- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1066

Shandong Weigao Group Medical Polymer Company Limited's (HKG:1066) 27% Share Price Plunge Could Signal Some Risk

The Shandong Weigao Group Medical Polymer Company Limited (HKG:1066) share price has fared very poorly over the last month, falling by a substantial 27%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

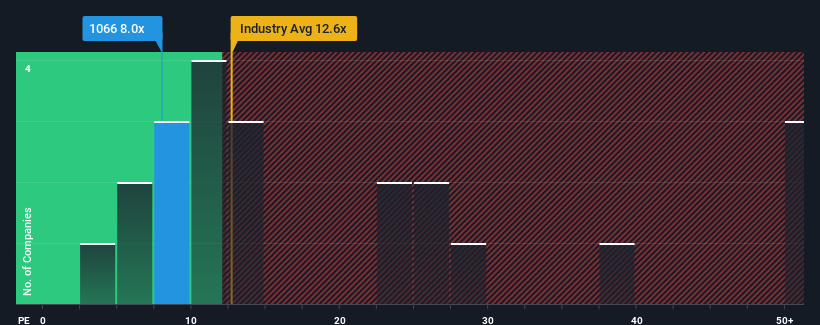

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Shandong Weigao Group Medical Polymer's P/E ratio of 8x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Shandong Weigao Group Medical Polymer could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Shandong Weigao Group Medical Polymer

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Shandong Weigao Group Medical Polymer's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 28%. The last three years don't look nice either as the company has shrunk EPS by 5.8% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 11% per year as estimated by the eight analysts watching the company. That's shaping up to be materially lower than the 16% per annum growth forecast for the broader market.

With this information, we find it interesting that Shandong Weigao Group Medical Polymer is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Shandong Weigao Group Medical Polymer's P/E?

With its share price falling into a hole, the P/E for Shandong Weigao Group Medical Polymer looks quite average now. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shandong Weigao Group Medical Polymer currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Shandong Weigao Group Medical Polymer you should know about.

If these risks are making you reconsider your opinion on Shandong Weigao Group Medical Polymer, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1066

Shandong Weigao Group Medical Polymer

Engages in the research and development, production, wholesale, and sale of medical devices in the People’s Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives