- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2170

Lacklustre Performance Is Driving Suzhou Basecare Medical Corporation Limited's (HKG:2170) Low P/S

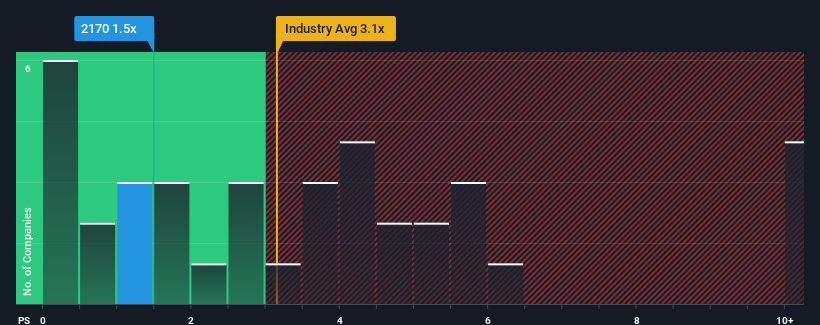

When you see that almost half of the companies in the Medical Equipment industry in Hong Kong have price-to-sales ratios (or "P/S") above 3.1x, Suzhou Basecare Medical Corporation Limited (HKG:2170) looks to be giving off some buy signals with its 1.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Suzhou Basecare Medical

What Does Suzhou Basecare Medical's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Suzhou Basecare Medical has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Suzhou Basecare Medical will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Suzhou Basecare Medical would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 57% gain to the company's top line. The latest three year period has also seen an excellent 149% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 17% as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 32% growth forecast for the broader industry.

With this in consideration, its clear as to why Suzhou Basecare Medical's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Suzhou Basecare Medical maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Suzhou Basecare Medical that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2170

Suzhou Basecare Medical

An investment holding company provides genetic testing solutions for assisted human reproduction in the People’s Republic of China and Australia.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives