- Hong Kong

- /

- Medical Equipment

- /

- SEHK:6929

Some Confidence Is Lacking In OrbusNeich Medical Group Holdings Limited (HKG:6929) As Shares Slide 28%

OrbusNeich Medical Group Holdings Limited (HKG:6929) shares have had a horrible month, losing 28% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

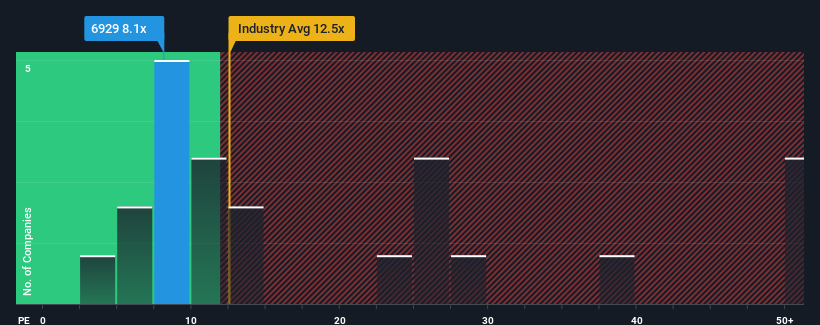

Although its price has dipped substantially, it's still not a stretch to say that OrbusNeich Medical Group Holdings' price-to-earnings (or "P/E") ratio of 8.1x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for OrbusNeich Medical Group Holdings as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for OrbusNeich Medical Group Holdings

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, OrbusNeich Medical Group Holdings would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 72% last year. The latest three year period has also seen an excellent 345% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 9.2% each year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 16% each year growth forecast for the broader market.

With this information, we find it interesting that OrbusNeich Medical Group Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Following OrbusNeich Medical Group Holdings' share price tumble, its P/E is now hanging on to the median market P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of OrbusNeich Medical Group Holdings' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with OrbusNeich Medical Group Holdings, and understanding should be part of your investment process.

You might be able to find a better investment than OrbusNeich Medical Group Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6929

OrbusNeich Medical Group Holdings

An investment holding company, researches, develops, manufactures, trades in, sells, and markets medical devices/instruments used for the treatment of coronary and peripheral vascular diseases in Japan, Europe, the Middle East, Africa, the Asia Pacific, the People’s Republic of China, and the United States.

Flawless balance sheet and undervalued.