Four Seas Mercantile Holdings (HKG:374) Has Announced A Dividend Of HK$0.065

The board of Four Seas Mercantile Holdings Limited (HKG:374) has announced that it will pay a dividend of HK$0.065 per share on the 26th of September. Including this payment, the dividend yield on the stock will be 3.5%, which is a modest boost for shareholders' returns.

See our latest analysis for Four Seas Mercantile Holdings

Four Seas Mercantile Holdings Doesn't Earn Enough To Cover Its Payments

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. The last payment made up 90% of earnings, but cash flows were much higher. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Looking forward, EPS could fall by 34.9% if the company can't turn things around from the last few years. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 140%, which could put the dividend under pressure if earnings don't start to improve.

Four Seas Mercantile Holdings Has A Solid Track Record

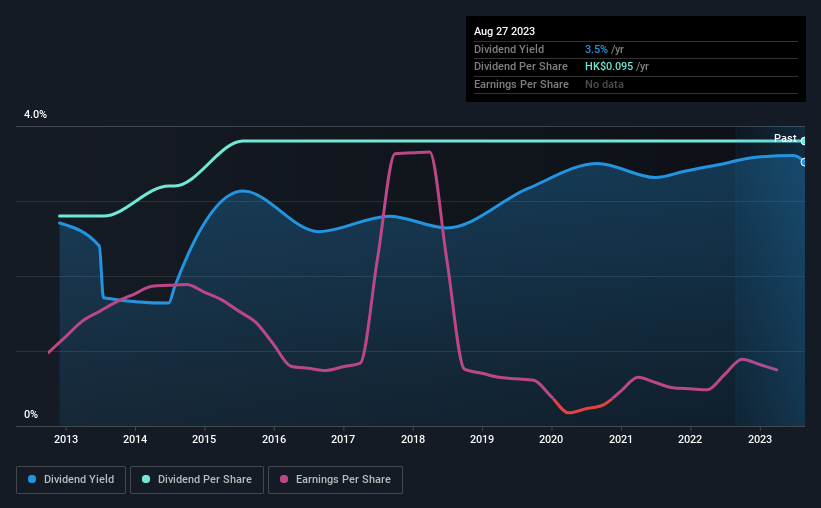

The company has a sustained record of paying dividends with very little fluctuation. Since 2013, the annual payment back then was HK$0.07, compared to the most recent full-year payment of HK$0.095. This means that it has been growing its distributions at 3.1% per annum over that time. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Four Seas Mercantile Holdings' EPS has fallen by approximately 35% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 2 warning signs for Four Seas Mercantile Holdings (of which 1 is significant!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:374

Four Seas Mercantile Holdings

An investment holding company, engages in the manufacture and trade in snack food, confectionery, beverages, frozen food products, noodles, and ham and ham-related products in Hong Kong, Mainland China, and Japan.

Slight risk and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026