Lindex Group Oyj And 2 Other Promising Penny Stocks To Consider

Reviewed by Simply Wall St

Recent global market movements have been marked by uncertainty surrounding the incoming U.S. administration's policies, with notable impacts on sectors such as healthcare and electric vehicles, while inflation data continues to influence interest rate expectations. In this context, investors are often drawn to opportunities that promise growth potential despite broader market volatility. Penny stocks, though an older term, remain a relevant investment area for those looking to uncover value in smaller or newer companies with strong financials. This article will explore three promising penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR771.82M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.15 | £796.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.895 | £373.95M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

Click here to see the full list of 5,794 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Lindex Group Oyj (HLSE:LINDEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lindex Group Oyj operates in the retail sector both in Finland and internationally, with a market cap of €395.17 million.

Operations: The company's revenue is divided into two segments: Lindex, generating €627.9 million, and Stockmann, contributing €313 million.

Market Cap: €395.17M

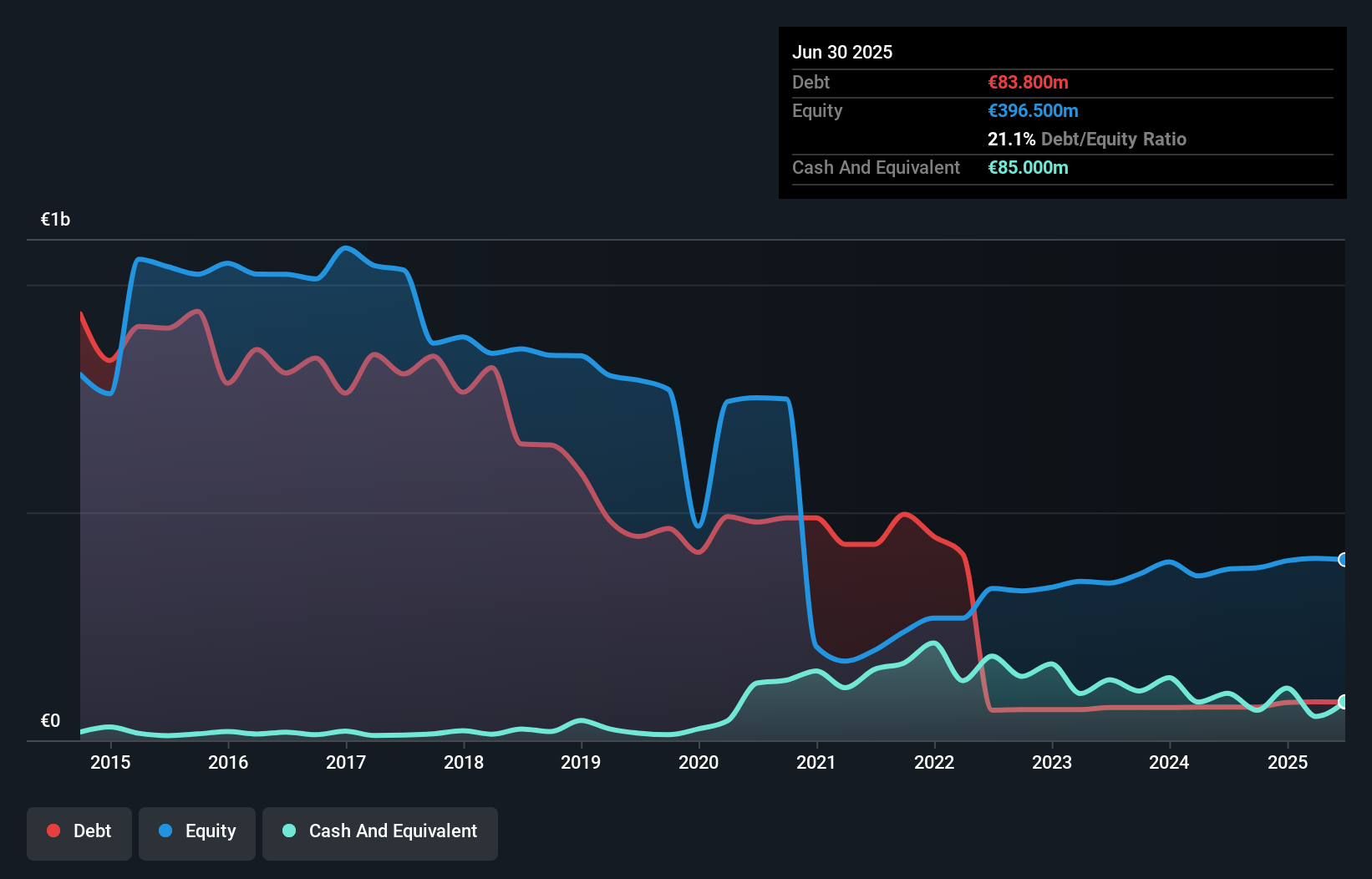

Lindex Group Oyj, with a market cap of €395.17 million, operates in the retail sector and has demonstrated financial challenges recently. The company reported a net loss of €6.5 million for the first nine months of 2024, contrasting with a net income of €42 million in the previous year. Despite stable weekly volatility and an experienced management team, Lindex's profit margins have declined significantly from 6.3% to 0.3%. Although debt levels are satisfactory and operating cash flow covers debt well, interest coverage remains weak at 1.6 times EBIT. Earnings growth is forecasted at 46.63% annually, suggesting potential recovery opportunities amidst current financial instability.

- Dive into the specifics of Lindex Group Oyj here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Lindex Group Oyj's future.

Anton Oilfield Services Group (SEHK:3337)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anton Oilfield Services Group is an investment holding company that offers oilfield engineering and technical services to oil companies in China, Iraq, and internationally, with a market cap of HK$1.75 billion.

Operations: The company's revenue is primarily generated from Oilfield Technical Services (CN¥2.22 billion), followed by Oilfield Management Services (CN¥1.77 billion), Inspection Services (CN¥441.14 million), and Drilling Rig Services (CN¥292.99 million).

Market Cap: HK$1.75B

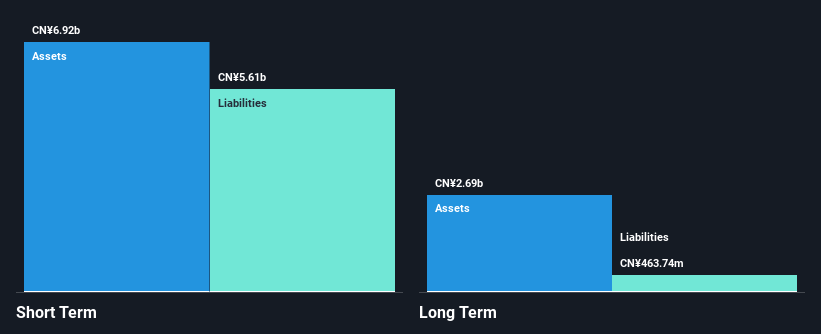

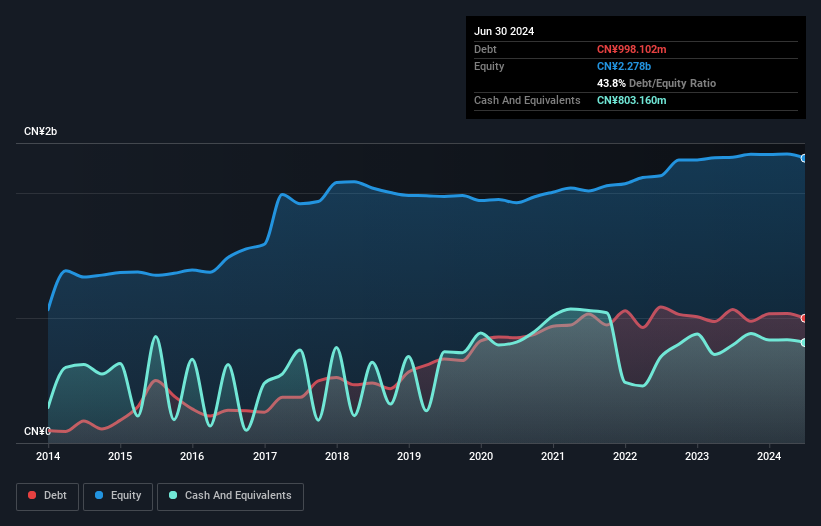

Anton Oilfield Services Group, with a market cap of HK$1.75 billion, has shown mixed performance in recent times. The company's revenue for the first half of 2024 was CN¥2.18 billion, up from CN¥1.89 billion a year prior, but net profit margins have declined to 4.3% from 8.1%. Despite this, the company maintains strong financial health with short-term assets exceeding liabilities and debt levels reduced significantly over five years to a more manageable ratio of 68.6%. While earnings growth has been negative recently, Anton's cash flow comfortably covers its debt obligations and no significant shareholder dilution occurred last year.

- Click here to discover the nuances of Anton Oilfield Services Group with our detailed analytical financial health report.

- Assess Anton Oilfield Services Group's future earnings estimates with our detailed growth reports.

Zhejiang Zhongcheng Packing Material (SZSE:002522)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Zhongcheng Packing Material Co., Ltd. operates in the packaging materials industry and has a market cap of CN¥3.88 billion.

Operations: Revenue Segments: No specific revenue segments have been reported for this company.

Market Cap: CN¥3.88B

Zhejiang Zhongcheng Packing Material Co., Ltd. has faced challenges with declining earnings, reporting a net income of CN¥44.59 million for the nine months ended September 2024, down from CN¥88.08 million the previous year. Despite this, its financial health appears stable as short-term assets exceed both short and long-term liabilities significantly. The company's debt is well-covered by operating cash flow, and interest payments are adequately managed by EBIT, indicating sound financial management despite increased debt-to-equity ratios over five years. However, profit margins have shrunk to 3.6% from 6.1%, reflecting ongoing profitability pressures in its operations.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Zhongcheng Packing Material.

- Assess Zhejiang Zhongcheng Packing Material's previous results with our detailed historical performance reports.

Make It Happen

- Investigate our full lineup of 5,794 Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Zhongcheng Packing Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002522

Zhejiang Zhongcheng Packing Material

Zhejiang Zhongcheng Packing Material Co., Ltd.

Excellent balance sheet slight.