There May Be Underlying Issues With The Quality Of San Miguel Brewery Hong Kong's (HKG:236) Earnings

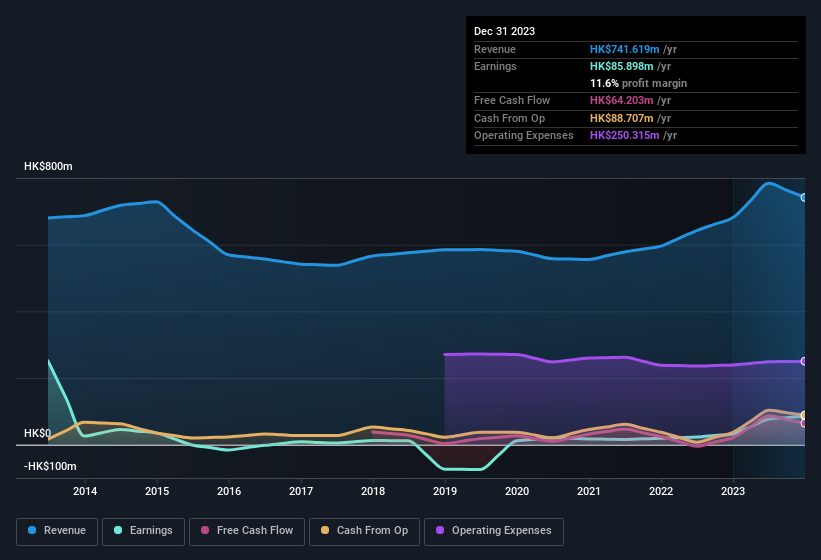

Despite posting some strong earnings, the market for San Miguel Brewery Hong Kong Limited's (HKG:236) stock hasn't moved much. Our analysis suggests that shareholders have noticed something concerning in the numbers.

Check out our latest analysis for San Miguel Brewery Hong Kong

An Unusual Tax Situation

San Miguel Brewery Hong Kong reported a tax benefit of HK$23m, which is well worth noting. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! We're sure the company was pleased with its tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of San Miguel Brewery Hong Kong.

Our Take On San Miguel Brewery Hong Kong's Profit Performance

As we have already discussed San Miguel Brewery Hong Kong reported that it received a tax benefit, rather than paying tax, in the last year. As a result we don't think its profit result, which includes that tax-boost, is a good guide to its sustainable profit levels. Because of this, we think that it may be that San Miguel Brewery Hong Kong's statutory profits are better than its underlying earnings power. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you want to do dive deeper into San Miguel Brewery Hong Kong, you'd also look into what risks it is currently facing. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of San Miguel Brewery Hong Kong.

This note has only looked at a single factor that sheds light on the nature of San Miguel Brewery Hong Kong's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:236

San Miguel Brewery Hong Kong

Manufactures and distributes bottled, canned, and draught beers in Hong Kong, Mainland China, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026