Asian Growth Companies With High Insider Ownership In May 2025

Reviewed by Simply Wall St

As of May 2025, Asian markets are navigating a complex landscape shaped by ongoing trade discussions between major economies and policy adjustments by central banks. With these uncertainties in mind, investors often look for growth companies with high insider ownership as they can indicate strong confidence from those closest to the business, potentially offering resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.0% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.3% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| giftee (TSE:4449) | 34.5% | 67.1% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Let's explore several standout options from the results in the screener.

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally with a market cap of approximately HK$1.23 trillion.

Operations: BYD generates revenue primarily from its operations in the automobiles and batteries sectors across various regions, including China, Hong Kong, Macau, Taiwan, and international markets.

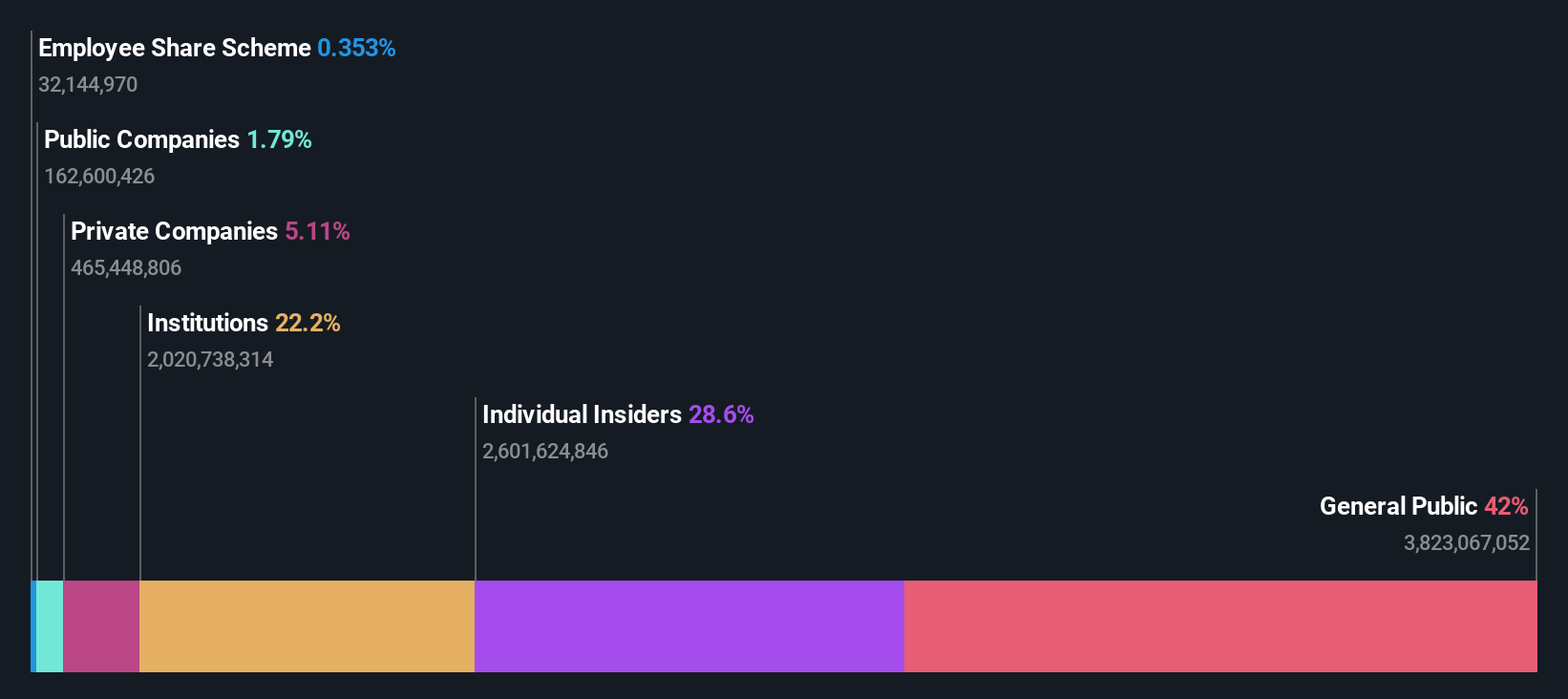

Insider Ownership: 28.6%

Revenue Growth Forecast: 13% p.a.

BYD Company Limited demonstrates strong growth potential, with earnings projected to grow 15.9% annually, outpacing the Hong Kong market. Recent results show significant sales and production increases, with April's sales volume at 380,089 units compared to 313,245 a year prior. Despite no recent insider trading activity, BYD maintains substantial insider ownership which can align management interests with shareholders. The company's strategic focus on new energy vehicles and energy storage solutions supports its robust position in the industry.

- Click to explore a detailed breakdown of our findings in BYD's earnings growth report.

- Upon reviewing our latest valuation report, BYD's share price might be too optimistic.

Smoore International Holdings (SEHK:6969)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Smoore International Holdings Limited is an investment holding company that provides vaping technology solutions with a market cap of HK$88.05 billion.

Operations: The company generates revenue primarily from the sale of APV and vaping devices and components, totaling CN¥11.80 billion.

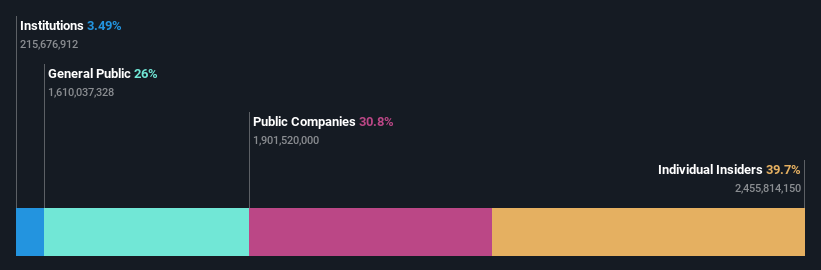

Insider Ownership: 39.7%

Revenue Growth Forecast: 11.7% p.a.

Smoore International Holdings is poised for significant earnings growth of 23.4% annually, surpassing the Hong Kong market average. Despite a slower revenue increase of 11.7%, insider confidence remains high with substantial recent share purchases and no major sales. The company's net income declined to CNY 1,303.26 million in 2024 from CNY 1,645.09 million in the previous year, yet it trades slightly below its estimated fair value, suggesting potential investor interest as earnings improve.

- Delve into the full analysis future growth report here for a deeper understanding of Smoore International Holdings.

- Our comprehensive valuation report raises the possibility that Smoore International Holdings is priced higher than what may be justified by its financials.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quanta Computer Inc. is a manufacturer and seller of notebook computers across Asia, the Americas, Europe, and internationally, with a market cap of NT$996.39 billion.

Operations: The Electronics Sector is a key revenue segment for Quanta Computer Inc., generating NT$3.05 billion.

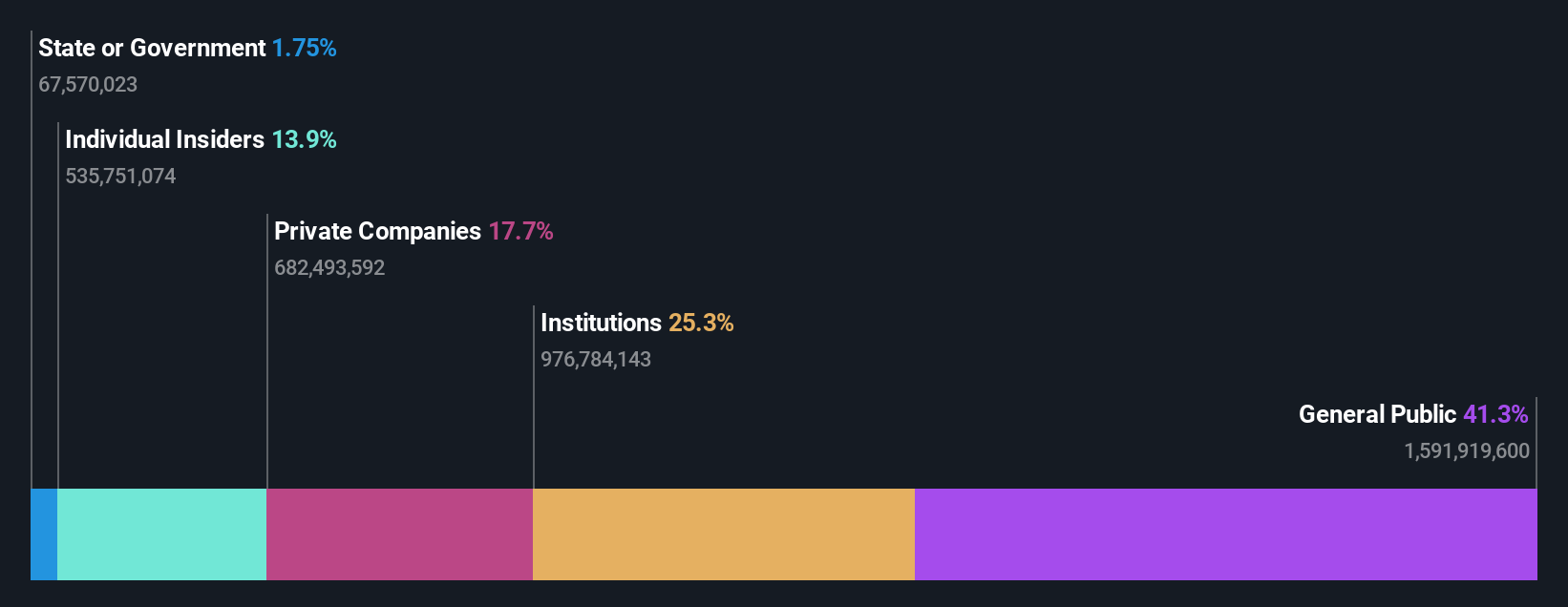

Insider Ownership: 13.9%

Revenue Growth Forecast: 26.7% p.a.

Quanta Computer's revenue is expected to grow at 26.7% annually, outpacing the Taiwan market, while earnings are projected to rise by 14.9%, slightly above market average. Despite no recent insider trading activity, analysts anticipate a 31.2% stock price increase and note it trades significantly below its fair value estimate. The company reported strong financial results for 2024 with sales of TWD 1.41 trillion and net income of TWD 59.7 billion, reflecting robust growth from the previous year.

- Get an in-depth perspective on Quanta Computer's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Quanta Computer implies its share price may be lower than expected.

Seize The Opportunity

- Explore the 618 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Contemplating Other Strategies? AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives