Four Seas Mercantile Holdings' (HKG:374) Soft Earnings Are Actually Better Than They Appear

The market for Four Seas Mercantile Holdings Limited's (HKG:374) shares didn't move much after it posted weak earnings recently. We did some digging, and we believe the earnings are stronger than they seem.

See our latest analysis for Four Seas Mercantile Holdings

Examining Cashflow Against Four Seas Mercantile Holdings' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

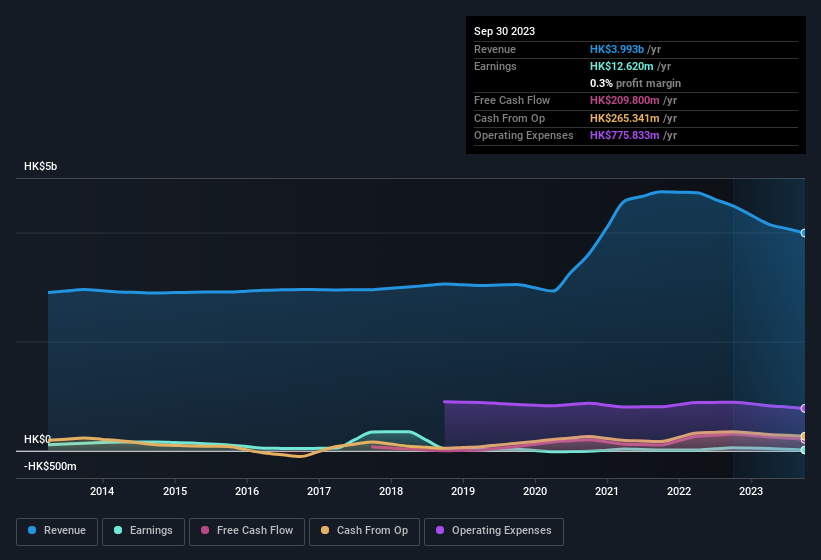

Over the twelve months to September 2023, Four Seas Mercantile Holdings recorded an accrual ratio of -0.12. That indicates that its free cash flow was a fair bit more than its statutory profit. Indeed, in the last twelve months it reported free cash flow of HK$210m, well over the HK$12.6m it reported in profit. Four Seas Mercantile Holdings' free cash flow actually declined over the last year, which is disappointing, like non-biodegradable balloons. However, that's not all there is to consider. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Four Seas Mercantile Holdings.

How Do Unusual Items Influence Profit?

Four Seas Mercantile Holdings' profit was reduced by unusual items worth HK$38m in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. This is what you'd expect to see where a company has a non-cash charge reducing paper profits. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Four Seas Mercantile Holdings took a rather significant hit from unusual items in the year to September 2023. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Our Take On Four Seas Mercantile Holdings' Profit Performance

In conclusion, both Four Seas Mercantile Holdings' accrual ratio and its unusual items suggest that its statutory earnings are probably reasonably conservative. After considering all this, we reckon Four Seas Mercantile Holdings' statutory profit probably understates its earnings potential! So while earnings quality is important, it's equally important to consider the risks facing Four Seas Mercantile Holdings at this point in time. For example, we've discovered 3 warning signs that you should run your eye over to get a better picture of Four Seas Mercantile Holdings.

After our examination into the nature of Four Seas Mercantile Holdings' profit, we've come away optimistic for the company. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you're looking to trade Four Seas Mercantile Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:374

Four Seas Mercantile Holdings

An investment holding company, engages in the manufacture and trade in snack foods, confectionery, beverages, frozen food products, noodles, and ham and ham-related products in Hong Kong and Mainland China.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives