- Hong Kong

- /

- Medical Equipment

- /

- SEHK:6699

How Does Angelalign Stack Up After Recent 10% Drop and Industry Shifts in 2025?

Reviewed by Bailey Pemberton

If you have Angelalign Technology on your radar and are weighing whether its current price tag offers genuine value or added risk, you are in good company. The stock has been anything but boring lately. After a modest 3.6% gain over the past week, Angelalign is still looking to recover from a bruising 10.4% slide over the last 30 days. Despite this recent volatility, the stock sits up 11.4% year-to-date. However, the longer-term one-year return looks less appealing at -13.1%. For investors with even more patience, a three-year stretch shows a flat return near 0.5%, suggesting both real hurdles and flashes of resilience.

What is behind these moves? Lately, changing market sentiment around digital health and medical device makers, along with shifting risk appetites for growth-focused companies, has certainly played its part. While no single headline explains the ups and downs, investors seem to be wrestling with whether the company’s potential is being fully recognized or if uncertainty around future growth is keeping a lid on prices.

From a pure numbers perspective, Angelalign Technology's value score currently tallies up to 2 out of 6. This means the company appears undervalued in two key valuation checks. But is that enough to call it a hidden gem, or a sign that the market is seeing something others might be missing?

To help you make sense of the numbers, next we will break down the main valuation methods used to judge Angelalign Technology and see what those checks really tell us. Before we wrap up, I will share what I believe is the smartest way to think about valuation for this stock, so stay tuned for that insight at the end.

Angelalign Technology scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Angelalign Technology Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular tool for valuing companies, especially those with predictable future growth. In simple terms, this model forecasts a business’s future cash flows and then discounts those amounts back to today’s value to estimate what the company is really worth.

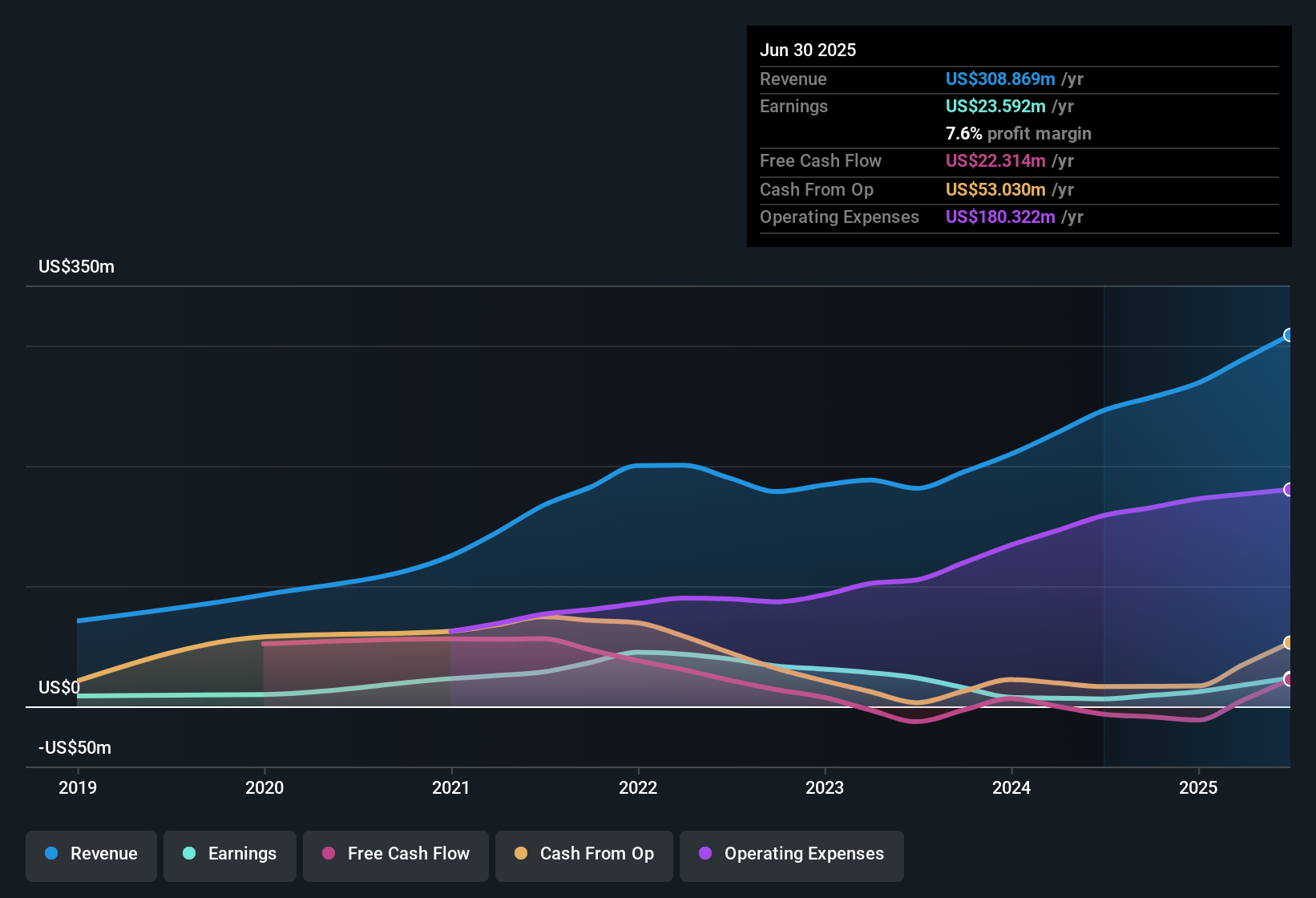

For Angelalign Technology, the analysis starts with a current Free Cash Flow of $23.9 million. Analyst estimates project these annual cash flows to rise steadily, reaching $70.95 million by 2029. While hard estimates exist for the next five years, additional projections beyond that period are carefully extrapolated to give an extended view well into the next decade.

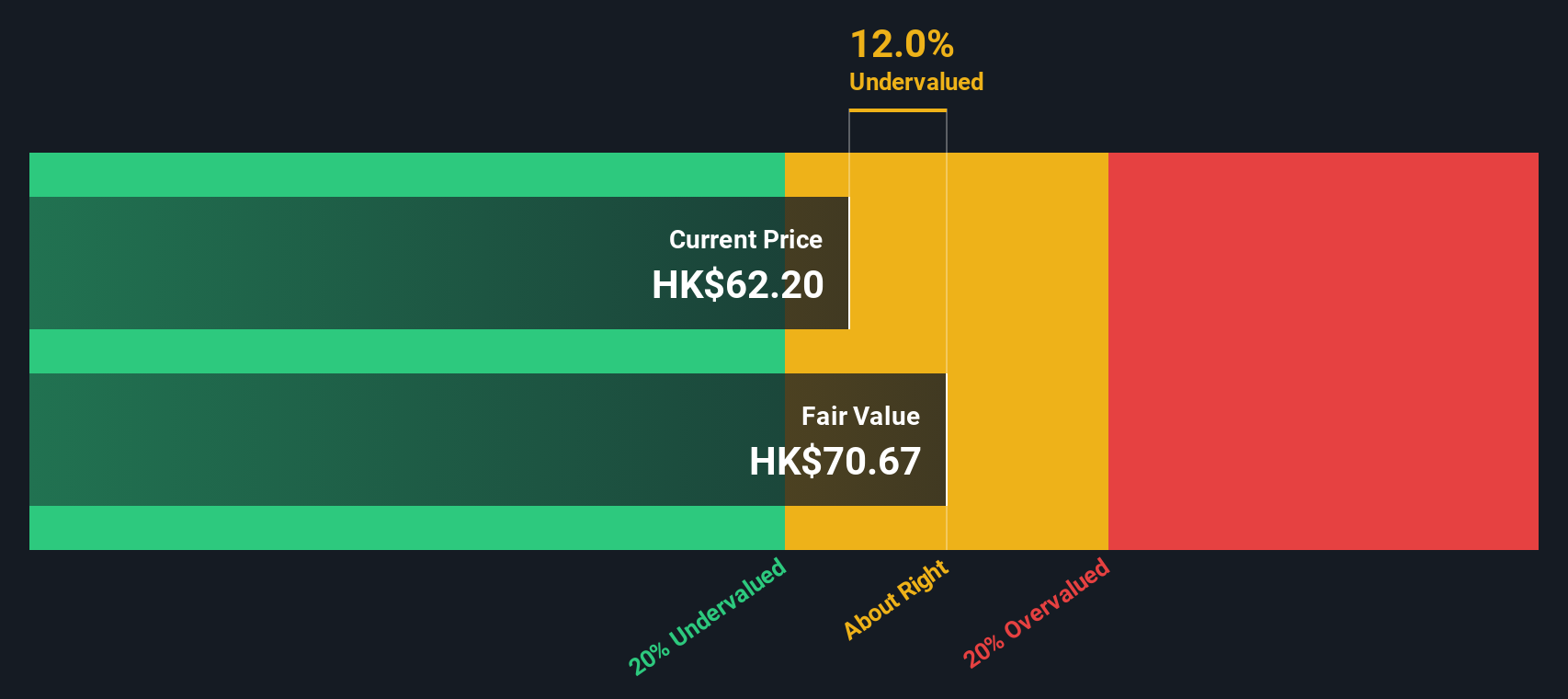

Pulling all this together, the DCF model calculates an intrinsic value for Angelalign Technology stock of $70.57. Comparing that figure to the current share price, the stock appears about 8.5% undervalued. That margin is relatively narrow and signals that the stock is trading close to its fair value by this method.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Angelalign Technology's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Angelalign Technology Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Angelalign Technology. It provides a snapshot of how much investors are willing to pay for each dollar of a company's earnings, making it a simple yet powerful way to compare valuation across similar businesses.

Interpreting a PE ratio is not just about bigger or smaller numbers, though. Growth expectations, profit stability, and sector-specific risks all help determine what a "normal" or "fair" PE ratio should look like. Higher-growth, lower-risk companies often justify a higher PE, while sector headwinds or uncertainties tend to pull it lower.

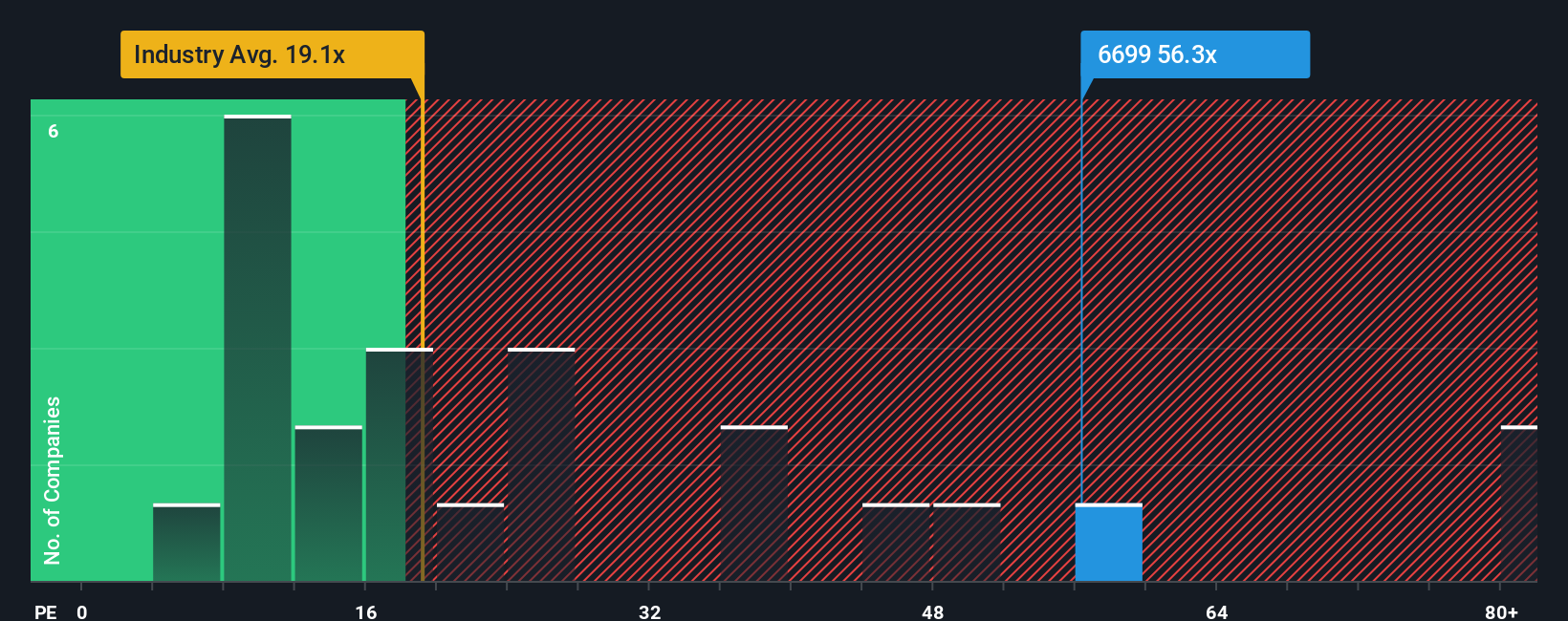

Currently, Angelalign Technology trades at a PE of 60.0x, noticeably above the medical equipment industry average of 20.6x and the peer group average of 49.9x. This suggests that the market expects significantly more growth or lower risk from Angelalign compared to typical peers. However, Simply Wall St’s proprietary “Fair Ratio” for the company is 20.0x. The Fair Ratio goes a step further than standard benchmarks, as it factors in not just earnings growth and industry norms but also profit margins, company size, and unique risk factors specific to Angelalign Technology. This holistic view offers a more tailored and reliable valuation anchor for investors.

Comparing the current PE to the Fair Ratio, the stock’s valuation looks stretched and not fully backed by fundamentals. As the gap between the actual multiple and the Fair Ratio is substantial, the stock appears overvalued by this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Angelalign Technology Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story about a company, connecting the numbers like your estimate of fair value, future revenue, earnings, and margins with your perspective on where the business is headed. Narratives help you see how a company’s long-term story translates into hard numbers and, ultimately, what you believe is a fair value for the stock.

This approach gives you more than just financial ratios. It creates a living forecast that you can track and refine as new information comes in. On Simply Wall St’s Community page, used by millions of investors, Narratives make it easy for anyone to set out their views and instantly see how different assumptions impact the company’s estimated worth. When news breaks or earnings are released, Narratives update dynamically, helping you decide whether to buy or sell as facts change and the gap between fair value and current price shifts.

For example, with Angelalign Technology, one investor might see rapid adoption in digital orthodontics and set a high fair value, while another might worry about rising competition and predict a lower valuation. Both perspectives are valid, and Narratives make visualizing these possibilities simple.

Do you think there's more to the story for Angelalign Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6699

Angelalign Technology

An investment holding company, researches and designs, manufactures, sells, and markets clear aligner treatment solutions in the People’s Republic of China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in