- Hong Kong

- /

- Healthcare Services

- /

- SEHK:6833

Sinco Pharmaceuticals Holdings Limited (HKG:6833) Might Not Be As Mispriced As It Looks

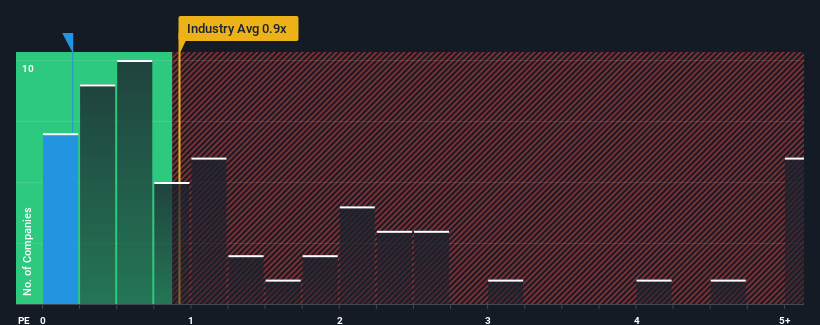

You may think that with a price-to-sales (or "P/S") ratio of 0.2x Sinco Pharmaceuticals Holdings Limited (HKG:6833) is a stock worth checking out, seeing as almost half of all the Healthcare companies in Hong Kong have P/S ratios greater than 0.9x and even P/S higher than 3x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sinco Pharmaceuticals Holdings

What Does Sinco Pharmaceuticals Holdings' P/S Mean For Shareholders?

For example, consider that Sinco Pharmaceuticals Holdings' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sinco Pharmaceuticals Holdings' earnings, revenue and cash flow.How Is Sinco Pharmaceuticals Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Sinco Pharmaceuticals Holdings would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.3%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 75% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 16% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Sinco Pharmaceuticals Holdings' P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Sinco Pharmaceuticals Holdings' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Sinco Pharmaceuticals Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 4 warning signs for Sinco Pharmaceuticals Holdings that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6833

Sinco Pharmaceuticals Holdings

An investment holding company, provides marketing, promotion, and channel management services for imported pharmaceutical products and medical devices in China.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives