- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1053

Should You Review Recent Insider Transactions At Chongqing Iron & Steel Company Limited (HKG:1053)?

We often see insiders buying up shares in companies that perform well over the long term. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So before you buy or sell Chongqing Iron & Steel Company Limited (HKG:1053), you may well want to know whether insiders have been buying or selling.

What Is Insider Selling?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

View our latest analysis for Chongqing Iron & Steel

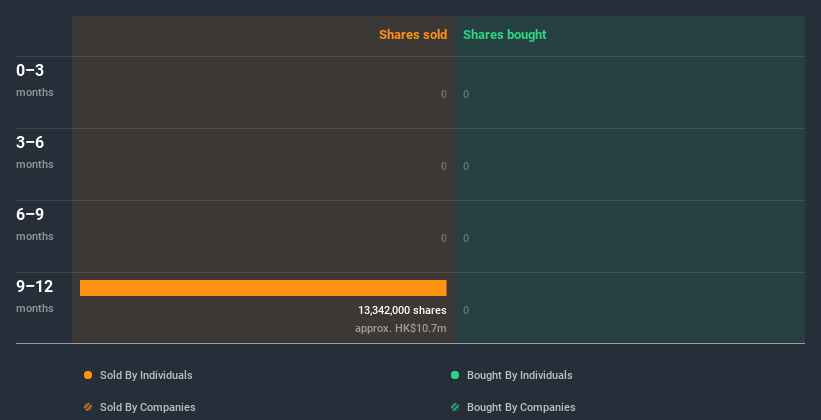

Chongqing Iron & Steel Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the insider, Hung Sang Ng, sold HK$3.4m worth of shares at a price of HK$0.85 per share. So what is clear is that an insider saw fit to sell at around the current price of HK$0.80. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern. Hung Sang Ng was the only individual insider to sell shares in the last twelve months.

Hung Sang Ng ditched 13.34m shares over the year. The average price per share was CN¥0.80. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

I will like Chongqing Iron & Steel better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Our data indicates that Chongqing Iron & Steel insiders own about HK$52m worth of shares (which is 0.4% of the company). But they may have an indirect interest through a corporate structure that we haven't picked up on. We do generally prefer see higher levels of insider ownership.

So What Does This Data Suggest About Chongqing Iron & Steel Insiders?

The fact that there have been no Chongqing Iron & Steel insider transactions recently certainly doesn't bother us. Our analysis of Chongqing Iron & Steel insider transactions leaves us cautious. But it's good to see that insiders own shares in the company. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. To assist with this, we've discovered 2 warning signs that you should run your eye over to get a better picture of Chongqing Iron & Steel.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Chongqing Iron & Steel, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1053

Chongqing Iron & Steel

Engages in the production and sale of steel plates in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.