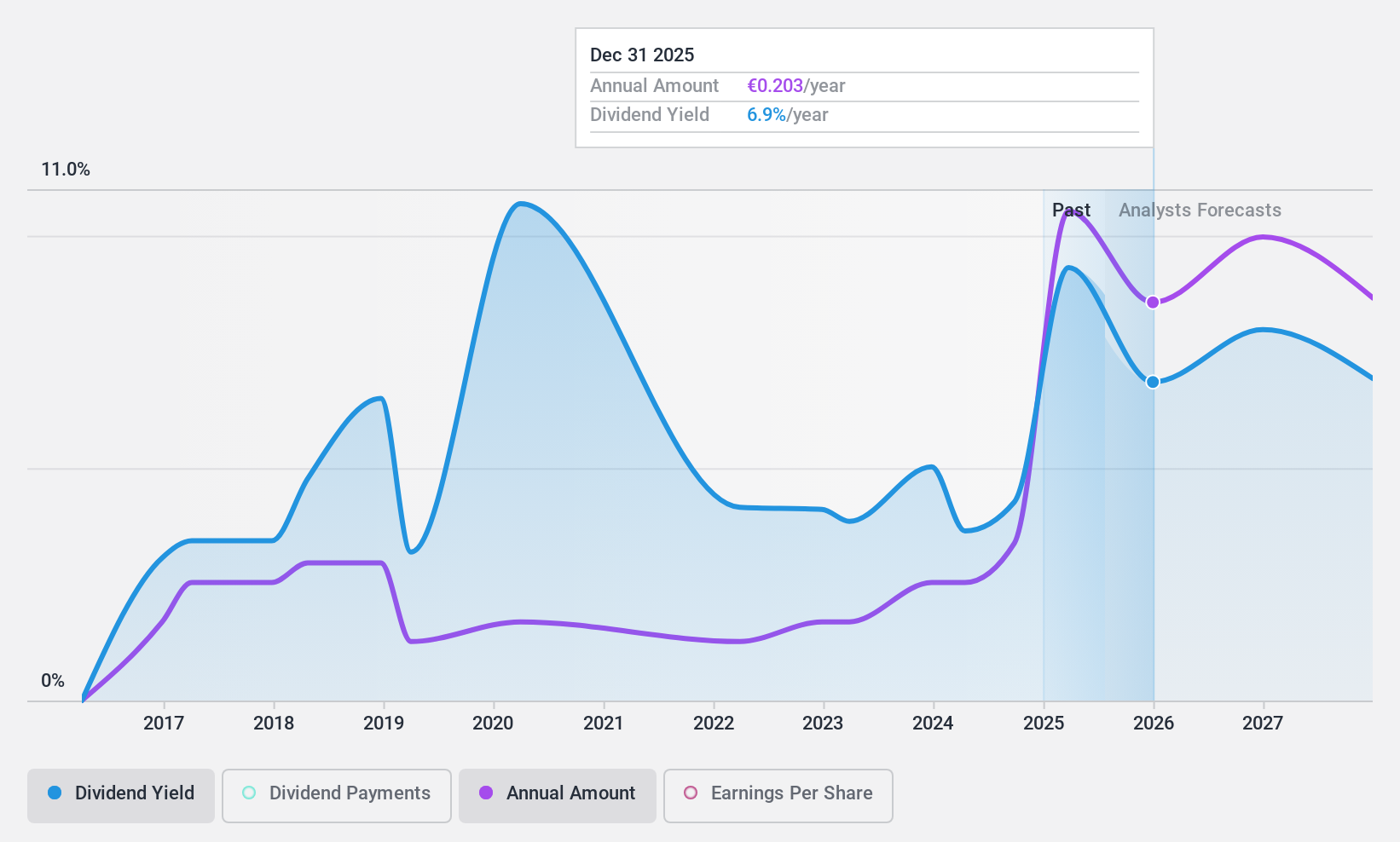

Banco de Sabadell (BME:SAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco de Sabadell, S.A. offers a range of banking products and services to personal, business, and private customers both in Spain and internationally, with a market cap of €9.86 billion.

Operations: Banco de Sabadell generates revenue from its banking operations in Spain (€3.95 billion), the UK (€1.19 billion), and Mexico (€186 million).

Dividend Yield: 4.4%

Banco de Sabadell's dividend payments are covered by a low payout ratio of 39.6%, indicating sustainability despite an unstable track record over the past decade. Recent earnings growth, with net income rising to €1.3 billion for the first nine months of 2024, supports this coverage. However, its dividend yield is lower than top-tier Spanish market payers and has been historically volatile. Additionally, the bank faces challenges with a high level of bad loans at 3%.

- Click here and access our complete dividend analysis report to understand the dynamics of Banco de Sabadell.

- The analysis detailed in our Banco de Sabadell valuation report hints at an deflated share price compared to its estimated value.

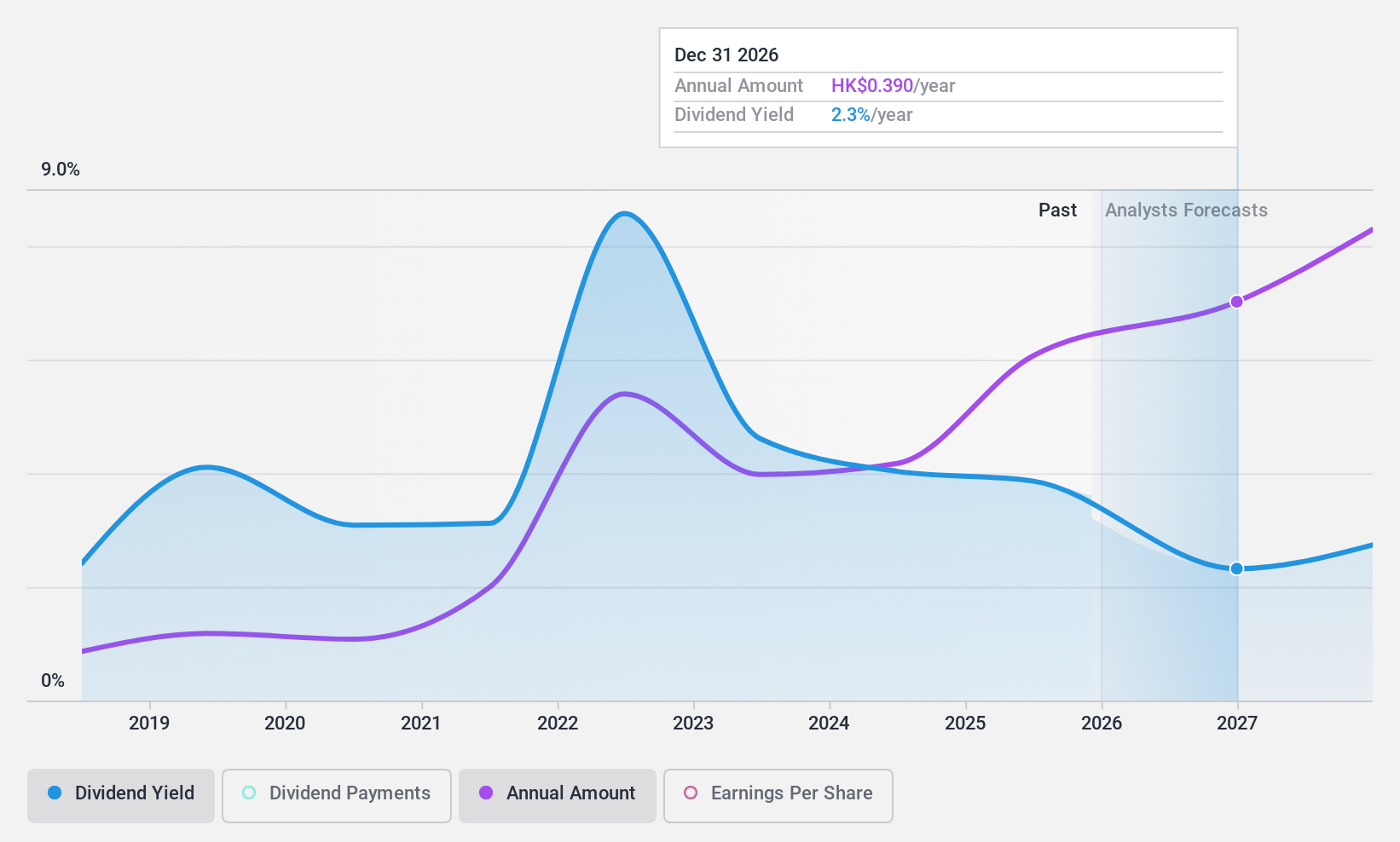

China Nonferrous Mining (SEHK:1258)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Nonferrous Mining Corporation Limited is an investment holding company involved in the exploration, mining, ore processing, leaching, smelting, and sale of copper products such as cathodes and anodes with a market cap of HK$20.64 billion.

Operations: China Nonferrous Mining Corporation Limited generates revenue from its leaching operations amounting to $1.04 billion and smelting operations totaling $2.77 billion.

Dividend Yield: 4.4%

China Nonferrous Mining's dividend payments are supported by a low payout ratio of 36%, indicating sustainability despite an unstable history over the past decade. Recent earnings guidance shows a profit increase to US$314 million for the first nine months of 2024, enhancing coverage. However, its dividend yield is below top-tier payers in Hong Kong and has been historically volatile. The company's valuation appears favorable compared to peers, though shareholders experienced dilution recently.

- Click to explore a detailed breakdown of our findings in China Nonferrous Mining's dividend report.

- Our valuation report here indicates China Nonferrous Mining may be undervalued.

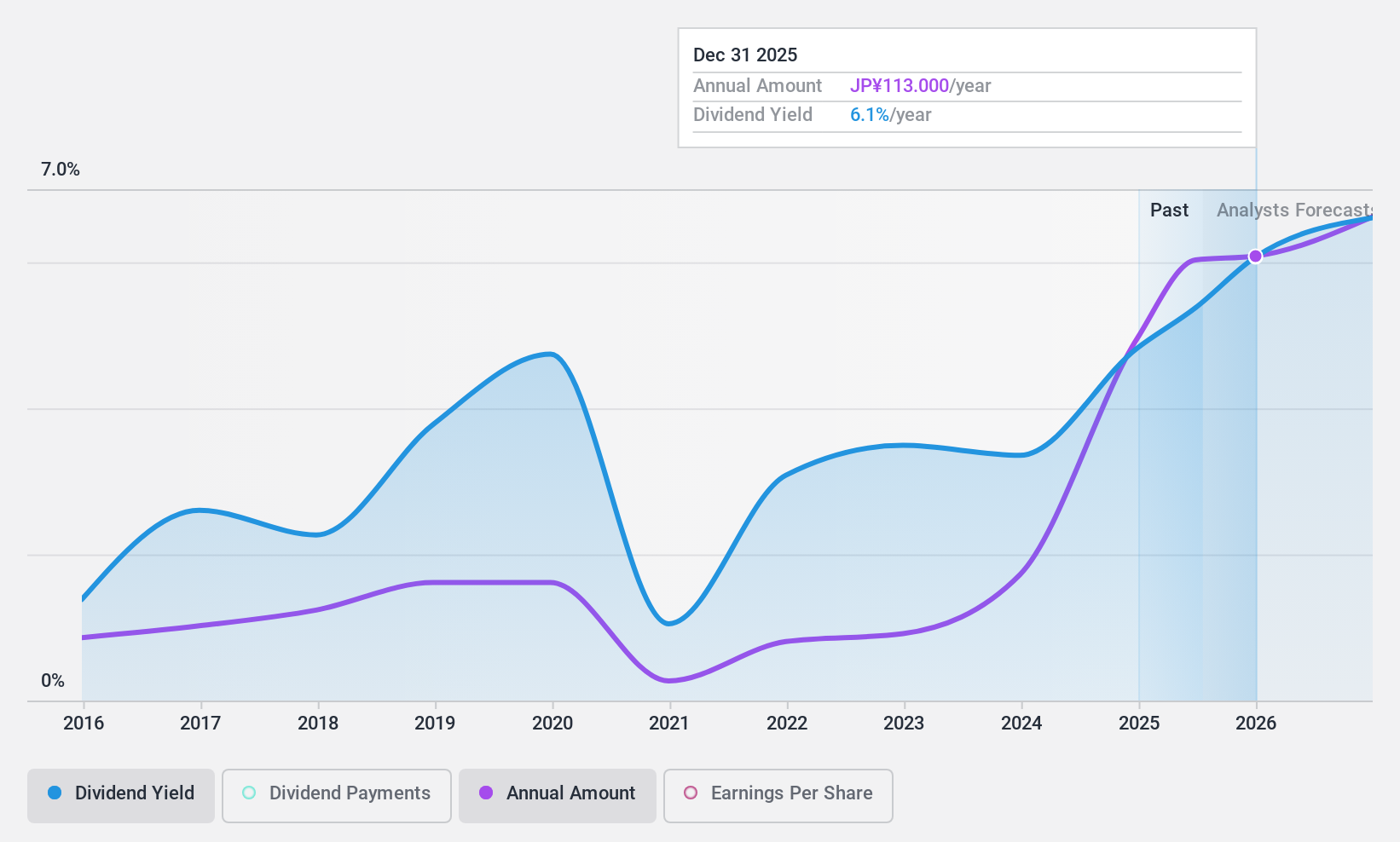

MUGEN ESTATELtd (TSE:3299)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MUGEN ESTATE Co., Ltd. specializes in purchasing and reselling used real estate properties in Japan, with a market cap of ¥46.72 billion.

Operations: MUGEN ESTATE Co., Ltd. generates revenue through the acquisition and resale of pre-owned real estate properties in Japan.

Dividend Yield: 4.6%

MUGEN ESTATE Ltd.'s dividend payments, recently revised to ¥92 for 2024, are well covered by earnings with a low payout ratio of 31%, though not by free cash flow due to a high cash payout ratio of 410.9%. Despite past volatility in dividends, the yield remains in Japan's top quartile at 4.58%. The company's valuation is attractive with a P/E ratio below the market average, but future earnings are projected to decline.

- Get an in-depth perspective on MUGEN ESTATELtd's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that MUGEN ESTATELtd is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Access the full spectrum of 1960 Top Dividend Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1258

China Nonferrous Mining

An investment holding company, engages in the exploration, mining, ore processing, leaching, smelting, and sale of copper and cobalt in Zambia and the Democratic Republic of Congo.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives