We Think Chaoda Modern Agriculture (Holdings) (HKG:682) Can Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether Chaoda Modern Agriculture (Holdings) (HKG:682) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Chaoda Modern Agriculture (Holdings)

How Long Is Chaoda Modern Agriculture (Holdings)'s Cash Runway?

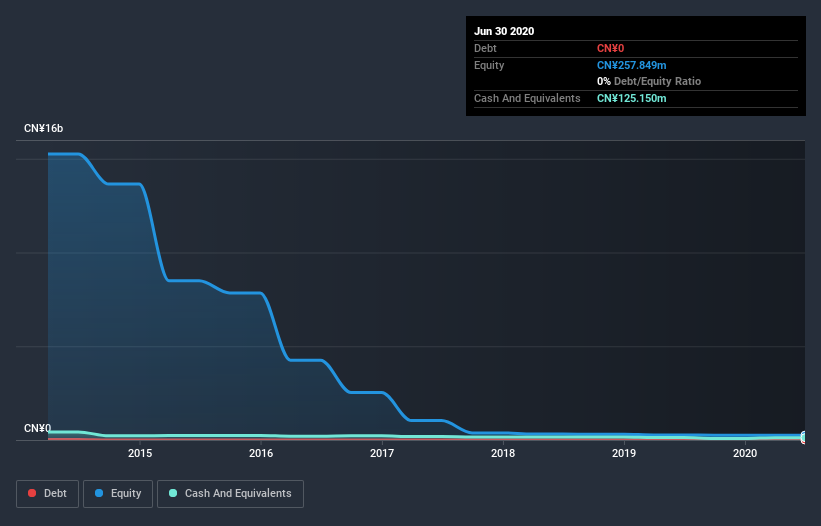

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In June 2020, Chaoda Modern Agriculture (Holdings) had CN¥125m in cash, and was debt-free. In the last year, its cash burn was CN¥11m. So it had a very long cash runway of many years from June 2020. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. You can see how its cash balance has changed over time in the image below.

How Well Is Chaoda Modern Agriculture (Holdings) Growing?

Chaoda Modern Agriculture (Holdings) managed to reduce its cash burn by 58% over the last twelve months, which suggests it's on the right flight path. Unfortunately, however, operating revenue dropped 12% during the same time frame. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic earnings and revenue shows how Chaoda Modern Agriculture (Holdings) is building its business over time.

How Hard Would It Be For Chaoda Modern Agriculture (Holdings) To Raise More Cash For Growth?

While Chaoda Modern Agriculture (Holdings) seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of CN¥158m, Chaoda Modern Agriculture (Holdings)'s CN¥11m in cash burn equates to about 6.8% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About Chaoda Modern Agriculture (Holdings)'s Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Chaoda Modern Agriculture (Holdings) is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. Although its falling revenue does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Taking an in-depth view of risks, we've identified 1 warning sign for Chaoda Modern Agriculture (Holdings) that you should be aware of before investing.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Chaoda Modern Agriculture (Holdings), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:682

Chaoda Modern Agriculture (Holdings)

An investment holding company, engages in growing and selling agricultural products primarily in Hong Kong.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives