3 Stocks Estimated To Be Trading At Up To 45.4% Below Intrinsic Value

Reviewed by Simply Wall St

In the midst of global market fluctuations driven by tariff uncertainties and mixed economic signals, investors are keenly observing opportunities within undervalued stocks. Despite recent declines in major U.S. indices, identifying stocks trading below their intrinsic value can offer potential for those looking to capitalize on market inefficiencies amidst the current economic climate.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shihlin Electric & Engineering (TWSE:1503) | NT$175.00 | NT$348.90 | 49.8% |

| National World (LSE:NWOR) | £0.225 | £0.45 | 49.9% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.20 | 49.7% |

| World Fitness Services (TWSE:2762) | NT$89.80 | NT$178.28 | 49.6% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.24 | SEK165.67 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.03 | 49.7% |

| Hanwha Systems (KOSE:A272210) | ₩25300.00 | ₩50252.31 | 49.7% |

| Kinaxis (TSX:KXS) | CA$165.40 | CA$330.68 | 50% |

| PR TIMES (TSE:3922) | ¥2232.00 | ¥4432.57 | 49.6% |

| Ming Yuan Cloud Group Holdings (SEHK:909) | HK$3.56 | HK$7.11 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

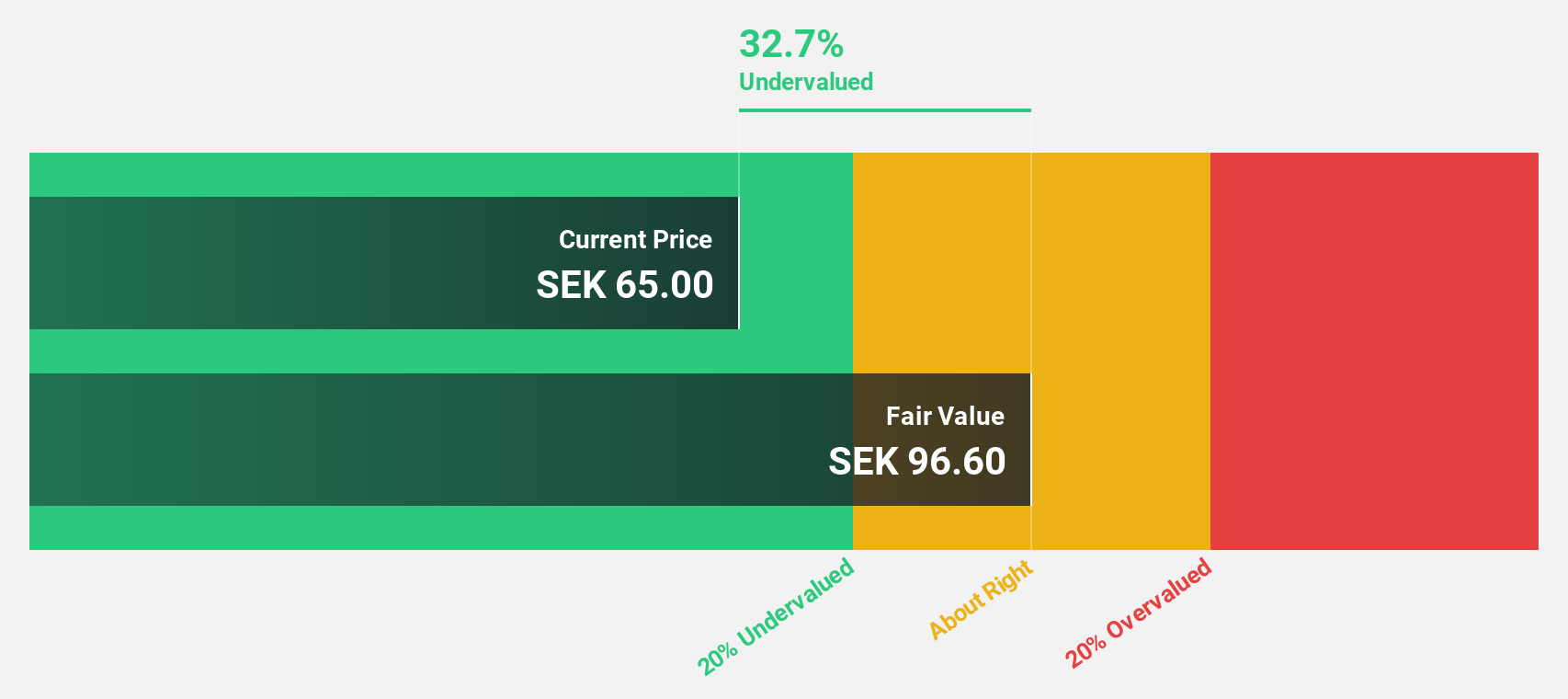

Truecaller (OM:TRUE B)

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK23.51 billion.

Operations: The company's revenue primarily comes from its communications software segment, which generated SEK1.78 billion.

Estimated Discount To Fair Value: 45.4%

Truecaller is trading at SEK68.55, significantly below its estimated fair value of SEK125.6, suggesting it may be undervalued based on cash flows. The company's earnings are expected to grow 26.47% annually over the next three years, outpacing the Swedish market's growth rate of 12.1%. Recent product updates for iOS users and strategic partnerships could enhance revenue streams and bolster its financial position further, supporting its undervaluation thesis.

- According our earnings growth report, there's an indication that Truecaller might be ready to expand.

- Click to explore a detailed breakdown of our findings in Truecaller's balance sheet health report.

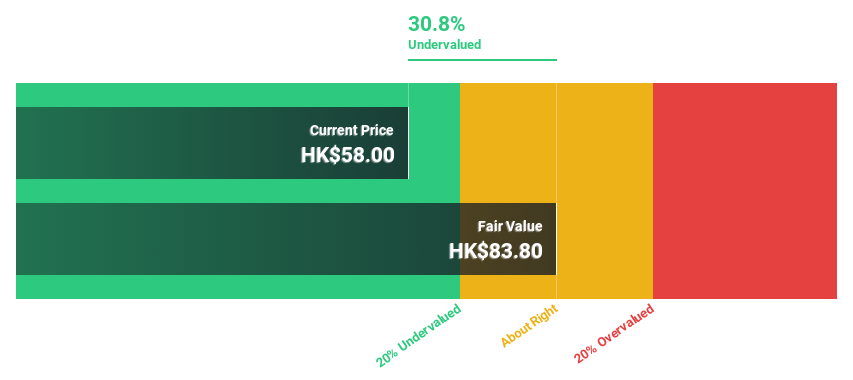

Mao Geping Cosmetics (SEHK:1318)

Overview: Mao Geping Cosmetics Co., Ltd. operates in China, offering color cosmetics and skincare products under the MAOGEPING and Love Keeps brands, with a market cap of HK$35.32 billion.

Operations: The company generates revenue of CN¥3.46 billion from its personal products segment.

Estimated Discount To Fair Value: 12.9%

Mao Geping Cosmetics is trading at HK$72.05, below its estimated fair value of HK$82.72, indicating potential undervaluation based on cash flows. Earnings are projected to grow 25% annually over the next three years, surpassing the Hong Kong market's growth rate of 11.5%. Following its recent HKD 2.34 billion IPO, changes in share capital structure could impact future valuations and investor sentiment positively or negatively depending on shareholder approval outcomes.

- The analysis detailed in our Mao Geping Cosmetics growth report hints at robust future financial performance.

- Click here to discover the nuances of Mao Geping Cosmetics with our detailed financial health report.

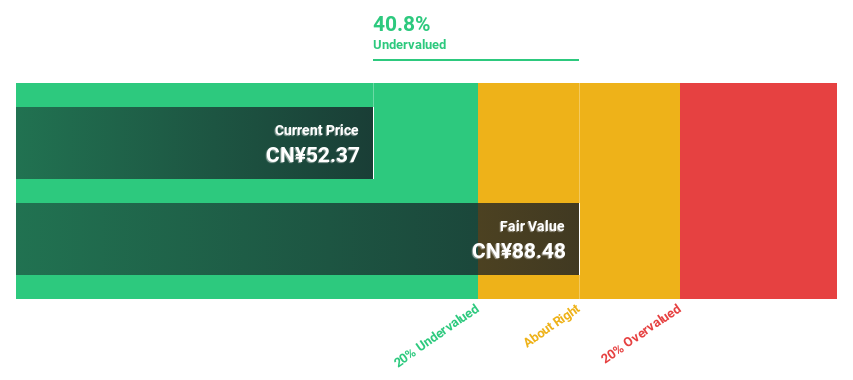

Betta Pharmaceuticals (SZSE:300558)

Overview: Betta Pharmaceuticals Co., Ltd. focuses on researching, developing, manufacturing, and marketing cancer treatment medicines in China with a market cap of CN¥24.17 billion.

Operations: The company's revenue primarily comes from its Pharmaceutical Manufacturing segment, which generated CN¥2.76 billion.

Estimated Discount To Fair Value: 34.7%

Betta Pharmaceuticals is trading at CN¥57.75, below its estimated fair value of CN¥88.48, suggesting it is undervalued based on cash flows. Earnings grew by 32.3% over the past year and are expected to grow significantly at 33.36% annually, outpacing the Chinese market's growth rate of 25.4%. However, a low forecasted Return on Equity of 13.2% in three years and large one-off items impacting results warrant cautious consideration.

- Our growth report here indicates Betta Pharmaceuticals may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Betta Pharmaceuticals stock in this financial health report.

Make It Happen

- Click here to access our complete index of 915 Undervalued Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives