- Hong Kong

- /

- Auto Components

- /

- SEHK:2025

3 Penny Stocks With Market Caps Over US$200M To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape of rising inflation and fluctuating interest rates, U.S. stock indexes are nearing record highs, with growth stocks outpacing their value counterparts. In such a climate, investors often turn to smaller companies for potential growth opportunities. Penny stocks, though an older term, still capture the essence of investing in emerging or less-established firms that may offer substantial value. By focusing on those with strong financial health and promising fundamentals, investors can uncover hidden gems within this segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.94 | HK$44.43B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR932.02M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR278.83M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Seng Fong Holdings Berhad (KLSE:SENFONG) | MYR0.88 | MYR685.57M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$144.95M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.15 | £313.29M | ★★★★☆☆ |

Click here to see the full list of 5,687 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Ruifeng Power Group (SEHK:2025)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ruifeng Power Group Company Limited is an investment holding company involved in the design, development, manufacture, and sale of cylinder blocks and heads in China with a market cap of HK$1.77 billion.

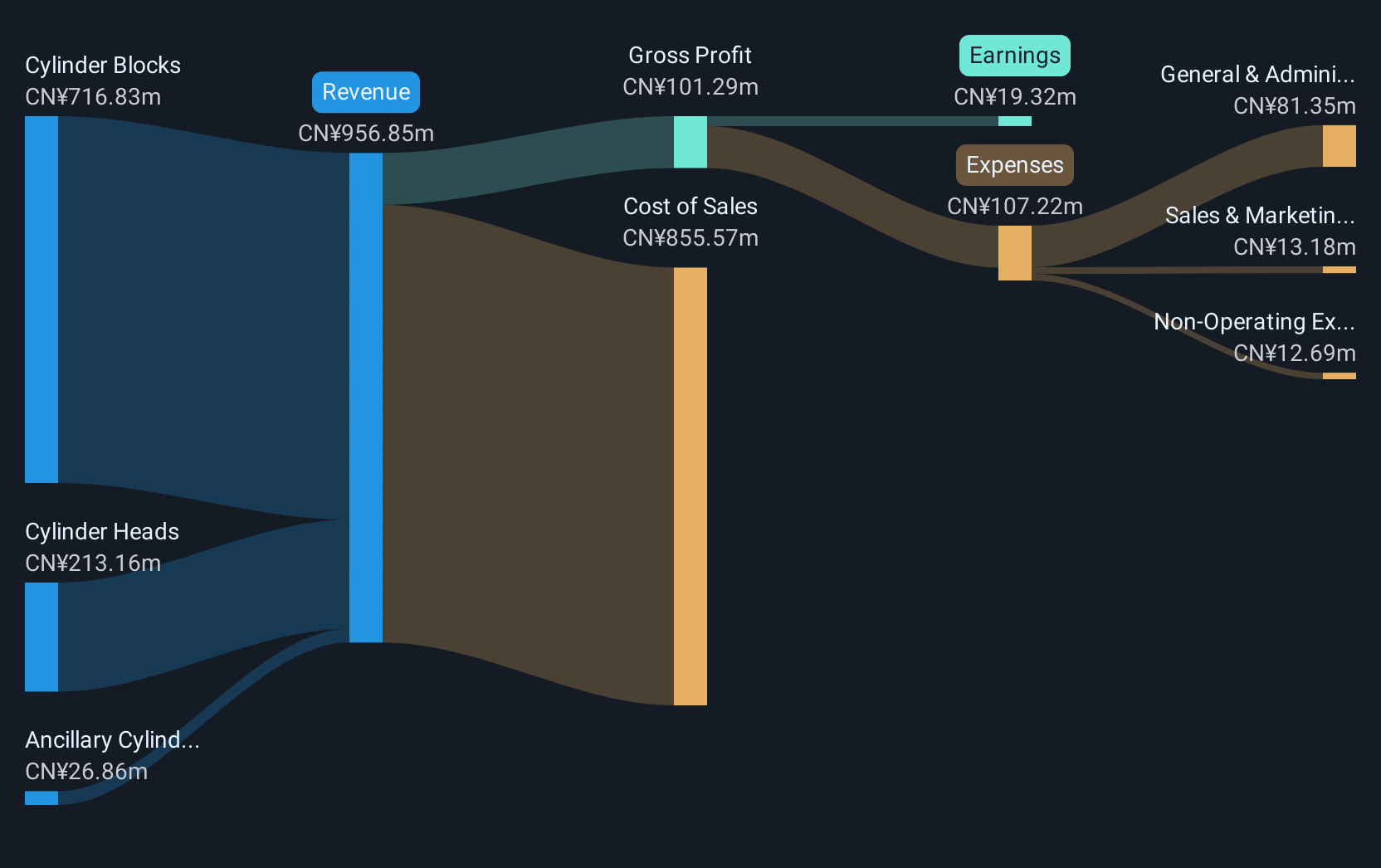

Operations: The company's revenue is primarily derived from cylinder blocks at CN¥644.44 million, followed by cylinder heads at CN¥154.71 million, and ancillary cylinder block components and others contributing CN¥8.38 million.

Market Cap: HK$1.77B

Ruifeng Power Group, with a market cap of HK$1.77 billion, primarily generates revenue from cylinder blocks (CN¥644.44 million) and heads (CN¥154.71 million). Despite high-quality past earnings, the company faces challenges such as declining earnings at 26% annually over five years and low return on equity at 1.4%. Debt management is satisfactory with a net debt to equity ratio of 23.6%, but interest coverage remains weak at 2.8x EBIT. Recent auditor changes saw KPMG replaced by Forvis Mazars due to fee disagreements, highlighting potential governance concerns amidst volatile share price movements.

- Unlock comprehensive insights into our analysis of Ruifeng Power Group stock in this financial health report.

- Explore historical data to track Ruifeng Power Group's performance over time in our past results report.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. is a home meal products company operating in China with a market capitalization of HK$4.97 billion.

Operations: The company generates revenue primarily from its retail segment, specifically grocery stores, amounting to CN¥5.99 billion.

Market Cap: HK$4.97B

Guoquan Food (Shanghai) Co., Ltd., with a market cap of HK$4.97 billion, primarily generates revenue from its retail segment, totaling CN¥5.99 billion. The company's net profit margin has slightly improved to 3.6%, and it effectively covers interest payments with earnings surpassing interest expenses. Despite negative earnings growth of 7.2% last year, the company maintains high-quality earnings and strong debt coverage by operating cash flow at 843.7%. Short-term assets comfortably cover both short- and long-term liabilities, while experienced management and board members contribute to stability amidst trading below estimated fair value by 73.7%.

- Take a closer look at Guoquan Food (Shanghai)'s potential here in our financial health report.

- Evaluate Guoquan Food (Shanghai)'s historical performance by accessing our past performance report.

United Energy Group (SEHK:467)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: United Energy Group Limited is an investment holding company involved in the upstream oil, natural gas, and other energy-related businesses across South Asia, the Middle East, and North Africa with a market cap of HK$9.56 billion.

Operations: The company's revenue is primarily derived from two segments: Trading, which contributes HK$5.34 billion, and Exploration and Production, generating HK$10.47 billion.

Market Cap: HK$9.56B

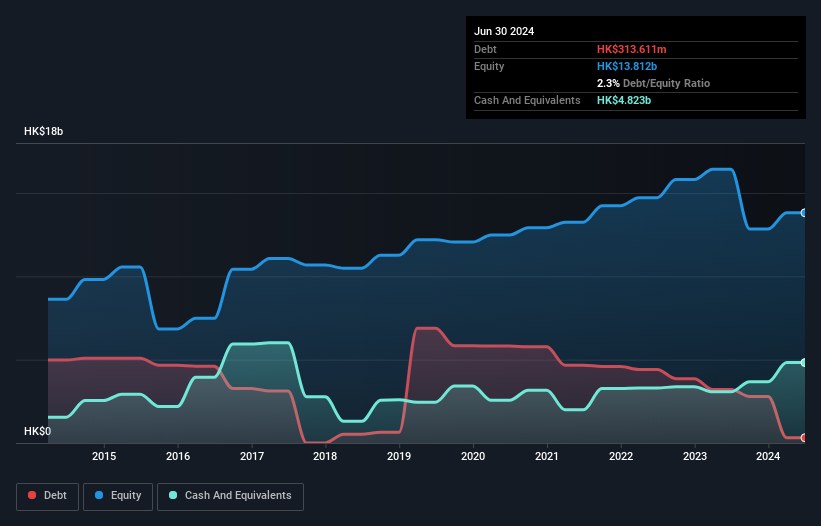

United Energy Group, with a market cap of HK$9.56 billion, derives significant revenue from its Trading (HK$5.34 billion) and Exploration and Production (HK$10.47 billion) segments across South Asia, the Middle East, and North Africa. Despite being unprofitable with losses increasing by 23% annually over five years, the company has reduced its debt to equity ratio significantly from 56.4% to 2.3%. Its short-term assets exceed both short- and long-term liabilities while interest payments are well-covered by EBIT at 30 times coverage. The management team is highly experienced with an average tenure of nearly 15 years, contributing to operational stability amidst trading at a substantial discount below estimated fair value.

- Get an in-depth perspective on United Energy Group's performance by reading our balance sheet health report here.

- Explore United Energy Group's analyst forecasts in our growth report.

Taking Advantage

- Jump into our full catalog of 5,687 Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2025

Ruifeng Power Group

An investment holding company, engages in the design, development, manufacture, and sale of cylinder blocks and heads in the People's Republic of China.

Adequate balance sheet low.

Market Insights

Community Narratives