- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1696

What Sisram Medical Ltd's (HKG:1696) 40% Share Price Gain Is Not Telling You

The Sisram Medical Ltd (HKG:1696) share price has done very well over the last month, posting an excellent gain of 40%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

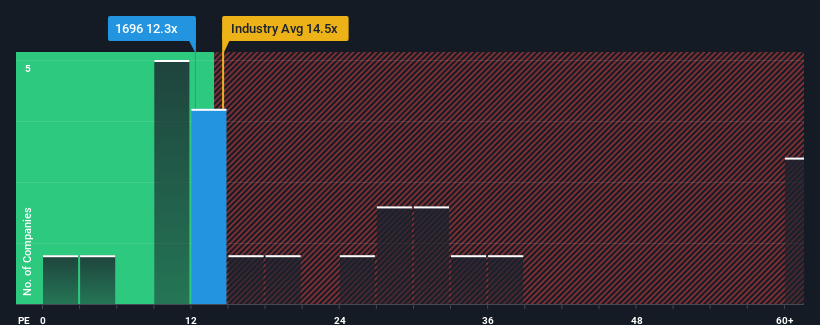

Although its price has surged higher, there still wouldn't be many who think Sisram Medical's price-to-earnings (or "P/E") ratio of 12.3x is worth a mention when the median P/E in Hong Kong is similar at about 11x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For instance, Sisram Medical's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Sisram Medical

How Is Sisram Medical's Growth Trending?

Sisram Medical's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 39%. This means it has also seen a slide in earnings over the longer-term as EPS is down 8.2% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 22% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Sisram Medical is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Bottom Line On Sisram Medical's P/E

Sisram Medical appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Sisram Medical revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Sisram Medical, and understanding them should be part of your investment process.

Of course, you might also be able to find a better stock than Sisram Medical. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1696

Sisram Medical

Engages in the research, design, development, manufacture, and sales of medical aesthetics and dental equipment, home use devices, injectables, and cosmeceuticals products in the Asia Pacific, Europe, North America, Latin America, the Middle East, and Africa.

Undervalued with excellent balance sheet.