- Hong Kong

- /

- Household Products

- /

- SEHK:2023

Here's Why I Think China Ludao Technology (HKG:2023) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like China Ludao Technology (HKG:2023). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for China Ludao Technology

How Fast Is China Ludao Technology Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, China Ludao Technology's EPS has grown 22% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

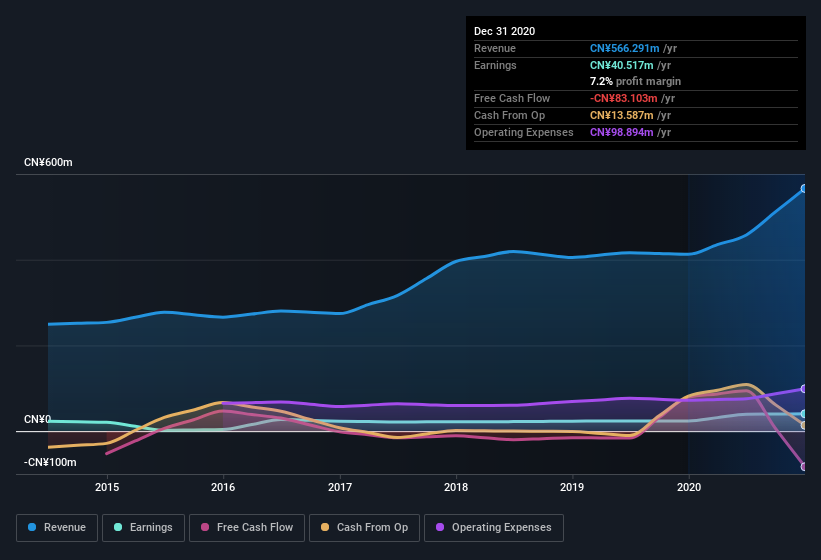

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. China Ludao Technology shareholders can take confidence from the fact that EBIT margins are up from 11% to 16%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

China Ludao Technology isn't a huge company, given its market capitalization of HK$570m. That makes it extra important to check on its balance sheet strength.

Are China Ludao Technology Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news is that China Ludao Technology insiders spent a whopping CN¥9.7m on stock in just one year, and I didn't see any selling. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. It is also worth noting that it was Executive Chairman & CEO Yuerong Yu who made the biggest single purchase, worth HK$1m, paying HK$1.25 per share.

On top of the insider buying, we can also see that China Ludao Technology insiders own a large chunk of the company. Actually, with 49% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about CN¥278m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Yuerong Yu is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like China Ludao Technology with market caps under CN¥1.3b is about CN¥1.5m.

The China Ludao Technology CEO received CN¥1.1m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does China Ludao Technology Deserve A Spot On Your Watchlist?

For growth investors like me, China Ludao Technology's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. You should always think about risks though. Case in point, we've spotted 3 warning signs for China Ludao Technology you should be aware of, and 2 of them make us uncomfortable.

As a growth investor I do like to see insider buying. But China Ludao Technology isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2023

China Ludao Technology

An investment holding company, researches and develops, manufactures, and sells aerosols and related products in Mainland China, the United States, Japan, Chile, and internationally.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026