- Hong Kong

- /

- Medical Equipment

- /

- SEHK:6699

Angelalign Technology (SEHK:6699): Evaluating Valuation After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

See our latest analysis for Angelalign Technology.

Despite rallying earlier in the quarter, Angelalign Technology’s momentum has faded in recent weeks as the share price dipped 9.1% over the past month and the 1-year total shareholder return stands at -8.5%. Investors seem to be recalibrating their outlook based on the company’s underlying growth profile and recent shifts in sentiment.

If you’re looking for fresh opportunities beyond Angelalign, now could be a smart time to broaden your search and discover fast growing stocks with high insider ownership.

With shares down and growth metrics pointing upward, does Angelalign Technology now offer a rare value play for investors, or is the current price already factoring in all of its future potential?

Price-to-Earnings of 57.4x: Is it justified?

Currently, Angelalign Technology is trading at a price-to-earnings (P/E) ratio of 57.4x, which is well above both its industry peers and its own estimated fair value.

The P/E ratio is a widely used valuation metric that compares a company’s current share price to its per-share earnings. For healthcare technology companies like Angelalign, high P/E ratios can sometimes be justified if investors expect strong future growth or margin improvements. However, the premium should still align with sector realities.

Angelalign’s P/E of 57.4x is significantly higher than the Hong Kong Medical Equipment industry average of 21.1x and its peer average of 50.1x. It is also far above the estimated fair P/E of 19.6x, revealing a strong disconnect between current market expectations and fundamental value. This level suggests buyers may be pricing in robust future performance, but the valuation gap poses a risk if growth slows or expectations change.

Explore the SWS fair ratio for Angelalign Technology

Result: Price-to-Earnings of 57.4x (OVERVALUED)

However, steep valuation and slowing one-year returns could spark volatility if future growth does not meet elevated market expectations.

Find out about the key risks to this Angelalign Technology narrative.

Another View: What Does the SWS DCF Model Say?

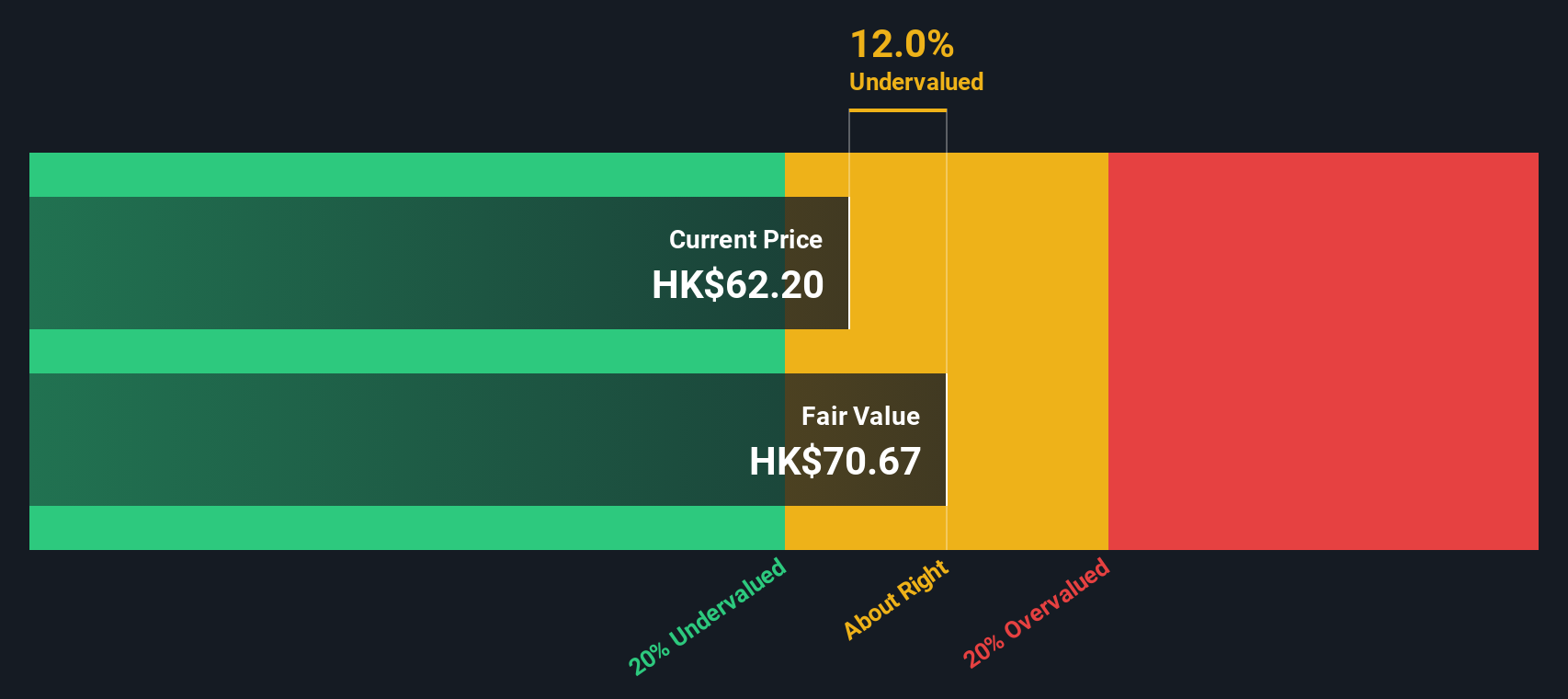

Looking at Angelalign Technology through the lens of our DCF model, the picture shifts. While the current share price appears expensive relative to earnings, the SWS DCF model suggests the stock is trading about 12.7% below its estimated fair value. Could the market be undervaluing future cash flow potential, or are the risks reflected in the valuation for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Angelalign Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Angelalign Technology Narrative

If you have a different perspective or enjoy digging into the numbers yourself, you can build your own data-driven narrative in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Angelalign Technology.

Looking for More Investment Ideas?

Seize the chance to take your portfolio further. These hand-picked screeners could reveal overlooked gems, sector leaders, or future trends you do not want to miss out on.

- Boost your potential income stream by tapping into these 19 dividend stocks with yields > 3%, offering yields above 3%, chosen for their robust payouts.

- Catch the wave of artificial intelligence innovation by targeting these 24 AI penny stocks, set to reshape industries and create lasting value.

- Position yourself at the frontier of computing by exploring these 26 quantum computing stocks, featuring companies pushing the boundaries of what technology can do.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6699

Angelalign Technology

An investment holding company, researches and designs, manufactures, sells, and markets clear aligner treatment solutions in the People’s Republic of China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives