Here's Why Health and Happiness (H&H) International Holdings (HKG:1112) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Health and Happiness (H&H) International Holdings Limited (HKG:1112) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Health and Happiness (H&H) International Holdings

What Is Health and Happiness (H&H) International Holdings's Net Debt?

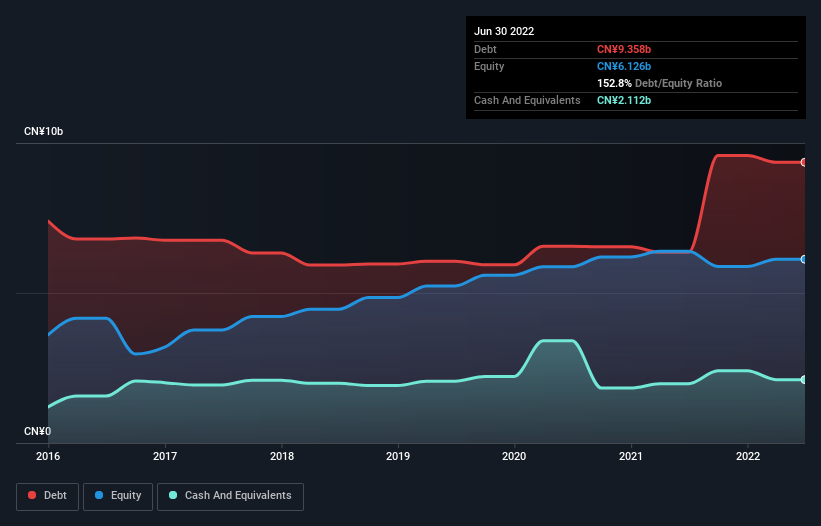

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Health and Happiness (H&H) International Holdings had CN¥9.36b of debt, an increase on CN¥6.35b, over one year. However, it does have CN¥2.11b in cash offsetting this, leading to net debt of about CN¥7.25b.

A Look At Health and Happiness (H&H) International Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that Health and Happiness (H&H) International Holdings had liabilities of CN¥3.75b due within 12 months and liabilities of CN¥10.0b due beyond that. Offsetting this, it had CN¥2.11b in cash and CN¥687.9m in receivables that were due within 12 months. So its liabilities total CN¥11.0b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥5.60b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Health and Happiness (H&H) International Holdings would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Health and Happiness (H&H) International Holdings has a debt to EBITDA ratio of 4.5 and its EBIT covered its interest expense 3.9 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Another concern for investors might be that Health and Happiness (H&H) International Holdings's EBIT fell 11% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Health and Happiness (H&H) International Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Health and Happiness (H&H) International Holdings generated free cash flow amounting to a very robust 94% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

We'd go so far as to say Health and Happiness (H&H) International Holdings's level of total liabilities was disappointing. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. We're quite clear that we consider Health and Happiness (H&H) International Holdings to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Health and Happiness (H&H) International Holdings that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Health and Happiness (H&H) International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Health and Happiness (H&H) International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1112

Health and Happiness (H&H) International Holdings

An investment holding company, manufactures and sells pediatric nutrition, baby care, adult nutrition and care, and pet nutrition and care products in Mainland China, Australia, New Zealand, North America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives