TS Wonders Holding (HKG:1767) Will Be Hoping To Turn Its Returns On Capital Around

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Having said that, from a first glance at TS Wonders Holding (HKG:1767) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for TS Wonders Holding, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

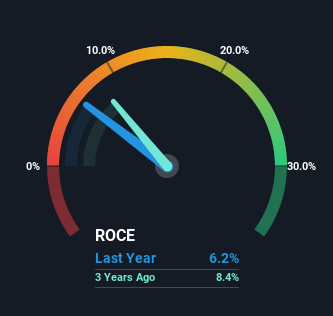

0.062 = S$4.3m ÷ (S$76m - S$7.0m) (Based on the trailing twelve months to June 2022).

So, TS Wonders Holding has an ROCE of 6.2%. In absolute terms, that's a low return and it also under-performs the Food industry average of 9.1%.

Check out our latest analysis for TS Wonders Holding

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating TS Wonders Holding's past further, check out this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For TS Wonders Holding Tell Us?

In terms of TS Wonders Holding's historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 6.2% from 22% five years ago. However it looks like TS Wonders Holding might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

On a side note, TS Wonders Holding has done well to pay down its current liabilities to 9.2% of total assets. So we could link some of this to the decrease in ROCE. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

What We Can Learn From TS Wonders Holding's ROCE

In summary, TS Wonders Holding is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Since the stock has declined 61% over the last three years, investors may not be too optimistic on this trend improving either. All in all, the inherent trends aren't typical of multi-baggers, so if that's what you're after, we think you might have more luck elsewhere.

Like most companies, TS Wonders Holding does come with some risks, and we've found 2 warning signs that you should be aware of.

While TS Wonders Holding may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if TS Wonders Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1767

TS Wonders Holding

An investment holding company, engages in the production, packaging, and sale of food products in Singapore, Malaysia, the People's Republic of China, Hong Kong, Macau, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026