- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1763

China Isotope & Radiation Corporation's (HKG:1763) 36% Share Price Surge Not Quite Adding Up

China Isotope & Radiation Corporation (HKG:1763) shareholders have had their patience rewarded with a 36% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 8.1% isn't as impressive.

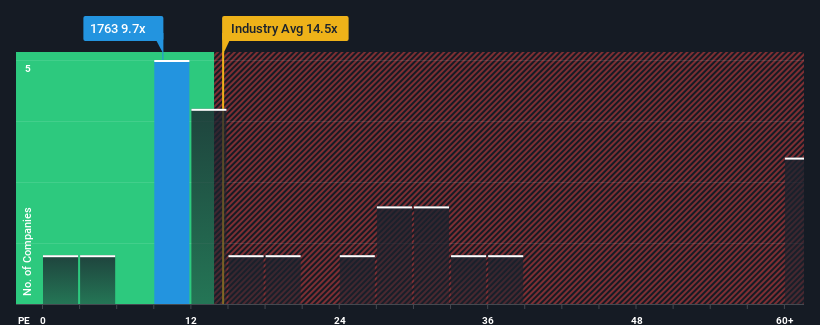

Although its price has surged higher, you could still be forgiven for feeling indifferent about China Isotope & Radiation's P/E ratio of 9.7x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at China Isotope & Radiation over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for China Isotope & Radiation

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like China Isotope & Radiation's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.4%. Even so, admirably EPS has lifted 61% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that China Isotope & Radiation is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From China Isotope & Radiation's P/E?

China Isotope & Radiation's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Isotope & Radiation currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for China Isotope & Radiation that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1763

China Isotope & Radiation

Engages in the research and development, manufacture, and sale of nuclides, diagnostic and therapeutic radiopharmaceuticals and radioactive source products for medical and industrial applications in China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives