- Hong Kong

- /

- Healthcare Services

- /

- SEHK:8037

China Biotech Services Holdings' (HKG:8037) Robust Earnings Are Supported By Other Strong Factors

China Biotech Services Holdings Limited (HKG:8037) just reported healthy earnings but the stock price didn't move much. Our analysis suggests that investors might be missing some promising details.

View our latest analysis for China Biotech Services Holdings

Zooming In On China Biotech Services Holdings' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

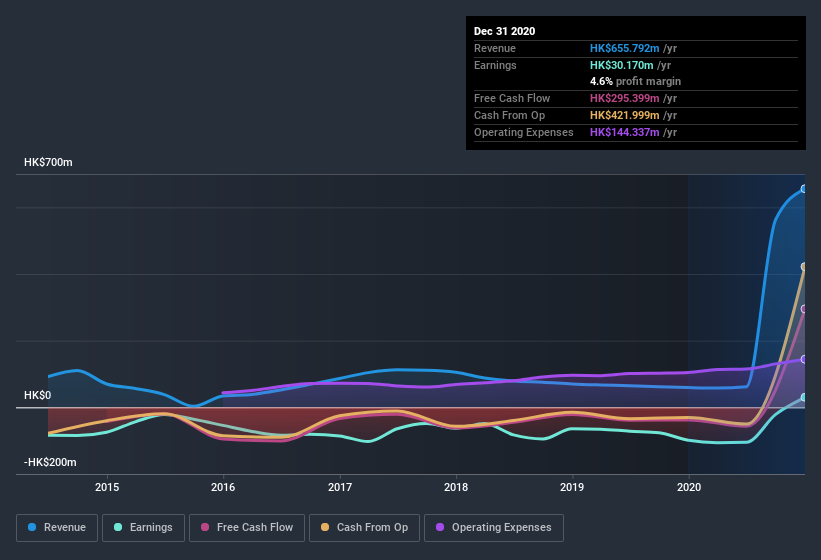

China Biotech Services Holdings has an accrual ratio of -1.04 for the year to December 2020. That indicates that its free cash flow quite significantly exceeded its statutory profit. In fact, it had free cash flow of HK$295m in the last year, which was a lot more than its statutory profit of HK$30.2m. Given that China Biotech Services Holdings had negative free cash flow in the prior corresponding period, the trailing twelve month resul of HK$295m would seem to be a step in the right direction.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of China Biotech Services Holdings.

Our Take On China Biotech Services Holdings' Profit Performance

As we discussed above, China Biotech Services Holdings' accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Based on this observation, we consider it possible that China Biotech Services Holdings' statutory profit actually understates its earnings potential! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, we've discovered 1 warning sign that you should run your eye over to get a better picture of China Biotech Services Holdings.

This note has only looked at a single factor that sheds light on the nature of China Biotech Services Holdings' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade China Biotech Services Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade China Biotech Services Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8037

China Biotech Services Holdings

An investment holding company, provides medical laboratory testing and health check services in the People’s Republic of China and Hong Kong.

Low with weak fundamentals.

Market Insights

Community Narratives