Shareholders Are Thrilled That The China Shengmu Organic Milk (HKG:1432) Share Price Increased 176%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the China Shengmu Organic Milk Limited (HKG:1432) share price has soared 176% in the last year. Most would be very happy with that, especially in just one year! And in the last month, the share price has gained -2.8%. On the other hand, longer term shareholders have had a tougher run, with the stock falling 49% in three years.

Check out our latest analysis for China Shengmu Organic Milk

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year China Shengmu Organic Milk grew its earnings per share, moving from a loss to a profit.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

However the year on year revenue growth of 8.1% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

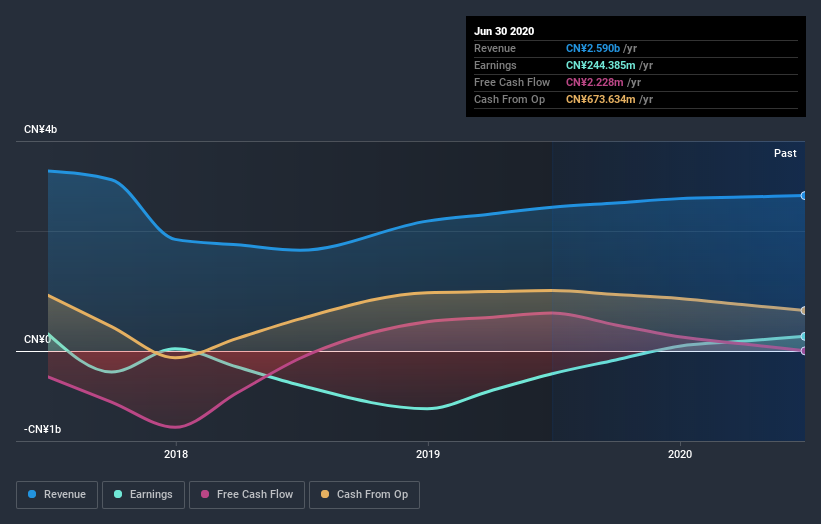

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of China Shengmu Organic Milk's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that China Shengmu Organic Milk shareholders have received a total shareholder return of 176% over one year. That certainly beats the loss of about 10% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for China Shengmu Organic Milk (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade China Shengmu Organic Milk, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1432

China Shengmu Organic Milk

An investment holding company, engages in the production and distribution of raw milk and dairy products in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives