- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1066

3 Dividend Stocks To Consider With Yields Up To 5.7%

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares. In this environment of economic uncertainty and fluctuating interest rates, dividend stocks can offer a steady income stream, making them an attractive option for investors seeking stability and potential yield in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.83% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.35% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

Click here to see the full list of 1977 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

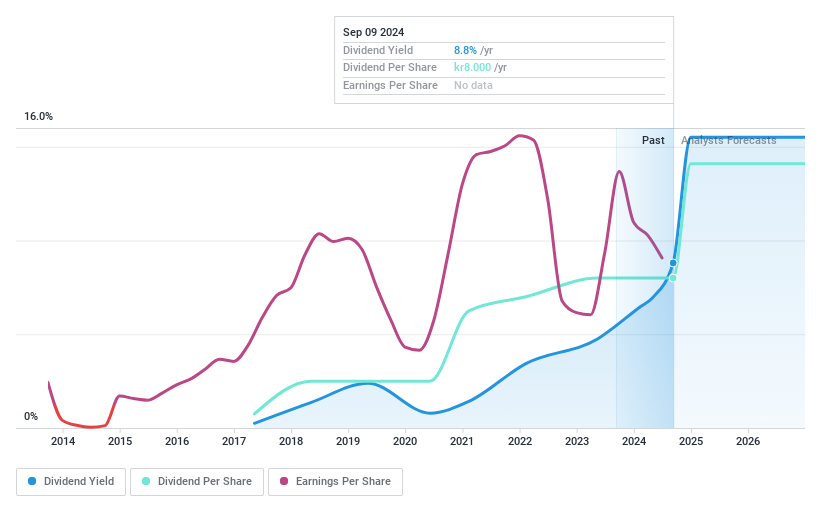

G5 Entertainment (OM:G5EN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: G5 Entertainment AB (publ) develops and publishes free-to-play games for smartphones, tablets, and personal computers in Sweden, with a market cap of SEK1.08 billion.

Operations: G5 Entertainment AB (publ) generates revenue primarily from the development and sales of casual games, amounting to SEK1.13 billion.

Dividend Yield: 5.8%

G5 Entertainment's recent earnings report shows a decline in sales but a significant increase in net income for Q4 2024. Despite only eight years of dividend history, its dividends are stable and covered by both earnings and cash flows, with payout ratios of 52.5% and 35%, respectively. The dividend yield is among the top quartile in Sweden at 5.76%. G5 is trading below estimated fair value, offering potential appeal for dividend-focused investors seeking value.

- Click here and access our complete dividend analysis report to understand the dynamics of G5 Entertainment.

- Our comprehensive valuation report raises the possibility that G5 Entertainment is priced lower than what may be justified by its financials.

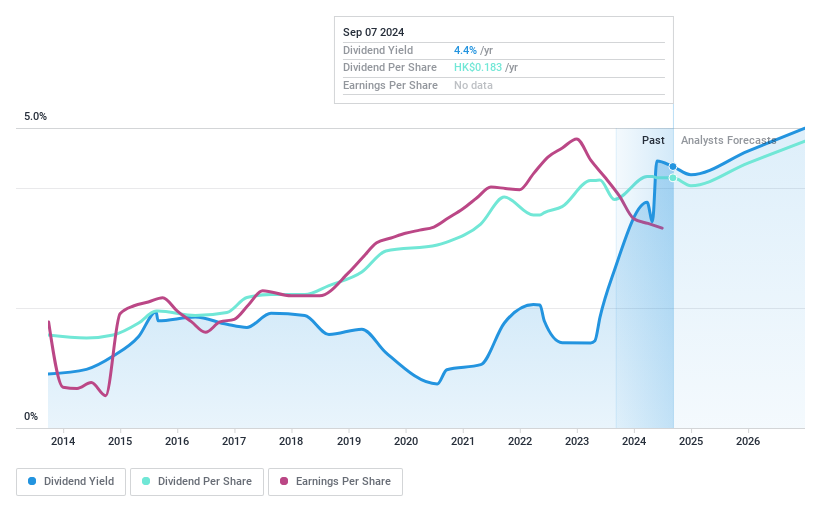

Shandong Weigao Group Medical Polymer (SEHK:1066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shandong Weigao Group Medical Polymer Company Limited focuses on the research, development, production, wholesale, and sale of medical devices in China with a market cap of HK$22.67 billion.

Operations: Shandong Weigao Group Medical Polymer Company Limited's revenue is derived from several segments including Orthopaedic Products (CN¥1.22 billion), Interventional Products (CN¥1.99 billion), Medical Device Products (CN¥6.74 billion), Blood Management Products (CN¥936.84 million), and Pharma Packaging Products (CN¥2.13 billion).

Dividend Yield: 3.6%

Shandong Weigao Group Medical Polymer's dividend payments, although increased over the past decade, have been volatile and unreliable. The dividends are well covered by earnings (payout ratio: 43.9%) and cash flows (cash payout ratio: 37.5%). Trading at a good value compared to peers, its dividend yield of 3.58% is low relative to top payers in Hong Kong. Recent share buybacks aim to boost net asset value and earnings per share.

- Click to explore a detailed breakdown of our findings in Shandong Weigao Group Medical Polymer's dividend report.

- The valuation report we've compiled suggests that Shandong Weigao Group Medical Polymer's current price could be quite moderate.

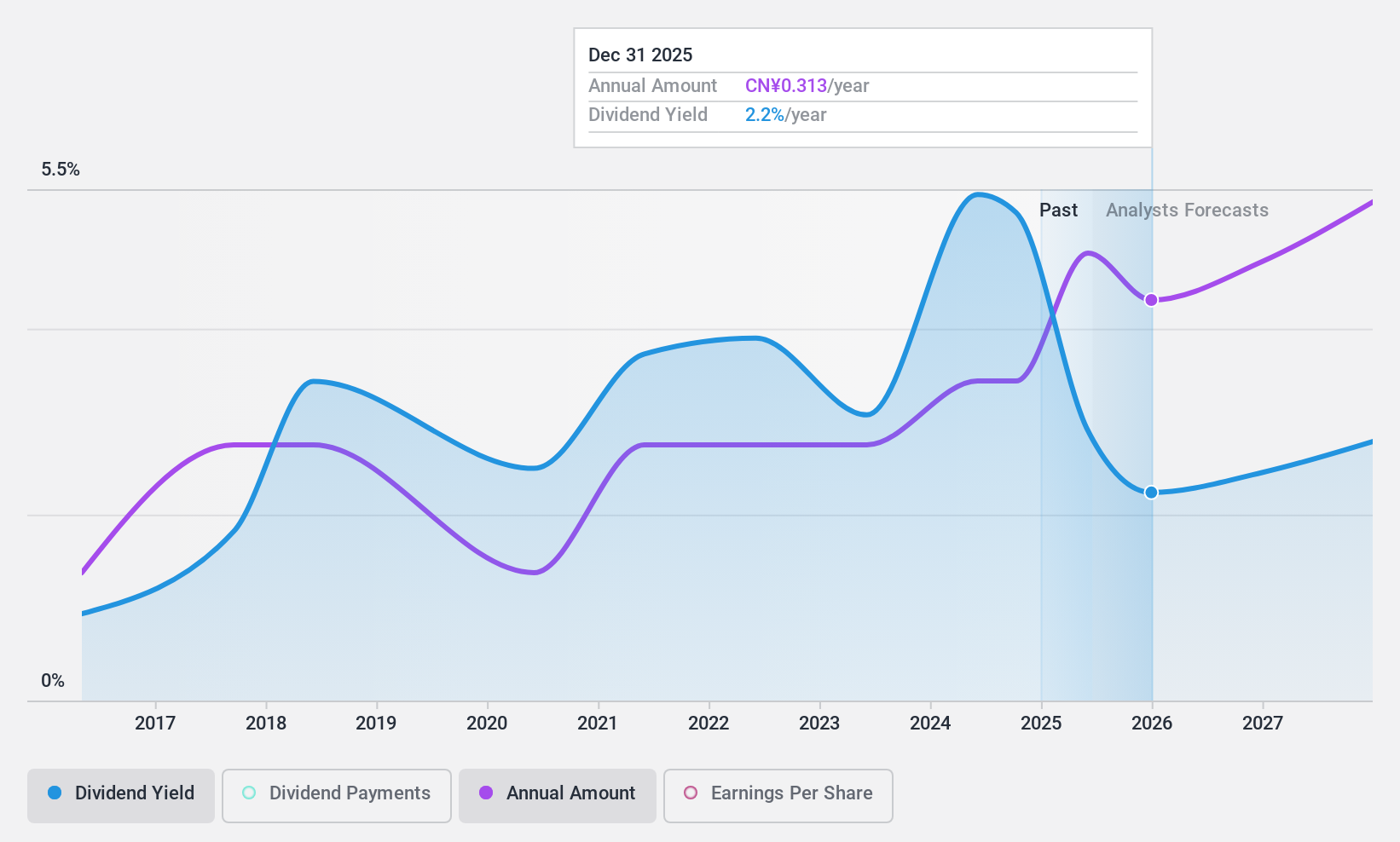

Guangdong Chj IndustryLtd (SZSE:002345)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Guangdong Chj Industry Co., Ltd. produces and sells jewelry and fashion consumer goods, with a market cap of CN¥5.09 billion.

Operations: Guangdong Chj Industry Co., Ltd. generates revenue primarily from the production and sale of jewelry and fashion consumer goods.

Dividend Yield: 3.5%

Guangdong Chj Industry Ltd. offers a dividend yield of 3.49%, placing it in the top 25% of CN market payers, yet its dividend history is marked by volatility and unreliability over the past decade. While dividends are well covered by cash flows (42.7%), the payout ratio is high at 90%. The company trades at a favorable value with a P/E ratio of 15.1x, below the market average, amidst recent board changes approved in November 2024.

- Unlock comprehensive insights into our analysis of Guangdong Chj IndustryLtd stock in this dividend report.

- Our expertly prepared valuation report Guangdong Chj IndustryLtd implies its share price may be lower than expected.

Taking Advantage

- Unlock our comprehensive list of 1977 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1066

Shandong Weigao Group Medical Polymer

Engages in the research and development, production, wholesale, and sale of medical devices in the People’s Republic of China.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives