3 SEHK Growth Stocks With High Insider Ownership Expecting Up To 90% Earnings Growth

Reviewed by Simply Wall St

In recent weeks, the Hong Kong market has experienced a notable surge, with the Hang Seng Index climbing 10.2%, bolstered by optimism around Beijing's support measures despite ongoing global tensions. As investors navigate these turbulent times, growth companies with high insider ownership can offer potential stability and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 32.6% |

| Akeso (SEHK:9926) | 20.5% | 54.2% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| RemeGen (SEHK:9995) | 16.1% | 52.2% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| DPC Dash (SEHK:1405) | 38.1% | 104.2% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

Let's dive into some prime choices out of the screener.

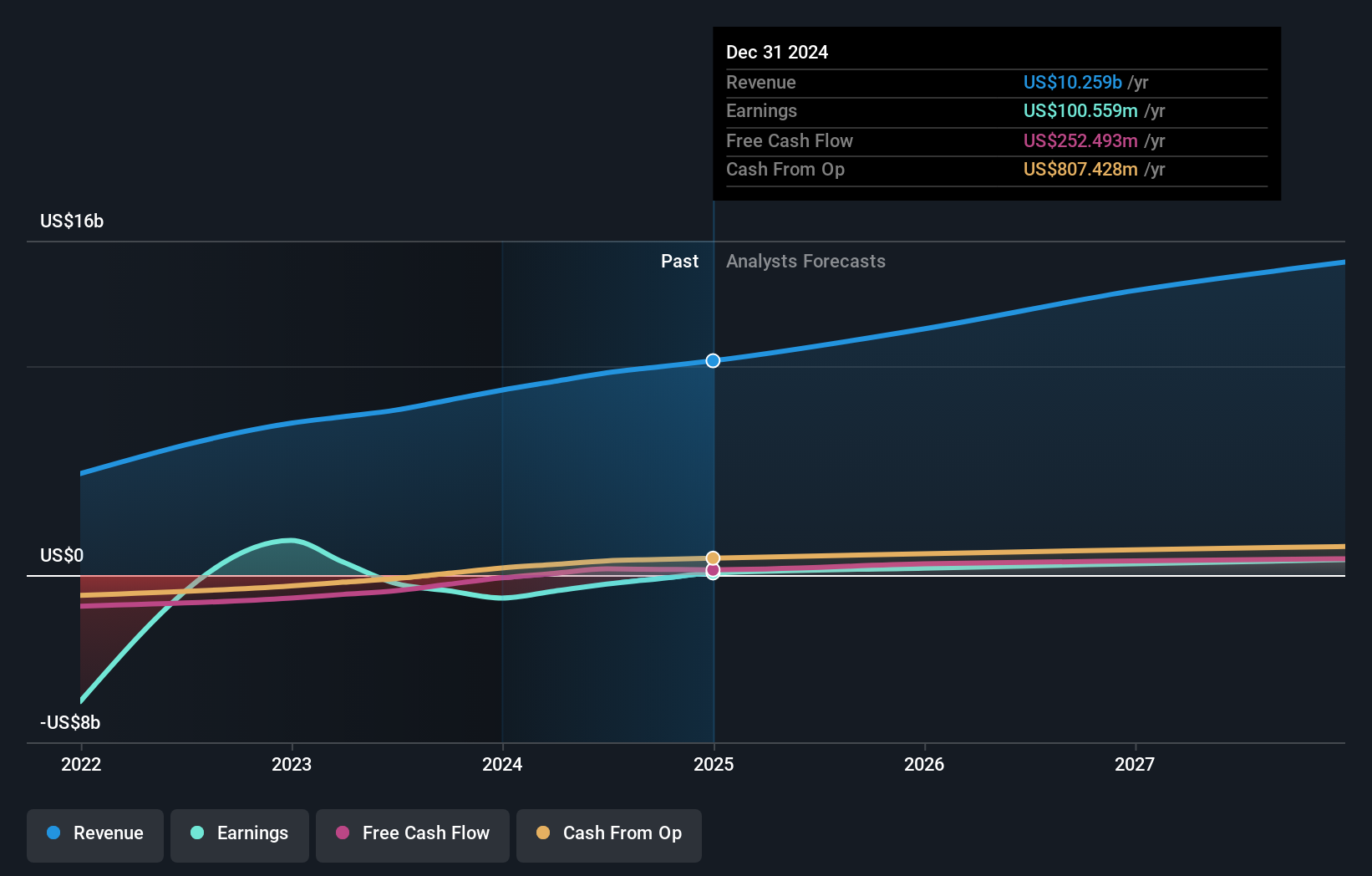

J&T Global Express (SEHK:1519)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J&T Global Express Limited, with a market cap of HK$60.51 billion, is an investment holding company that provides express delivery services.

Operations: The company's revenue segment consists of Transportation - Air Freight, generating $9.68 billion.

Insider Ownership: 18.9%

Earnings Growth Forecast: 58.8% p.a.

J&T Global Express, recently added to the Hang Seng China Enterprises Index, is forecasted to achieve above-average market growth by becoming profitable within three years. Despite trading significantly below estimated fair value and analysts predicting a 32.6% price increase, its Return on Equity is expected to remain low at 15.2%. The company reported a half-year net income of US$27.59 million from a previous loss, indicating financial improvement but faces challenges with insider ownership stability.

- Take a closer look at J&T Global Express' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that J&T Global Express is priced lower than what may be justified by its financials.

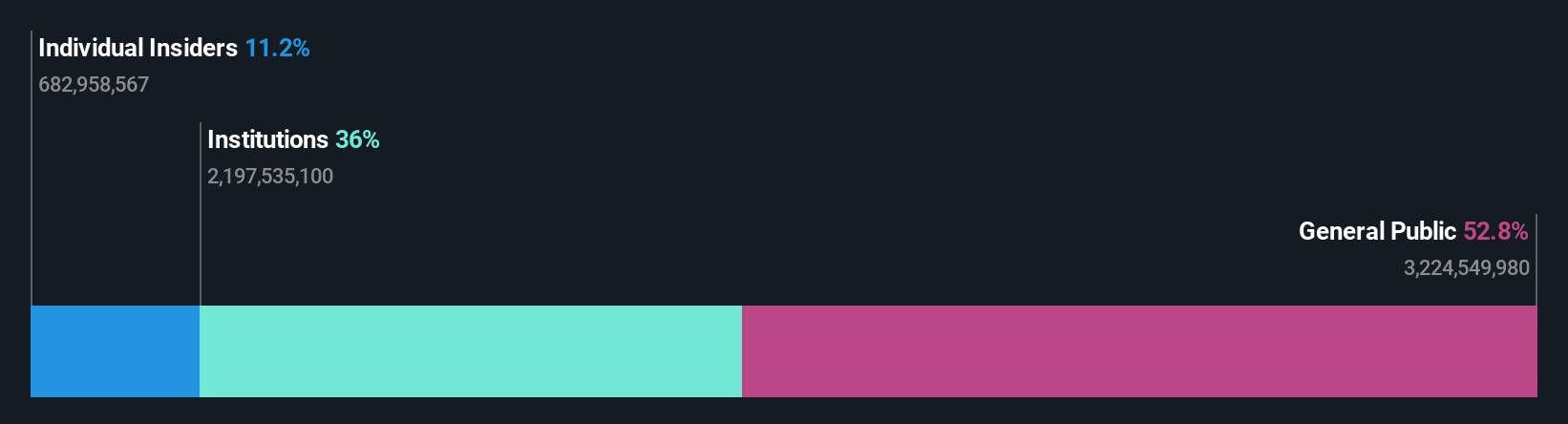

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan is a technology retail company operating in the People's Republic of China with a market capitalization of approximately HK$1.27 trillion.

Operations: The company's revenue is derived from two main segments: New Initiatives, generating CN¥77.56 billion, and Core Local Commerce, contributing CN¥228.13 billion.

Insider Ownership: 11.8%

Earnings Growth Forecast: 26.1% p.a.

Meituan's earnings are projected to grow significantly, outpacing the Hong Kong market. Despite slower revenue growth forecasts, recent financials show robust performance with net income doubling to CNY 16.72 billion for the first half of 2024. The company has executed substantial share buybacks totaling HKD 7.17 billion this year, reflecting confidence in its valuation as it trades below fair value estimates. While insider buying is limited recently, insider selling is also minimal.

- Unlock comprehensive insights into our analysis of Meituan stock in this growth report.

- In light of our recent valuation report, it seems possible that Meituan is trading beyond its estimated value.

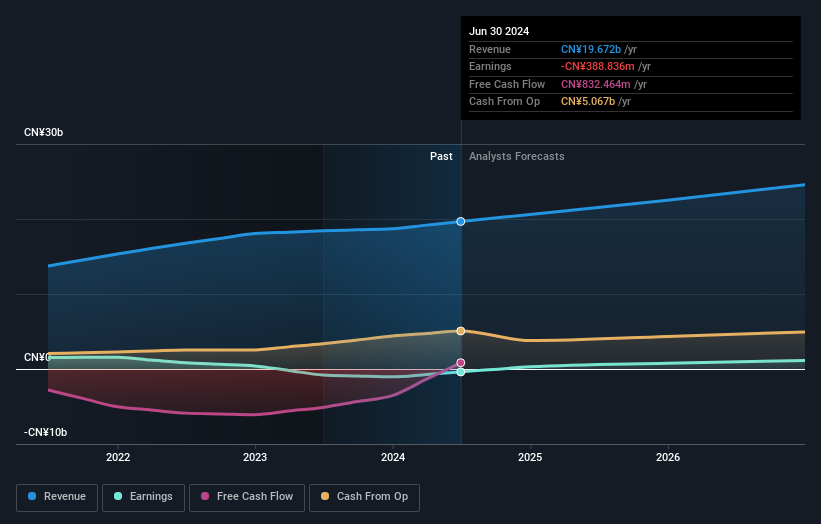

China Youran Dairy Group (SEHK:9858)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Youran Dairy Group Limited is an investment holding company that operates as an integrated provider of products and services in the upstream dairy industry in China, with a market cap of HK$5.92 billion.

Operations: The company's revenue segments include the Raw Milk Business, generating CN¥14.07 billion, and Comprehensive Ruminant Farming Solutions, contributing CN¥7.65 billion.

Insider Ownership: 14.5%

Earnings Growth Forecast: 90.3% p.a.

China Youran Dairy Group's recent earnings report highlights a narrowing net loss of CNY 330.87 million for H1 2024, compared to a much larger loss last year, suggesting operational improvements. Revenue growth is forecasted at 9% annually, outpacing the Hong Kong market average. Despite high debt levels and past shareholder dilution, the stock trades at good value relative to peers with analysts projecting a potential price increase of over 20%. Insider trading activity remains minimal recently.

- Get an in-depth perspective on China Youran Dairy Group's performance by reading our analyst estimates report here.

- The analysis detailed in our China Youran Dairy Group valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Get an in-depth perspective on all 47 Fast Growing SEHK Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9858

China Youran Dairy Group

An investment holding company, operates as an integrated provider of products and services in the upstream dairy industry in the People's Republic of China.

Reasonable growth potential and fair value.