- Hong Kong

- /

- Healthtech

- /

- SEHK:2506

High Growth Tech Stocks in Asia for July 2025

Reviewed by Simply Wall St

As of July 2025, Asian markets have shown resilience amidst global economic shifts, with China's stock indices posting gains and Japan's market experiencing modest growth despite political uncertainties. In this context, identifying high-growth tech stocks involves looking for companies that demonstrate robust innovation and adaptability to evolving market demands, especially in sectors poised to benefit from technological advancements and regional economic trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Fositek | 29.16% | 36.17% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 26.95% | 29.93% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

CARsgen Therapeutics Holdings (SEHK:2171)

Simply Wall St Growth Rating: ★★★★★★

Overview: CARsgen Therapeutics Holdings Limited focuses on the discovery, development, and commercialization of CAR-T cell therapies for hematological malignancies, solid tumors, and autoimmune diseases in China with a market capitalization of HK$13.76 billion.

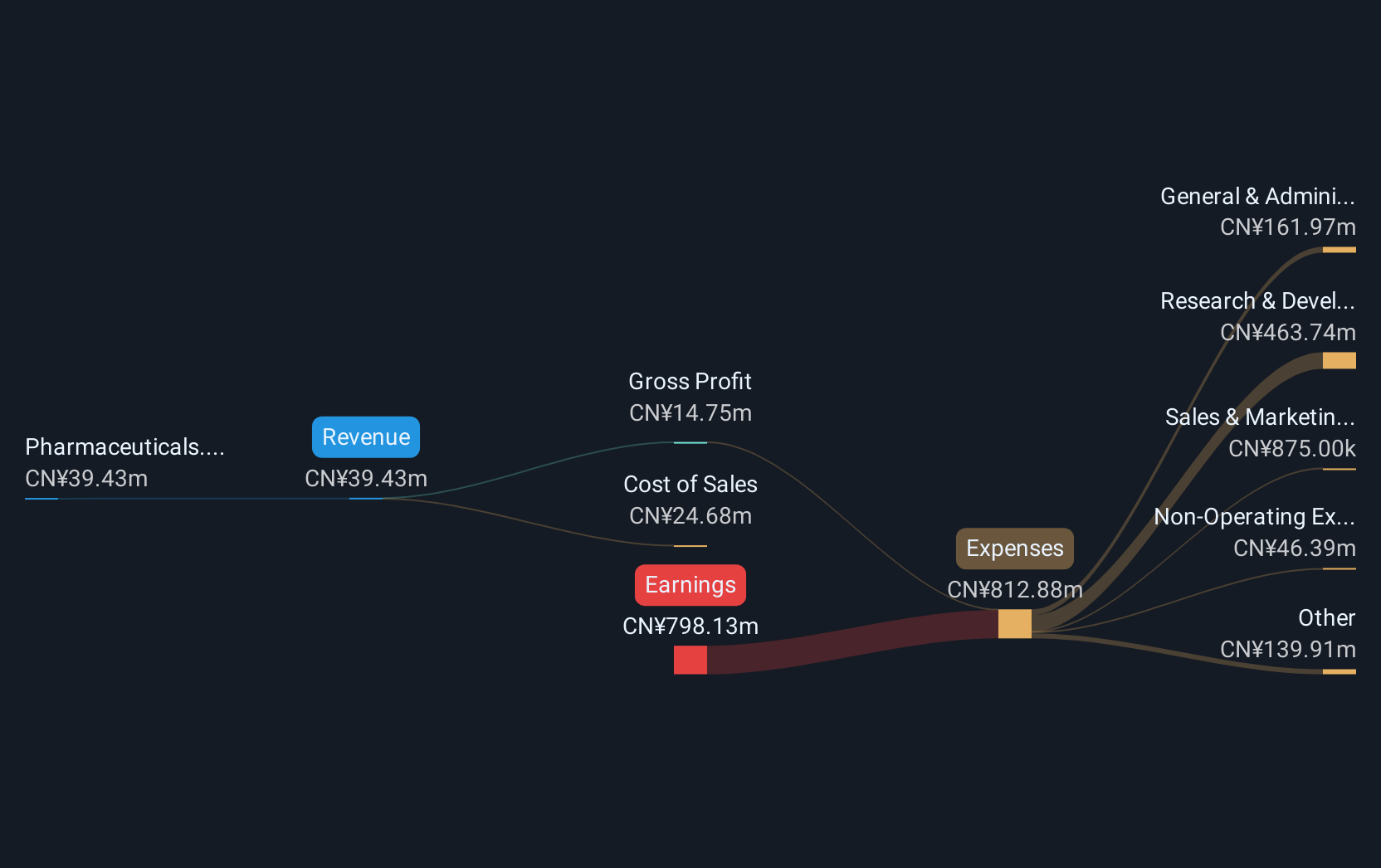

Operations: The company generates revenue primarily from its pharmaceuticals segment, which amounted to CN¥39.43 million. It is involved in the development of CAR-T cell therapies targeting various diseases, with operations centered in China.

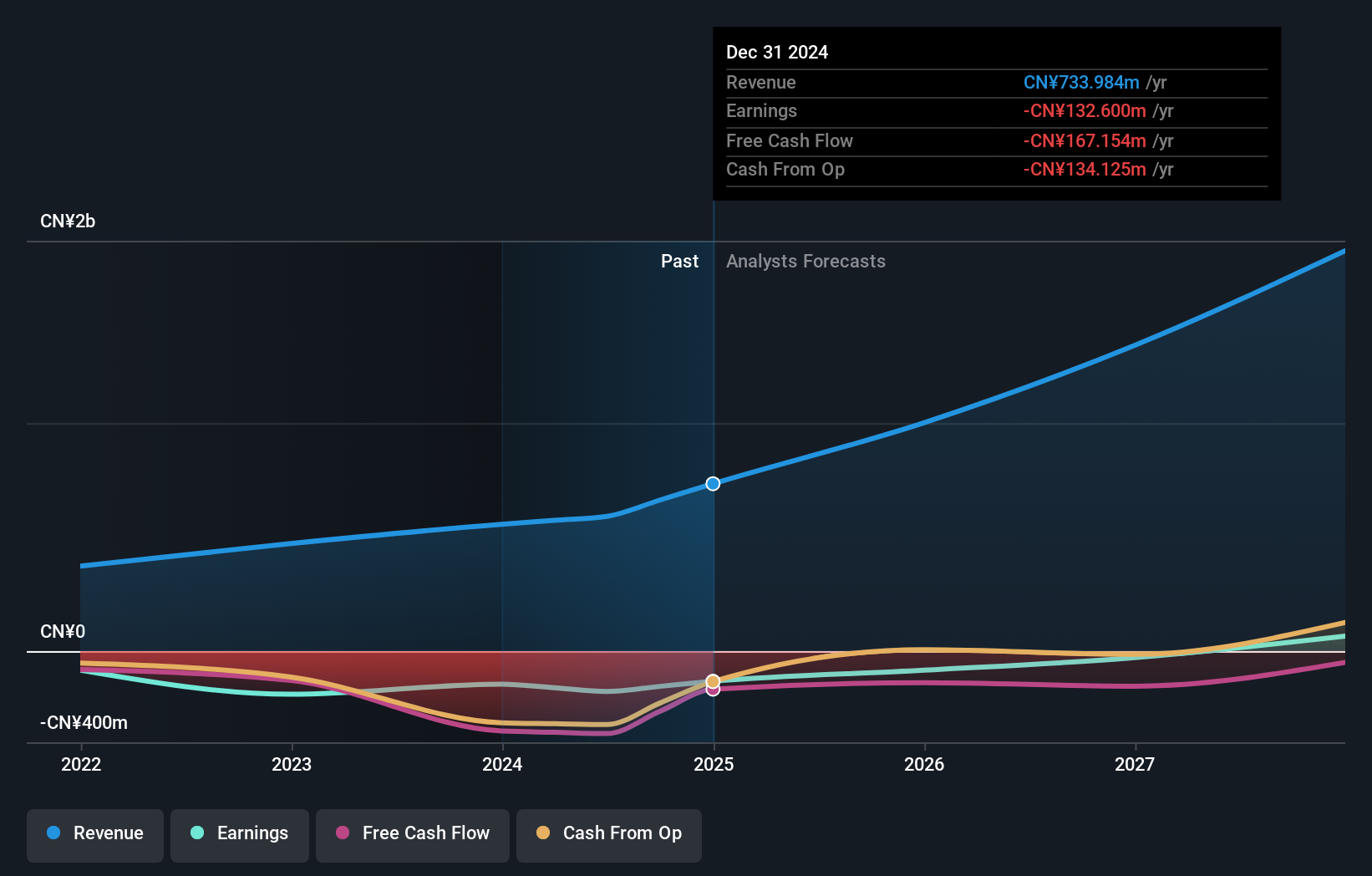

CARsgen Therapeutics Holdings has recently fortified its position in the biotech sector, particularly with its GPC3-targeted CAR-T cell therapies. Following a favorable resolution at the European Patent Office, CARsgen's intellectual property for this innovative cancer treatment stands unchallenged, promising enhanced market exclusivity. This development complements their clinical advancements, notably the Priority Review status granted by China’s National Medical Products Administration for their Claudin18.2-targeted therapy in advanced gastric cancer—a testament to its potential impact on treatment paradigms. With an annual revenue growth forecast at 81.5% and earnings expected to surge by 96.1%, CARsgen is not just navigating but shaping the future of oncological care through significant R&D investments and strategic product pipeline development.

- Take a closer look at CARsgen Therapeutics Holdings' potential here in our health report.

Learn about CARsgen Therapeutics Holdings' historical performance.

Xunfei Healthcare Technology (SEHK:2506)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xunfei Healthcare Technology Co., Ltd. offers healthcare AI solutions in the People’s Republic of China and has a market capitalization of HK$13.89 billion.

Operations: The company generates revenue through four primary segments: PHC Services (CN¥237.03 million), Patient Services (CN¥211.16 million), Hospital Services (CN¥132.04 million), and Regional Healthcare Solutions (CN¥153.76 million).

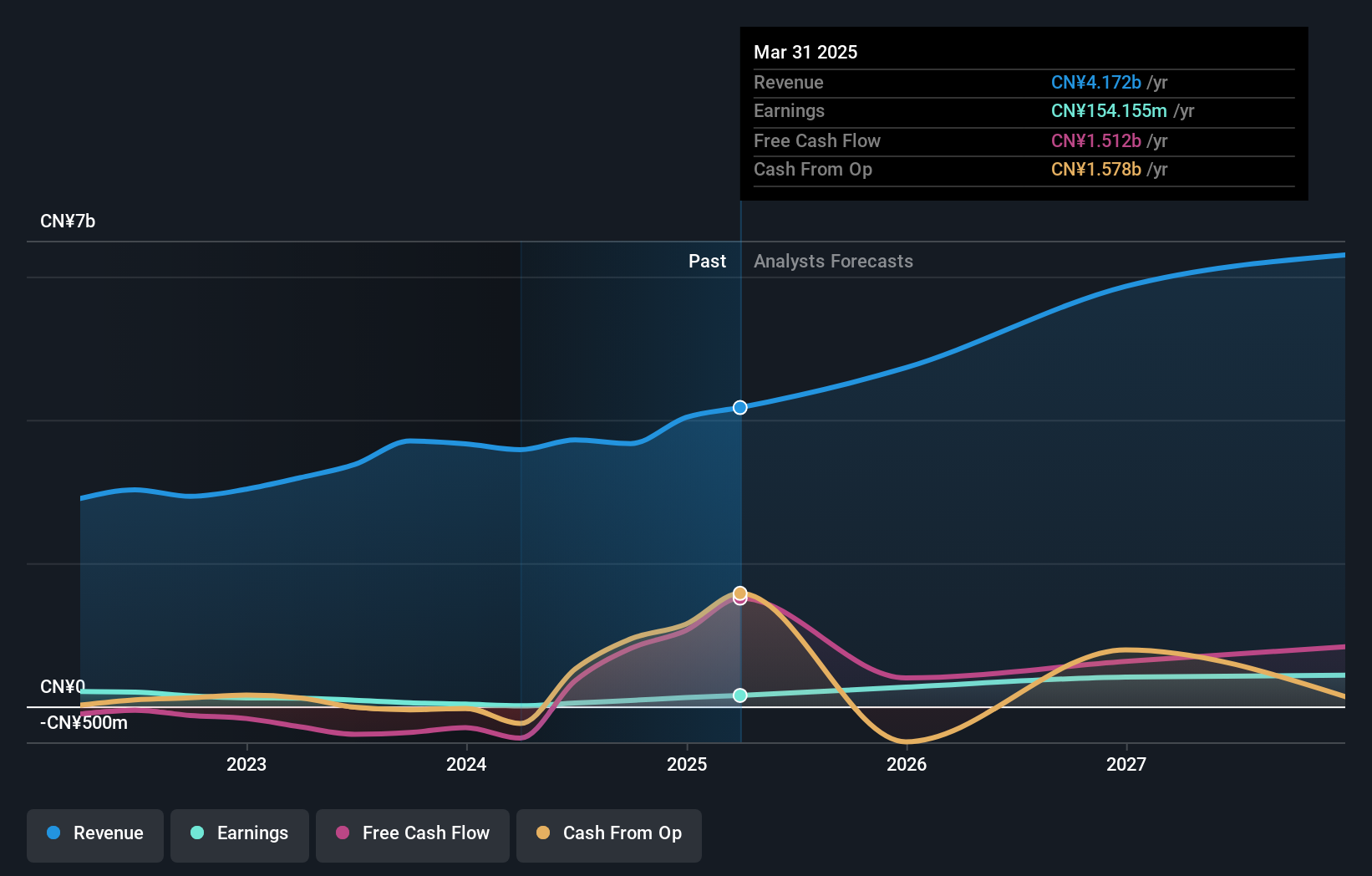

Xunfei Healthcare Technology is navigating a transformative path in the high-growth tech sector in Asia, with a notable 28.2% annual revenue growth and an impressive forecast of 83.65% earnings growth per year. The company's recent strategic amendments to its bylaws underscore a proactive approach to governance, aligning with its ambitious expansion plans. Despite currently being unprofitable, Xunfei's aggressive R&D investments are setting the stage for future profitability, making it a significant player in the evolving healthcare technology landscape.

- Dive into the specifics of Xunfei Healthcare Technology here with our thorough health report.

Understand Xunfei Healthcare Technology's track record by examining our Past report.

JWIPC Technology (SZSE:001339)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JWIPC Technology Co., Ltd. focuses on researching, developing, and manufacturing IoT hardware solutions with a market cap of CN¥13.28 billion.

Operations: JWIPC Technology specializes in IoT hardware solutions, with a focus on research, development, and manufacturing.

JWIPC Technology, a contender in Asia's tech landscape, has demonstrated robust financial performance with a 1477.2% surge in earnings over the past year, significantly outpacing its industry's growth rate of 6.5%. This remarkable growth is underpinned by an aggressive R&D strategy that not only fuels innovation but also aligns with recent corporate actions like dividend affirmations and strategic AGM decisions aimed at agile empowerment for new manufacturing sectors. With expected annual revenue and earnings growth rates of 15.6% and 34.2%, respectively, JWIPC is strategically positioned to leverage its technological advancements further, despite a competitive market environment where continuous innovation is crucial for maintaining lead.

Seize The Opportunity

- Investigate our full lineup of 479 Asian High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2506

Xunfei Healthcare Technology

Provides healthcare AI solutions in the People’s Republic of China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives