- China

- /

- Gas Utilities

- /

- SHSE:603706

3 Dividend Stocks To Consider Yielding Up To 4.8%

Reviewed by Simply Wall St

As global markets navigate a mix of rising treasury yields, fluctuating consumer confidence, and geopolitical tensions, investors are increasingly looking towards dividend stocks for stability and income. In this environment, selecting dividend stocks with reliable payouts can provide a buffer against market volatility while potentially enhancing portfolio returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1952 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

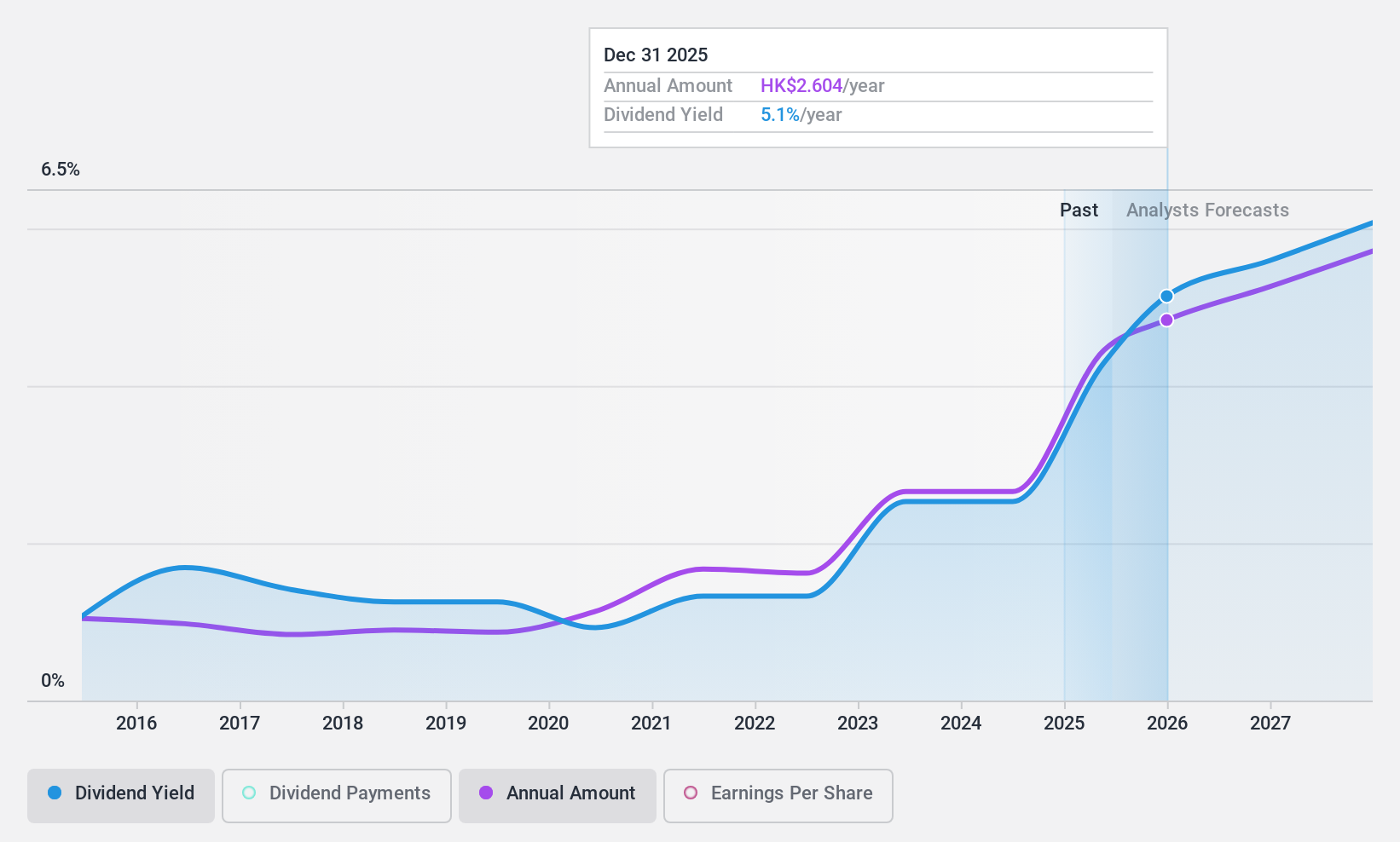

Tsingtao Brewery (SEHK:168)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tsingtao Brewery Company Limited, along with its subsidiaries, is involved in the production, distribution, wholesale, and retail sale of beer products across Mainland China, Hong Kong, Macau, and internationally with a market cap of HK$95.45 billion.

Operations: Tsingtao Brewery's revenue primarily comes from the production and sale of beer products across its various markets.

Dividend Yield: 3.7%

Tsingtao Brewery's dividend yield of 3.74% is modest compared to top-tier dividend payers in Hong Kong, yet it has maintained stable and growing dividends over the past decade. However, its high cash payout ratio suggests dividends are not well-covered by free cash flow, raising sustainability concerns. Recent earnings showed a slight increase in net income despite a drop in sales, indicating resilience. Leadership changes with Mr. Jiang as Chairman are expected to maintain strategic continuity without impacting operations negatively.

- Click here and access our complete dividend analysis report to understand the dynamics of Tsingtao Brewery.

- Our expertly prepared valuation report Tsingtao Brewery implies its share price may be lower than expected.

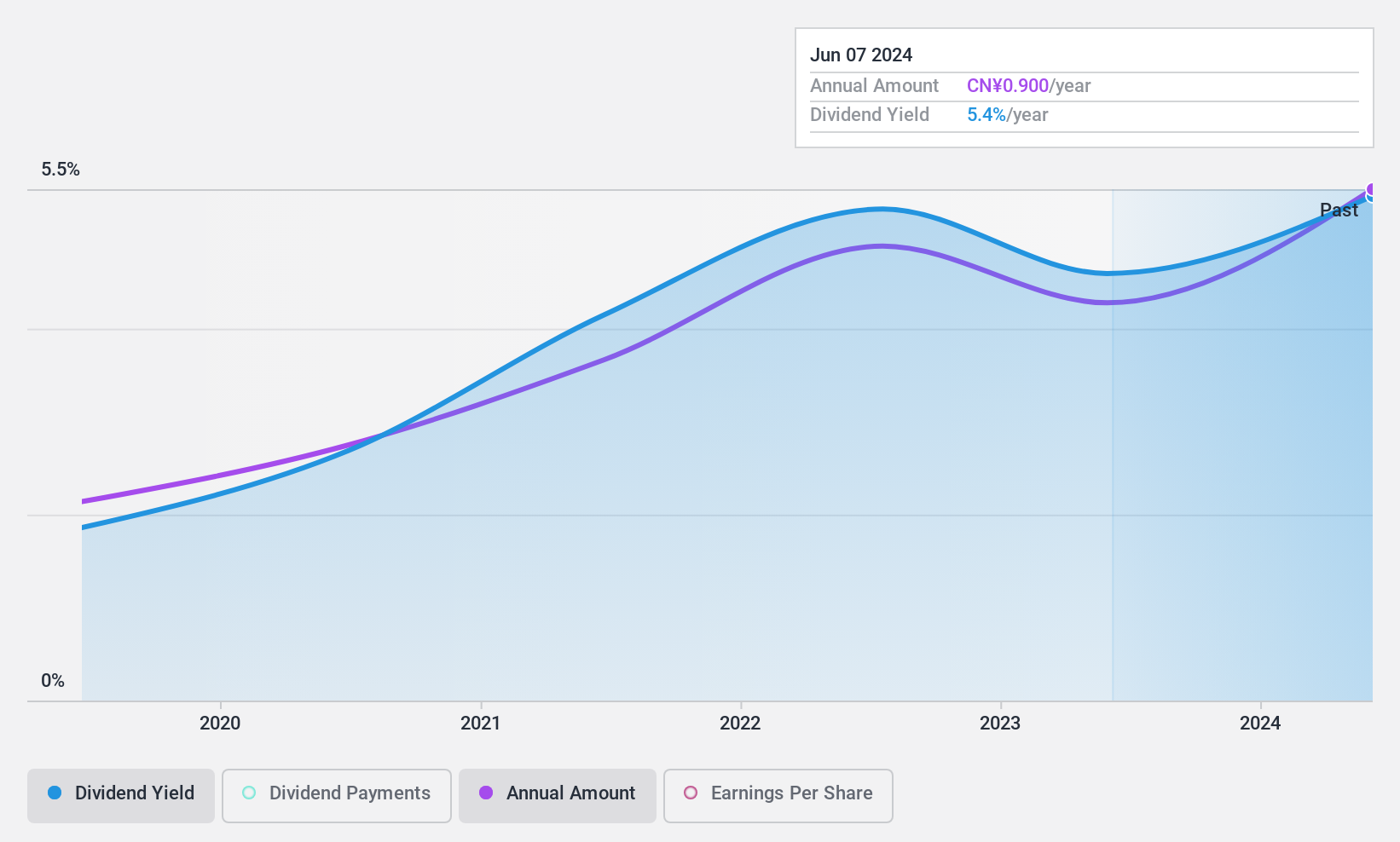

Xinjiang East Universe GasLtd (SHSE:603706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang East Universe Gas Co.Ltd. operates in the natural gas sector, focusing on sales, facility equipment installation, and heating services, with a market cap of CN¥3.41 billion.

Operations: Xinjiang East Universe Gas Co.Ltd. generates revenue from its core activities in natural gas sales, facility equipment installation, and heating services.

Dividend Yield: 4.8%

Xinjiang East Universe Gas Ltd. offers a compelling dividend profile with a yield in the top 25% of the Chinese market and dividends covered by both earnings (80.6% payout ratio) and cash flows (59.6% cash payout ratio). Despite only six years of dividend history, payments have been stable and growing, supported by recent earnings growth to CNY 121.69 million from CNY 105.16 million last year, indicating financial robustness amidst increasing revenue figures.

- Delve into the full analysis dividend report here for a deeper understanding of Xinjiang East Universe GasLtd.

- Our comprehensive valuation report raises the possibility that Xinjiang East Universe GasLtd is priced lower than what may be justified by its financials.

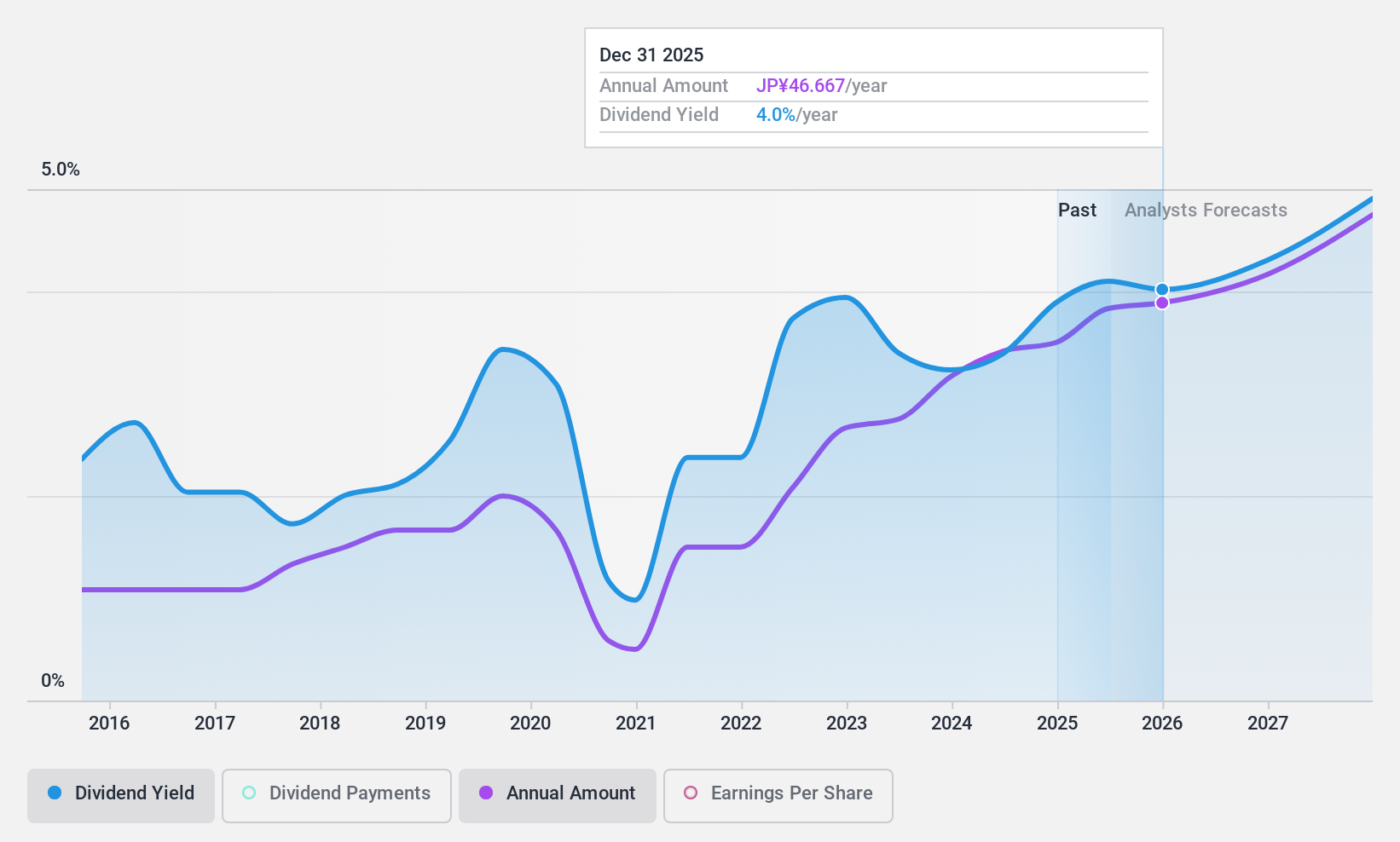

KITZ (TSE:6498)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KITZ Corporation manufactures and sells valves and other flow control devices both in Japan and internationally, with a market cap of ¥98.89 billion.

Operations: KITZ Corporation's revenue is primarily derived from its Valve Business, which generated ¥139.45 billion, and its Copper Products Business, contributing ¥31.50 billion.

Dividend Yield: 3.7%

KITZ Corporation's dividend payments have been inconsistent over the past decade, with volatility including annual drops exceeding 20%. Despite this, dividends are well-covered by earnings (34% payout ratio) and cash flows (37.2% cash payout ratio). Trading at 40.8% below its estimated fair value, KITZ offers good relative value compared to peers. Recent share buybacks totaling ¥2.99 billion may signal management's confidence in the company's financial stability despite a lower-than-top-tier dividend yield of 3.69%.

- Navigate through the intricacies of KITZ with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that KITZ is trading behind its estimated value.

Turning Ideas Into Actions

- Explore the 1952 names from our Top Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603706

Xinjiang East Universe GasLtd

Engages in the natural gas sales, natural gas facility equipment installation, and natural gas heating businesses.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives