- Hong Kong

- /

- Personal Products

- /

- SEHK:8281

Is Now The Time To Put China Golden Classic Group (HKG:8281) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like China Golden Classic Group (HKG:8281). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for China Golden Classic Group

China Golden Classic Group's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that China Golden Classic Group's EPS went from CN¥0.0029 to CN¥0.01 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

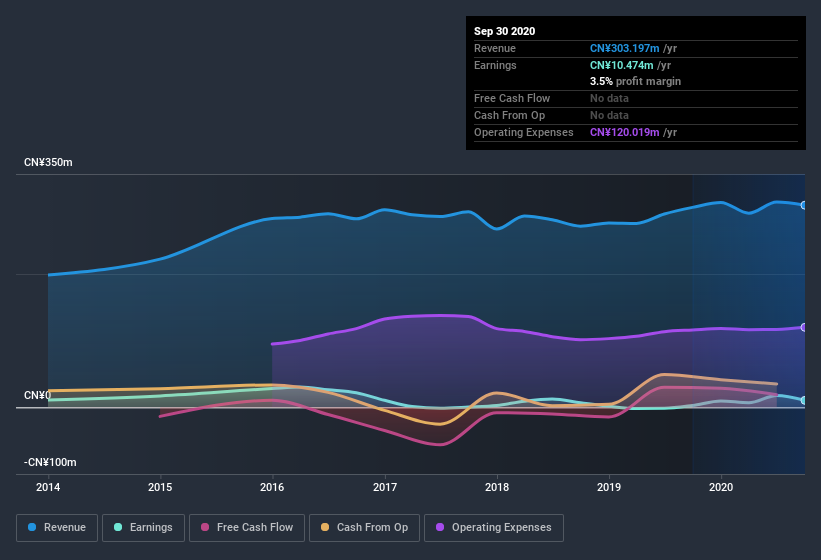

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It seems China Golden Classic Group is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not bad, but it doesn't point to ongoing future growth, either.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since China Golden Classic Group is no giant, with a market capitalization of HK$300m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are China Golden Classic Group Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that China Golden Classic Group insiders own a meaningful share of the business. Indeed, with a collective holding of 68%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about CN¥205m riding on the stock, at current prices. That's nothing to sneeze at!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like China Golden Classic Group with market caps under CN¥1.3b is about CN¥1.5m.

The China Golden Classic Group CEO received total compensation of only CN¥332k in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Does China Golden Classic Group Deserve A Spot On Your Watchlist?

China Golden Classic Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The strong EPS improvement suggests the businesses is humming along. China Golden Classic Group certainly ticks a few of my boxes, so I think it's probably well worth further consideration. You still need to take note of risks, for example - China Golden Classic Group has 3 warning signs (and 1 which is concerning) we think you should know about.

Although China Golden Classic Group certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade China Golden Classic Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade China Golden Classic Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:8281

China Golden Classic Group

An investment holding company, manufactures and trades in oral care, leather care, and household hygiene products in China, the United States, Australia, and internationally.

Excellent balance sheet slight.

Market Insights

Community Narratives