- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2170

Suzhou Basecare Medical Corporation Limited (HKG:2170) Screens Well But There Might Be A Catch

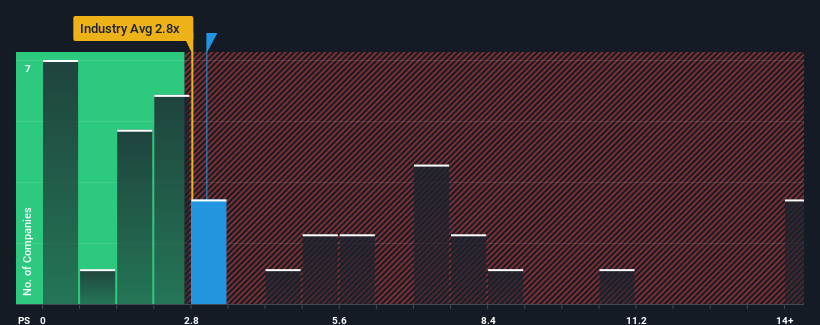

With a median price-to-sales (or "P/S") ratio of close to 2.8x in the Medical Equipment industry in Hong Kong, you could be forgiven for feeling indifferent about Suzhou Basecare Medical Corporation Limited's (HKG:2170) P/S ratio of 3.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Suzhou Basecare Medical

How Suzhou Basecare Medical Has Been Performing

Suzhou Basecare Medical could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Suzhou Basecare Medical.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Suzhou Basecare Medical would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. Pleasingly, revenue has also lifted 159% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 136% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 65%, which is noticeably less attractive.

With this information, we find it interesting that Suzhou Basecare Medical is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Suzhou Basecare Medical's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for Suzhou Basecare Medical that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2170

Suzhou Basecare Medical

An investment holding company provides genetic testing solutions for assisted human reproduction in the People’s Republic of China and Australia.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives