- Singapore

- /

- Semiconductors

- /

- SGX:558

3 Promising Penny Stocks With Market Caps Over US$500M

Reviewed by Simply Wall St

Global markets experienced a turbulent week, with major indices like the Nasdaq Composite and S&P MidCap 400 hitting record highs before retreating, while small-cap stocks showed resilience. Amid this backdrop of fluctuating market conditions, investors often look to alternative opportunities such as penny stocks—an area that continues to intrigue despite its somewhat outdated moniker. These smaller or newer companies can offer significant value when backed by solid financials, and in this article, we explore three promising penny stocks that may present hidden value for discerning investors.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.565 | MYR2.81B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.84 | HK$533.22M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.92 | £467.47M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.44 | £347M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.52 | MYR756.88M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.87 | £391.86M | ★★★★☆☆ |

Click here to see the full list of 5,790 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

ClouDr Group (SEHK:9955)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ClouDr Group Limited, an investment holding company with a market cap of HK$874.69 million, offers SaaS to hospitals and pharmacies, digital marketing services to pharmaceutical companies, and online consultation and prescriptions for chronic condition management.

Operations: The company generates revenue primarily from its wholesale drug segment, amounting to CN¥4.01 billion.

Market Cap: HK$874.69M

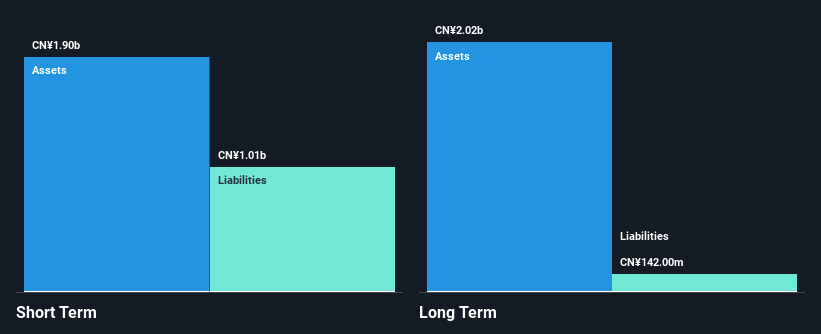

ClouDr Group Limited, with a market cap of HK$874.69 million, is navigating the penny stock landscape by leveraging its SaaS offerings and strategic partnerships. Recent approval of its digital drug ClouDT-01 marks a significant step in its healthcare innovation efforts. Despite being unprofitable, the company has reduced losses over five years and shows potential for revenue growth at 23.48% annually. Strategic agreements, like the one with Schaper & Brümmer GmbH & Co., enhance its market reach in China’s pharmaceutical sector. The company's cash position covers short-term liabilities and exceeds long-term obligations, providing financial stability amidst volatility concerns.

- Navigate through the intricacies of ClouDr Group with our comprehensive balance sheet health report here.

- Understand ClouDr Group's earnings outlook by examining our growth report.

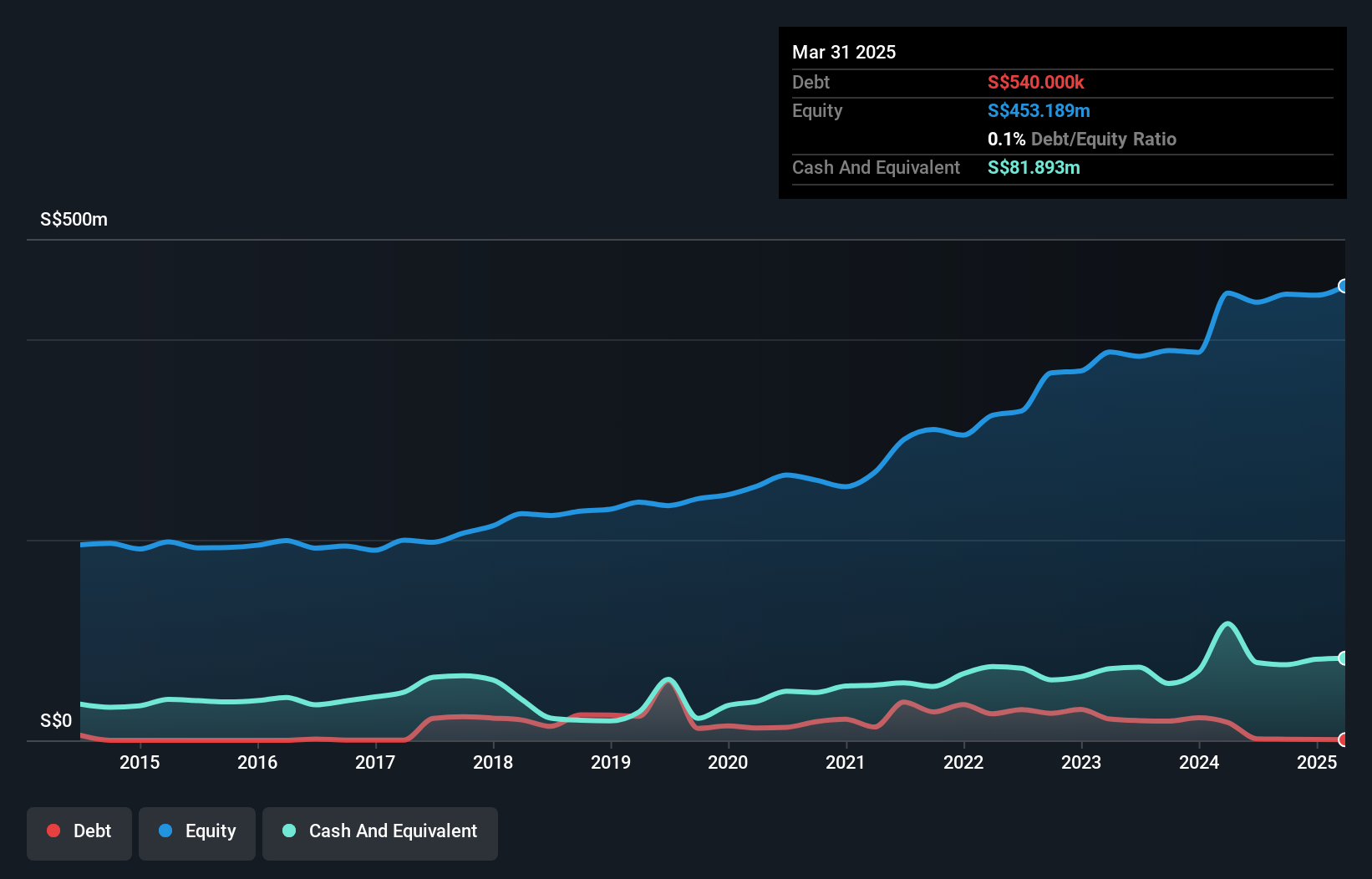

UMS Integration (SGX:558)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: UMS Integration Limited is an investment holding company that manufactures and markets high precision front-end semiconductor components while providing electromechanical assembly and final testing services, with a market cap of SGD746.06 million.

Operations: The company's revenue is primarily derived from the Semiconductor segment, which accounts for SGD214.30 million, followed by the Aerospace segment with SGD23.93 million.

Market Cap: SGD746.06M

UMS Integration Limited, with a market cap of SGD746.06 million, operates in the semiconductor and aerospace sectors. Recent changes include appointing new company secretaries and a name change from UMS Holdings Limited. The company's financials show declining sales and net income year-over-year, with earnings forecasted to grow by 8.2% annually. Despite negative earnings growth recently, UMS maintains strong liquidity as short-term assets exceed liabilities significantly, and its debt is well-covered by operating cash flow. However, shareholder dilution occurred over the past year, impacting overall equity value despite seasoned management and board stability.

- Click here to discover the nuances of UMS Integration with our detailed analytical financial health report.

- Learn about UMS Integration's future growth trajectory here.

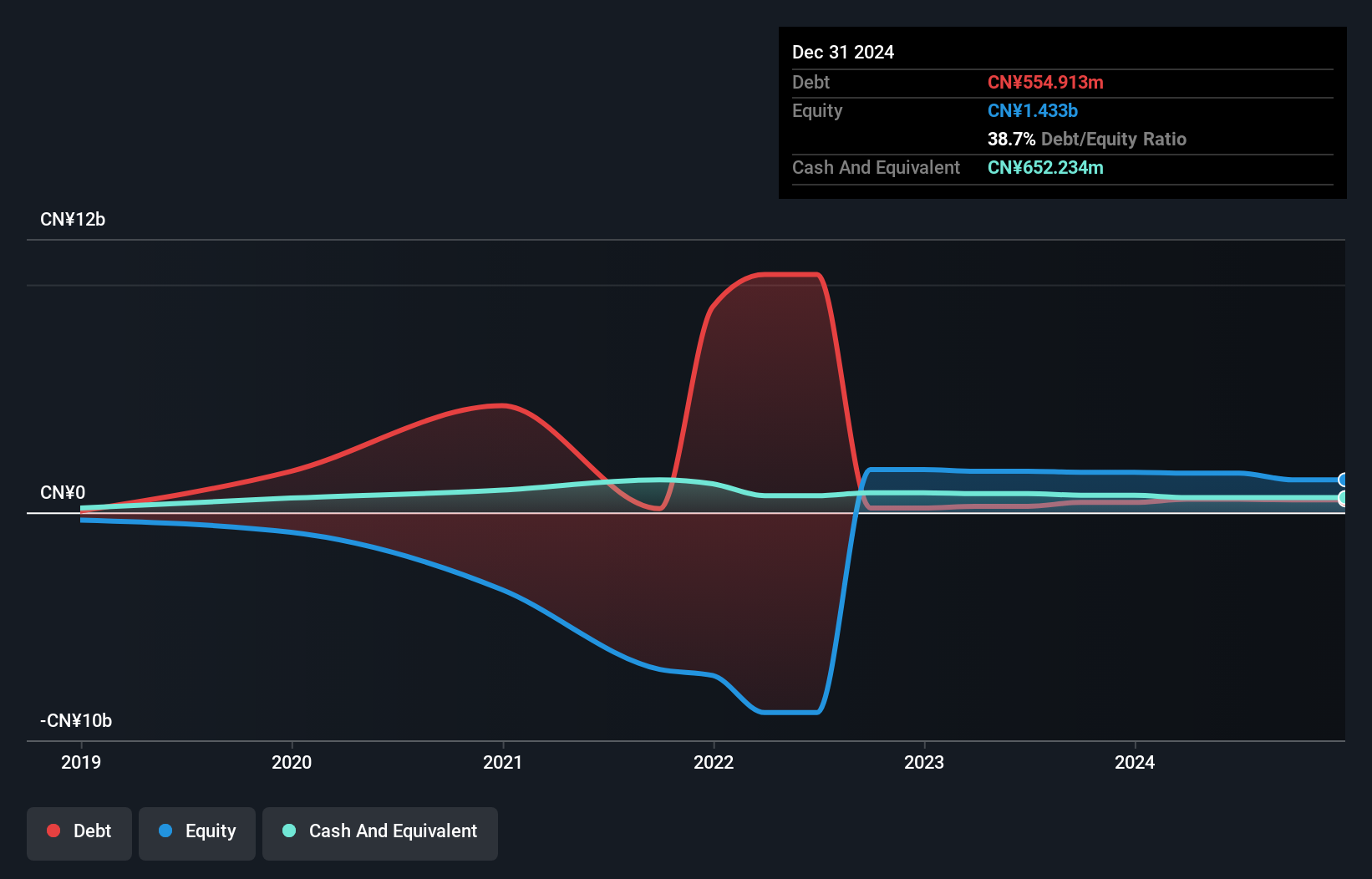

Shenzhen Glory MedicalLtd (SZSE:002551)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shenzhen Glory Medical Co., Ltd. offers hospital construction and medical system integrated solutions both in China and internationally, with a market cap of CN¥2.79 billion.

Operations: Shenzhen Glory Medical Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.79B

Shenzhen Glory Medical Co., Ltd. has demonstrated stable revenue growth, reporting CN¥1.00 billion in sales for the nine months ended September 2024, up from CN¥918.8 million a year prior. Despite this growth, the company remains unprofitable with a negative return on equity of -5.84%. Its financial stability is supported by more cash than total debt and short-term assets exceeding both short and long-term liabilities significantly. However, earnings have declined substantially over five years at a rate of 57.9% annually, and there's insufficient data on management experience or interest coverage by profit due to ongoing losses.

- Click to explore a detailed breakdown of our findings in Shenzhen Glory MedicalLtd's financial health report.

- Gain insights into Shenzhen Glory MedicalLtd's historical outcomes by reviewing our past performance report.

Where To Now?

- Click here to access our complete index of 5,790 Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:558

UMS Integration

An investment holding company, manufactures and markets high precision front-end semiconductor components, and provides electromechanical assembly and final testing services.

Flawless balance sheet and good value.