China Modern Dairy Holdings Ltd.'s (HKG:1117) 38% Share Price Surge Not Quite Adding Up

China Modern Dairy Holdings Ltd. (HKG:1117) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

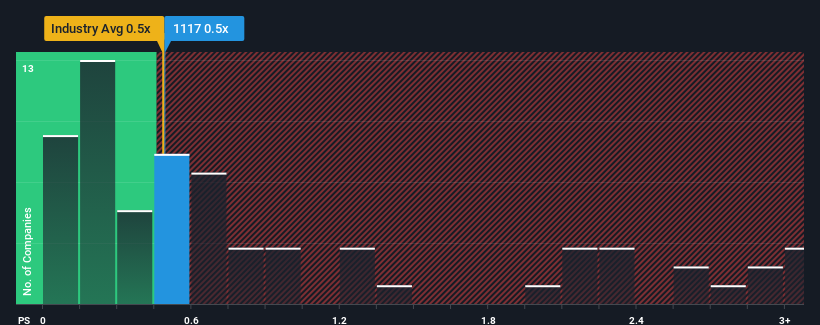

Although its price has surged higher, it's still not a stretch to say that China Modern Dairy Holdings' price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Food industry in Hong Kong, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for China Modern Dairy Holdings

How Has China Modern Dairy Holdings Performed Recently?

There hasn't been much to differentiate China Modern Dairy Holdings' and the industry's retreating revenue lately. The P/S ratio is probably moderate because investors think the company's revenue trend will continue to follow the rest of the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think China Modern Dairy Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

China Modern Dairy Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 108% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 4.3% over the next year. With the industry predicted to deliver 6.6% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that China Modern Dairy Holdings' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From China Modern Dairy Holdings' P/S?

Its shares have lifted substantially and now China Modern Dairy Holdings' P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that China Modern Dairy Holdings' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 1 warning sign for China Modern Dairy Holdings you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1117

China Modern Dairy Holdings

An investment holding company, produces and sells milk for processing into dairy products in Mainland China, the United States, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives