- Hong Kong

- /

- Healthcare Services

- /

- SEHK:2453

Why We're Not Concerned Yet About Concord Healthcare Group Co., Ltd.'s (HKG:2453) 27% Share Price Plunge

Concord Healthcare Group Co., Ltd. (HKG:2453) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

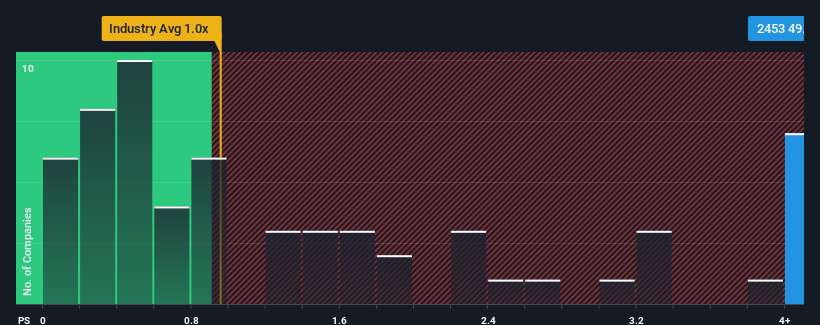

In spite of the heavy fall in price, given around half the companies in Hong Kong's Healthcare industry have price-to-sales ratios (or "P/S") below 1x, you may still consider Concord Healthcare Group as a stock to avoid entirely with its 49.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Concord Healthcare Group

What Does Concord Healthcare Group's Recent Performance Look Like?

Revenue has risen firmly for Concord Healthcare Group recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Concord Healthcare Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Concord Healthcare Group?

In order to justify its P/S ratio, Concord Healthcare Group would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Pleasingly, revenue has also lifted 224% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 13% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Concord Healthcare Group's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Concord Healthcare Group's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Concord Healthcare Group can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Plus, you should also learn about this 1 warning sign we've spotted with Concord Healthcare Group.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2453

Concord Healthcare Group

Provides oncology healthcare service for cancer patients and third-party medical institutions in the People’s Republic of China.

Imperfect balance sheet minimal.

Market Insights

Community Narratives