- Hong Kong

- /

- Medical Equipment

- /

- SEHK:853

MicroPort Scientific Corporation (HKG:853) Held Back By Insufficient Growth Even After Shares Climb 30%

MicroPort Scientific Corporation (HKG:853) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 65% share price decline over the last year.

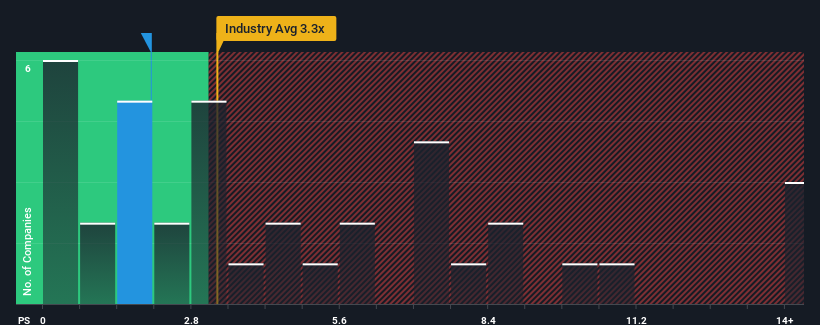

Although its price has surged higher, MicroPort Scientific may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2x, since almost half of all companies in the Medical Equipment industry in Hong Kong have P/S ratios greater than 3.3x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for MicroPort Scientific

How MicroPort Scientific Has Been Performing

With revenue growth that's inferior to most other companies of late, MicroPort Scientific has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think MicroPort Scientific's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, MicroPort Scientific would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 15%. The solid recent performance means it was also able to grow revenue by 30% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 27% each year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 86% each year, which is noticeably more attractive.

With this in consideration, its clear as to why MicroPort Scientific's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On MicroPort Scientific's P/S

MicroPort Scientific's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of MicroPort Scientific's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for MicroPort Scientific that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:853

MicroPort Scientific

Engages in the innovating, manufacturing, and marketing medical devices globally in the People’s Republic of China, Europe, Middle East and Africa, Japan, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives