- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1858

Here's Why We Think Beijing Chunlizhengda Medical Instruments (HKG:1858) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Beijing Chunlizhengda Medical Instruments (HKG:1858). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Beijing Chunlizhengda Medical Instruments

How Fast Is Beijing Chunlizhengda Medical Instruments Growing Its Earnings Per Share?

Over the last three years, Beijing Chunlizhengda Medical Instruments has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. It's good to see that Beijing Chunlizhengda Medical Instruments's EPS have grown from CN¥0.68 to CN¥0.82 over twelve months. That's a 21% gain; respectable growth in the broader scheme of things.

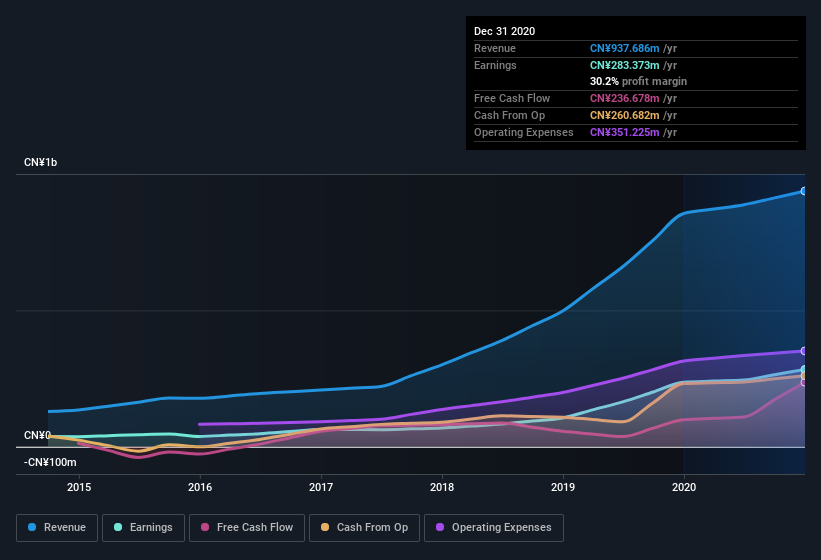

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Beijing Chunlizhengda Medical Instruments is growing revenues, and EBIT margins improved by 2.8 percentage points to 34%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Beijing Chunlizhengda Medical Instruments Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Beijing Chunlizhengda Medical Instruments insiders own a meaningful share of the business. Indeed, with a collective holding of 66%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. And their holding is extremely valuable at the current share price, totalling CN¥6.0b. Now that's what I call some serious skin in the game!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Beijing Chunlizhengda Medical Instruments with market caps between CN¥2.6b and CN¥10b is about CN¥2.6m.

The Beijing Chunlizhengda Medical Instruments CEO received CN¥1.3m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Beijing Chunlizhengda Medical Instruments Deserve A Spot On Your Watchlist?

One positive for Beijing Chunlizhengda Medical Instruments is that it is growing EPS. That's nice to see. Earnings growth might be the main game for Beijing Chunlizhengda Medical Instruments, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. However, before you get too excited we've discovered 1 warning sign for Beijing Chunlizhengda Medical Instruments that you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Beijing Chunlizhengda Medical Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1858

Beijing Chunlizhengda Medical Instruments

Beijing Chunlizhengda Medical Instruments Co., Ltd.

High growth potential with excellent balance sheet.