- Hong Kong

- /

- Medical Equipment

- /

- SEHK:6929

Optimistic Investors Push OrbusNeich Medical Group Holdings Limited (HKG:6929) Shares Up 27% But Growth Is Lacking

Those holding OrbusNeich Medical Group Holdings Limited (HKG:6929) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 69% share price drop in the last twelve months.

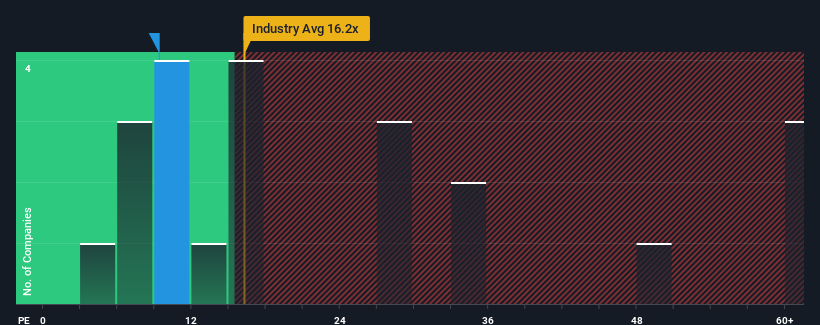

Although its price has surged higher, there still wouldn't be many who think OrbusNeich Medical Group Holdings' price-to-earnings (or "P/E") ratio of 9.4x is worth a mention when the median P/E in Hong Kong is similar at about 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for OrbusNeich Medical Group Holdings as its earnings have been rising faster than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for OrbusNeich Medical Group Holdings

Is There Some Growth For OrbusNeich Medical Group Holdings?

OrbusNeich Medical Group Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 72%. Pleasingly, EPS has also lifted 344% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 9.5% per year over the next three years. With the market predicted to deliver 16% growth per year, the company is positioned for a weaker earnings result.

With this information, we find it interesting that OrbusNeich Medical Group Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From OrbusNeich Medical Group Holdings' P/E?

OrbusNeich Medical Group Holdings appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that OrbusNeich Medical Group Holdings currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with OrbusNeich Medical Group Holdings, and understanding should be part of your investment process.

If you're unsure about the strength of OrbusNeich Medical Group Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade OrbusNeich Medical Group Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6929

OrbusNeich Medical Group Holdings

An investment holding company, engages in the manufacturing, trading, sales, and marketing of medical devices/instruments for the treatment of coronary and peripheral vascular diseases in Japan, Europe, the Middle East, Africa, the Asia Pacific, the People’s Republic of China, and the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives