Did You Miss Health and Happiness (H&H) International Holdings's 96% Share Price Gain?

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, the Health and Happiness (H&H) International Holdings Limited (HKG:1112) share price is up 96% in the last three years, clearly besting than the market return of around 56%. However, more recent returns haven't been as impressive as that, with the stock returning just 2.4% in the last year.

Check out our latest analysis for Health and Happiness (H&H) International Holdings

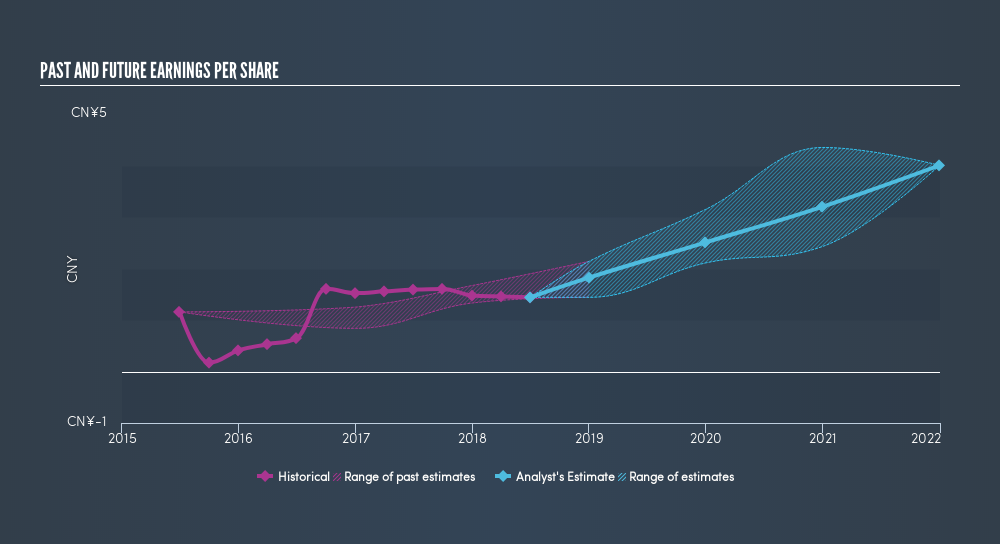

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Health and Happiness (H&H) International Holdings was able to grow its EPS at 2.4% per year over three years, sending the share price higher. In comparison, the 25% per year gain in the share price outpaces the EPS growth. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Health and Happiness (H&H) International Holdings's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) and any discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Health and Happiness (H&H) International Holdings's TSR of 96% over the last 3 years is better than the share price return.

A Different Perspective

We're pleased to report that Health and Happiness (H&H) International Holdings shareholders have received a total shareholder return of 2.4% over one year. That certainly beats the loss of about 5.6% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. Is Health and Happiness (H&H) International Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Health and Happiness (H&H) International Holdings may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1112

Health and Happiness (H&H) International Holdings

An investment holding company, manufactures and sells pediatric nutrition, baby care, adult nutrition and care, and pet nutrition and care products in Mainland China, Australia, New Zealand, North America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives