We Think Ngai Hing Hong (HKG:1047) Is Taking Some Risk With Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Ngai Hing Hong Company Limited (HKG:1047) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Our analysis indicates that 1047 is potentially undervalued!

What Is Ngai Hing Hong's Net Debt?

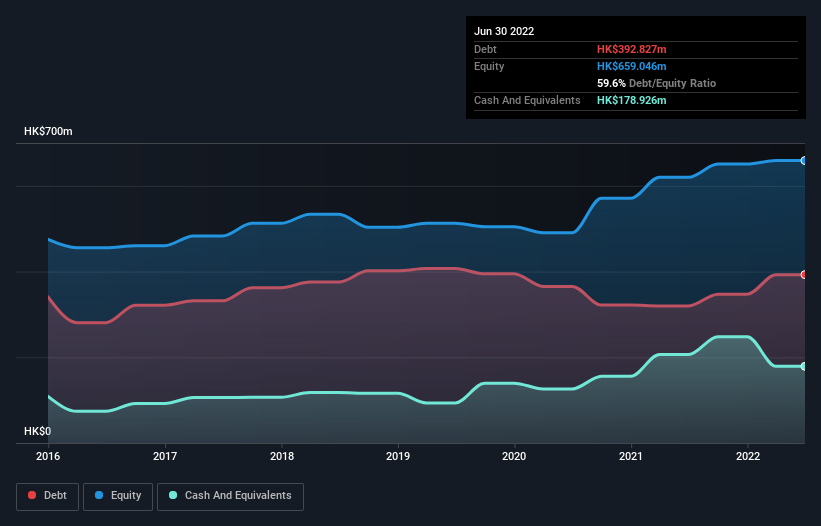

As you can see below, at the end of June 2022, Ngai Hing Hong had HK$392.8m of debt, up from HK$319.7m a year ago. Click the image for more detail. However, because it has a cash reserve of HK$178.9m, its net debt is less, at about HK$213.9m.

How Healthy Is Ngai Hing Hong's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Ngai Hing Hong had liabilities of HK$553.3m due within 12 months and liabilities of HK$15.3m due beyond that. Offsetting this, it had HK$178.9m in cash and HK$282.8m in receivables that were due within 12 months. So it has liabilities totalling HK$106.9m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of HK$164.3m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Ngai Hing Hong's net debt to EBITDA ratio of about 1.9 suggests only moderate use of debt. And its strong interest cover of 12.8 times, makes us even more comfortable. Shareholders should be aware that Ngai Hing Hong's EBIT was down 27% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is Ngai Hing Hong's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Ngai Hing Hong recorded free cash flow worth 73% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

We feel some trepidation about Ngai Hing Hong's difficulty EBIT growth rate, but we've got positives to focus on, too. To wit both its interest cover and conversion of EBIT to free cash flow were encouraging signs. We think that Ngai Hing Hong's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Ngai Hing Hong is showing 2 warning signs in our investment analysis , you should know about...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Ngai Hing Hong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1047

Ngai Hing Hong

An investment holding company, engages in the manufacturing and trading of plastic materials, pigments, colorants, compounded plastic resins, and engineering plastic products in Hong Kong.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026