- Hong Kong

- /

- Real Estate

- /

- SEHK:93

3 Promising Penny Stocks With Market Caps Under US$300M

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with major indices showing varied results, investors are increasingly attentive to opportunities that may arise in less conventional areas. Penny stocks, while often considered a niche investment category, still present intriguing possibilities for those interested in smaller or emerging companies. With the potential for growth at lower price points and the allure of strong financial health, these stocks can offer unique opportunities worth exploring amidst current market dynamics.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.12 | £798.74M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.00 | HK$44.05B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.775 | £180.04M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,741 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Town Health International Medical Group (SEHK:3886)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Town Health International Medical Group Limited is an investment holding company that offers healthcare and related services in the People’s Republic of China and Hong Kong, with a market cap of HK$1.65 billion.

Operations: The company's revenue is primarily derived from Hong Kong Medical Services (HK$826.41 million), Hong Kong Managed Medical Network Business (HK$510.13 million), and Mainland Hospital Management and Medical Services (HK$533.79 million).

Market Cap: HK$1.65B

Town Health International Medical Group, with a market cap of HK$1.65 billion, derives significant revenue from its Hong Kong and Mainland China healthcare services. Despite being unprofitable and having a negative return on equity of -6.42%, the company trades at 90.9% below its estimated fair value and has not diluted shareholder value recently. It maintains more cash than total debt, providing a stable financial position with short-term assets covering both short- and long-term liabilities comfortably. Although earnings have declined by 9.8% annually over five years, the company has a positive free cash flow supporting over three years of operations without additional funding needs.

- Jump into the full analysis health report here for a deeper understanding of Town Health International Medical Group.

- Assess Town Health International Medical Group's previous results with our detailed historical performance reports.

Zero Fintech Group (SEHK:93)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zero Fintech Group Limited is an investment holding company that focuses on investing in, developing, and selling real estate properties in the People’s Republic of China and Hong Kong, with a market cap of approximately HK$1.63 billion.

Operations: The company generates revenue primarily from its property development and investment segment, which accounts for HK$1.57 billion, alongside a money lending segment contributing HK$217.17 million.

Market Cap: HK$1.63B

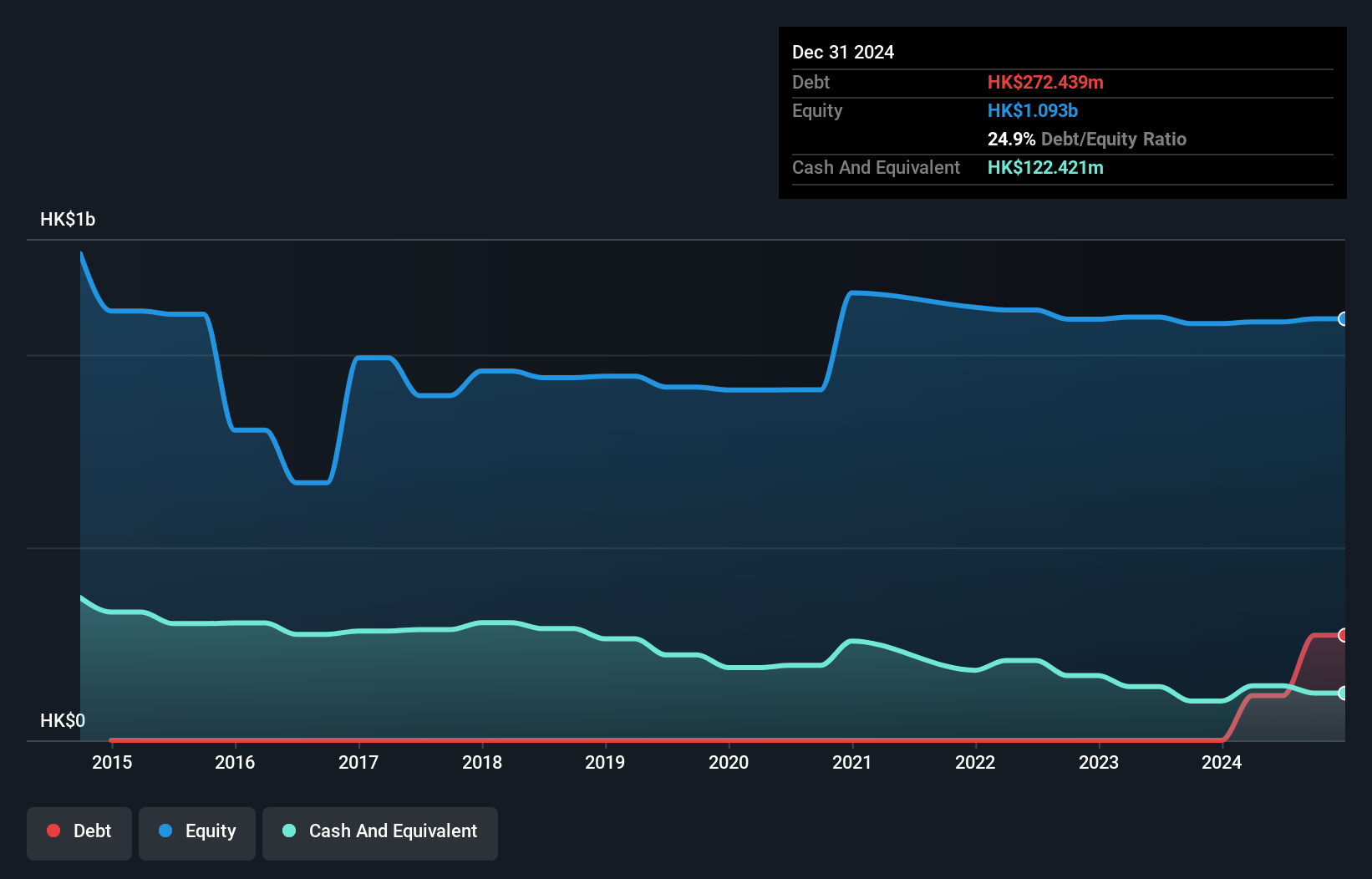

Zero Fintech Group, with a market cap of HK$1.63 billion, primarily generates revenue from its property development and investment segment, totaling HK$1.57 billion. Despite a seasoned management team with an average tenure of 14.1 years, the company faces challenges such as negative earnings growth over the past year and declining profit margins from 9.4% to 6.1%. However, it has more cash than total debt and short-term assets exceeding both short- and long-term liabilities significantly, indicating sound liquidity management despite increased debt levels over five years to a modest 10.7% debt-to-equity ratio.

- Click here and access our complete financial health analysis report to understand the dynamics of Zero Fintech Group.

- Gain insights into Zero Fintech Group's past trends and performance with our report on the company's historical track record.

Vicplas International (SGX:569)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vicplas International Ltd is an investment holding company involved in the medical devices and pipes and pipe fittings sectors across Singapore, Malaysia, China, and the UK, with a market cap of SGD51.11 million.

Operations: The company generates revenue from its Medical Devices segment, amounting to SGD63.15 million, and its Pipes & Pipe Fittings segment, which contributes SGD39.24 million.

Market Cap: SGD51.11M

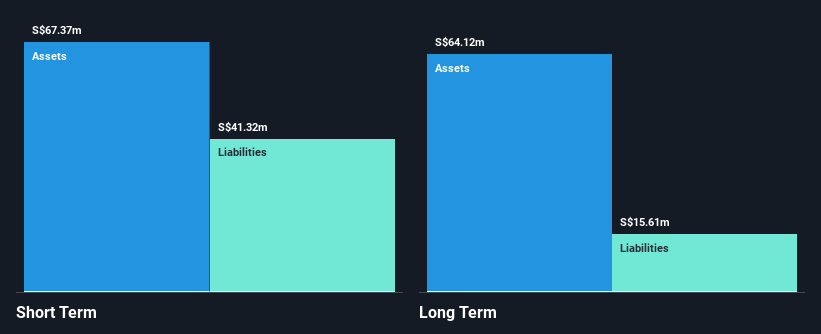

Vicplas International Ltd, with a market cap of SGD51.11 million, operates in the medical devices and pipes & pipe fittings sectors. The company reported a net loss of SGD1.36 million for the fiscal year ending July 31, 2024, attributed to declining sales in its medical devices segment due to post-pandemic inventory adjustments and increased costs from new plant operations. Despite stable weekly volatility at 8%, Vicplas faces challenges with negative return on equity and unprofitability over five years. However, it maintains satisfactory debt levels with short-term assets exceeding liabilities, supported by an experienced management team averaging 8.9 years tenure.

- Take a closer look at Vicplas International's potential here in our financial health report.

- Explore historical data to track Vicplas International's performance over time in our past results report.

Next Steps

- Embark on your investment journey to our 5,741 Penny Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zero Fintech Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:93

Zero Fintech Group

An investment holding company, invests in, develops, and sells real estate properties in the People’s Republic of China and Hong Kong.

Adequate balance sheet very low.