We Discuss Why Labixiaoxin Snacks Group Limited's (HKG:1262) CEO Will Find It Hard To Get A Pay Rise From Shareholders This Year

Key Insights

- Labixiaoxin Snacks Group's Annual General Meeting to take place on 18th of June

- Salary of CN¥800.0k is part of CEO Yu Shuang Zheng's total remuneration

- Total compensation is 35% below industry average

- Over the past three years, Labixiaoxin Snacks Group's EPS fell by 61% and over the past three years, the total loss to shareholders 63%

The disappointing performance at Labixiaoxin Snacks Group Limited (HKG:1262) will make some shareholders rather disheartened. There is an opportunity for shareholders to influence management to turn the performance around by voting on resolutions such as executive remuneration at the AGM coming up on 18th of June. The data we gathered below shows that CEO compensation looks acceptable for now.

View our latest analysis for Labixiaoxin Snacks Group

How Does Total Compensation For Yu Shuang Zheng Compare With Other Companies In The Industry?

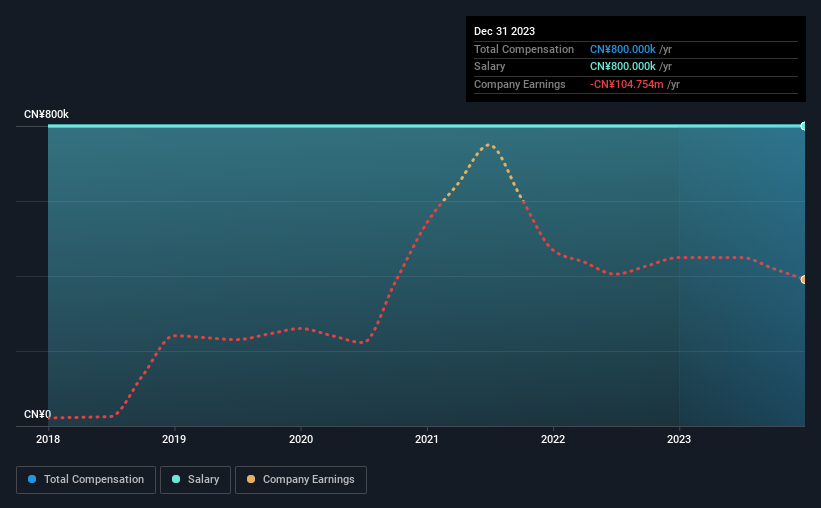

According to our data, Labixiaoxin Snacks Group Limited has a market capitalization of HK$157m, and paid its CEO total annual compensation worth CN¥800k over the year to December 2023. This was the same as last year. Notably, the salary of CN¥800k is the entirety of the CEO compensation.

In comparison with other companies in the Hong Kong Food industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥1.2m. This suggests that Yu Shuang Zheng is paid below the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥800k | CN¥800k | 100% |

| Other | - | - | - |

| Total Compensation | CN¥800k | CN¥800k | 100% |

On an industry level, around 74% of total compensation represents salary and 26% is other remuneration. At the company level, Labixiaoxin Snacks Group pays Yu Shuang Zheng solely through a salary, preferring to go down a conventional route. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Labixiaoxin Snacks Group Limited's Growth

Over the last three years, Labixiaoxin Snacks Group Limited has shrunk its earnings per share by 61% per year. It achieved revenue growth of 12% over the last year.

The decline in EPS is a bit concerning. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Labixiaoxin Snacks Group Limited Been A Good Investment?

With a total shareholder return of -63% over three years, Labixiaoxin Snacks Group Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Labixiaoxin Snacks Group pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Labixiaoxin Snacks Group that investors should think about before committing capital to this stock.

Important note: Labixiaoxin Snacks Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1262

Labixiaoxin Snacks Group

An investment holding company, manufactures and sells jelly, confectionary, beverage, and other snack products in the People’s Republic of China.

Mediocre balance sheet low.

Market Insights

Community Narratives