- Hong Kong

- /

- Medical Equipment

- /

- SEHK:6929

Some Confidence Is Lacking In OrbusNeich Medical Group Holdings Limited (HKG:6929) As Shares Slide 26%

Unfortunately for some shareholders, the OrbusNeich Medical Group Holdings Limited (HKG:6929) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 71% share price decline.

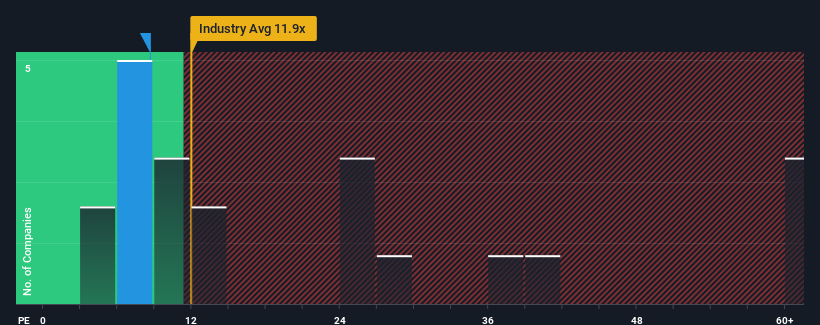

In spite of the heavy fall in price, there still wouldn't be many who think OrbusNeich Medical Group Holdings' price-to-earnings (or "P/E") ratio of 8.6x is worth a mention when the median P/E in Hong Kong is similar at about 9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With its earnings growth in positive territory compared to the declining earnings of most other companies, OrbusNeich Medical Group Holdings has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for OrbusNeich Medical Group Holdings

Does Growth Match The P/E?

In order to justify its P/E ratio, OrbusNeich Medical Group Holdings would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 72% last year. The latest three year period has also seen an excellent 344% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 9.6% per year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 16% each year growth forecast for the broader market.

In light of this, it's curious that OrbusNeich Medical Group Holdings' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On OrbusNeich Medical Group Holdings' P/E

Following OrbusNeich Medical Group Holdings' share price tumble, its P/E is now hanging on to the median market P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that OrbusNeich Medical Group Holdings currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for OrbusNeich Medical Group Holdings with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6929

OrbusNeich Medical Group Holdings

An investment holding company, engages in the manufacturing, trading, sales, and marketing of medical devices/instruments for the treatment of coronary and peripheral vascular diseases in Japan, Europe, the Middle East, Africa, the Asia Pacific, the People’s Republic of China, and the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives