We Think China Modern Dairy Holdings (HKG:1117) Is Taking Some Risk With Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, China Modern Dairy Holdings Ltd. (HKG:1117) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for China Modern Dairy Holdings

What Is China Modern Dairy Holdings's Net Debt?

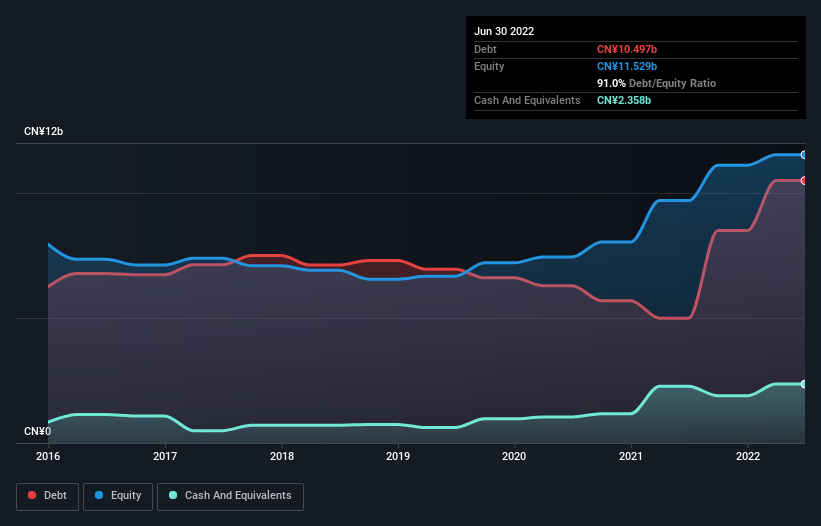

As you can see below, at the end of June 2022, China Modern Dairy Holdings had CN¥10.5b of debt, up from CN¥4.99b a year ago. Click the image for more detail. However, it does have CN¥2.36b in cash offsetting this, leading to net debt of about CN¥8.14b.

A Look At China Modern Dairy Holdings' Liabilities

The latest balance sheet data shows that China Modern Dairy Holdings had liabilities of CN¥6.61b due within a year, and liabilities of CN¥7.20b falling due after that. On the other hand, it had cash of CN¥2.36b and CN¥1.23b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥10.2b.

This deficit casts a shadow over the CN¥6.53b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, China Modern Dairy Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

China Modern Dairy Holdings's net debt is 3.2 times its EBITDA, which is a significant but still reasonable amount of leverage. However, its interest coverage of 11.1 is very high, suggesting that the interest expense on the debt is currently quite low. China Modern Dairy Holdings grew its EBIT by 9.0% in the last year. Whilst that hardly knocks our socks off it is a positive when it comes to debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if China Modern Dairy Holdings can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, China Modern Dairy Holdings created free cash flow amounting to 6.3% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Mulling over China Modern Dairy Holdings's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Looking at the bigger picture, it seems clear to us that China Modern Dairy Holdings's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 5 warning signs with China Modern Dairy Holdings (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1117

China Modern Dairy Holdings

An investment holding company, produces and sells milk for processing into dairy products in Mainland China, the United States, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives