Amid a temporary de-escalation in U.S.-China trade tensions, Asian markets have been buoyed by positive sentiment, reflecting broader global market trends. For investors interested in exploring opportunities beyond the larger, more established companies, penny stocks — often smaller or newer firms — present intriguing possibilities. Despite their vintage name, these stocks can offer surprising value and growth potential when backed by solid financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| T.A.C. Consumer (SET:TACC) | THB4.52 | THB2.71B | ✅ 3 ⚠️ 3 View Analysis > |

| North East Rubber (SET:NER) | THB4.34 | THB8.02B | ✅ 5 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.405 | SGD164.14M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.183 | SGD36.46M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.17 | SGD8.54B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.91 | HK$3.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.51 | HK$51.63B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.18 | HK$744.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.24 | HK$2.07B | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,162 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Anton Oilfield Services Group (SEHK:3337)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anton Oilfield Services Group is an investment holding company that provides integrated oilfield technology services in the People's Republic of China, Iraq, and internationally, with a market cap of HK$2.69 billion.

Operations: The company's revenue is primarily derived from its Oilfield Technical Services at CN¥2.13 billion and Oilfield Management Services at CN¥1.85 billion, supplemented by Inspection Services generating CN¥421.04 million and Drilling Rig Services contributing CN¥358.89 million.

Market Cap: HK$2.69B

Anton Oilfield Services Group, with a market cap of HK$2.69 billion, demonstrates strong financial stability, having more cash than total debt and a well-covered interest by EBIT (5.1x). Its earnings have grown significantly by 28.4% per year over the past five years, although recent growth has slightly decelerated to 23.5%. The company's short-term assets exceed both its long-term and short-term liabilities, indicating sound liquidity management. Despite trading at 87.6% below estimated fair value and offering a proposed dividend of RMB 0.025 per share for 2024, its Return on Equity remains low at 7.1%.

- Click here to discover the nuances of Anton Oilfield Services Group with our detailed analytical financial health report.

- Learn about Anton Oilfield Services Group's future growth trajectory here.

Zero Fintech Group (SEHK:93)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zero Fintech Group Limited, along with its subsidiaries, is involved in property investment and development in the People's Republic of China and Hong Kong, with a market capitalization of approximately HK$1.60 billion.

Operations: The company's revenue is derived from money lending, which generated HK$257.47 million, and property development and investment activities, contributing HK$1.51 million.

Market Cap: HK$1.6B

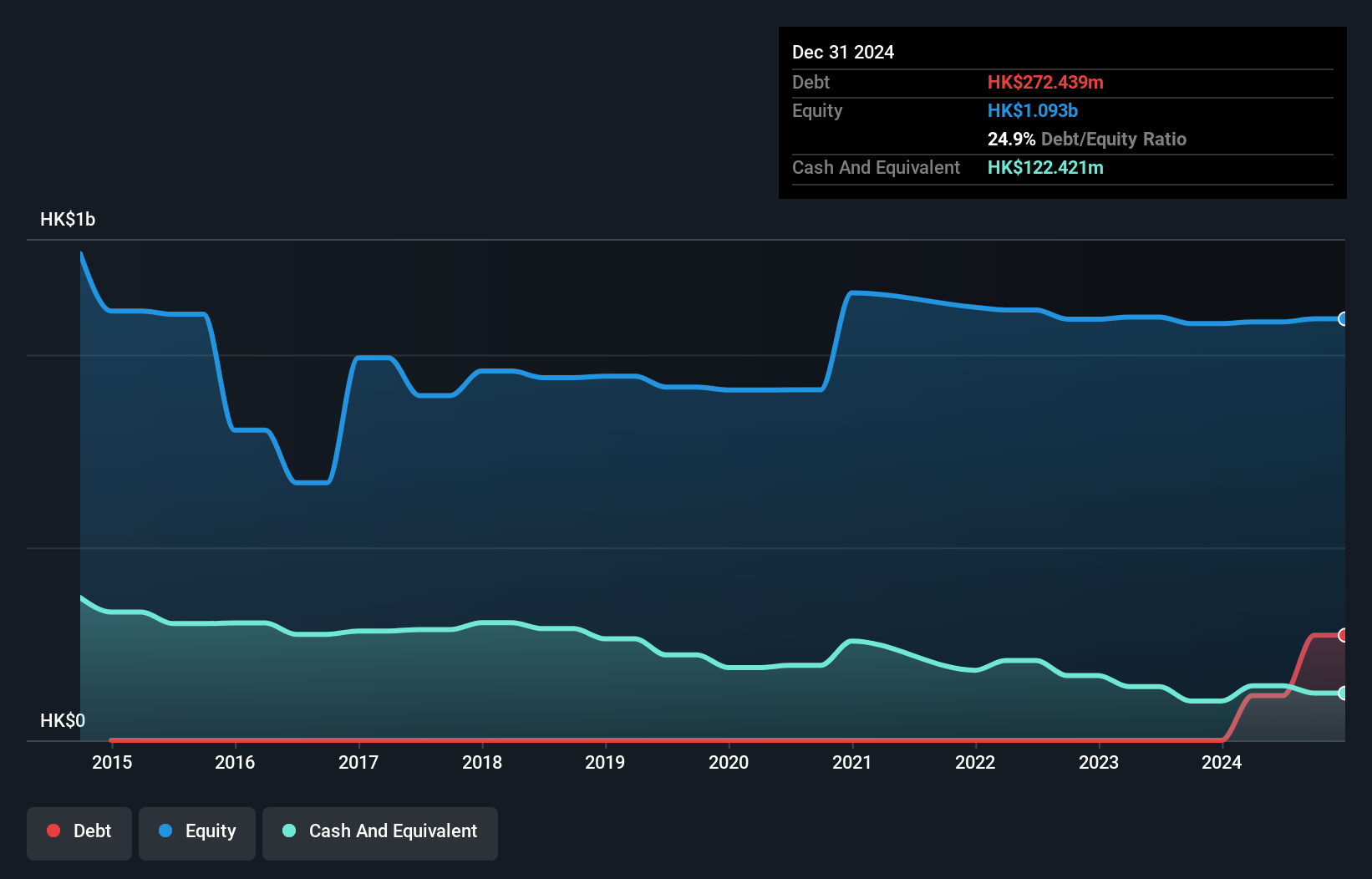

Zero Fintech Group Limited, with a market cap of HK$1.60 billion, has shown significant earnings growth, reporting HK$261.78 million in sales for 2024 compared to HK$196.61 million the previous year. The company benefits from a seasoned management team and an experienced board of directors. Its money lending business is a key revenue driver, generating approximately HK$250 million in interest income for 2024. Despite its low Return on Equity at 2.5%, Zero Fintech maintains strong liquidity with short-term assets exceeding liabilities and satisfactory debt levels, although operating cash flow remains negative indicating potential cash management challenges ahead.

- Navigate through the intricacies of Zero Fintech Group with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Zero Fintech Group's track record.

Jiangsu Huifeng Bio Agriculture (SZSE:002496)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Huifeng Bio Agriculture Co., Ltd. operates in the agricultural industry, focusing on the production and sale of agrochemical products, with a market cap of approximately CN¥2.37 billion.

Operations: Jiangsu Huifeng Bio Agriculture Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.37B

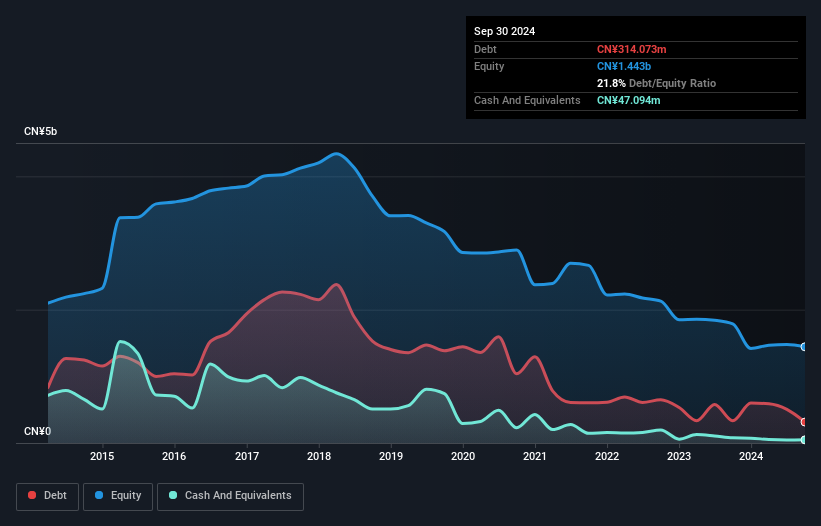

Jiangsu Huifeng Bio Agriculture Co., Ltd., with a market cap of CN¥2.37 billion, has faced ongoing financial challenges, including unprofitability and increased losses over the past five years. Despite reporting CN¥280.01 million in revenue for 2024, the company recorded a net loss of CN¥155.09 million, though this marks an improvement from previous years. The company's short-term assets are insufficient to cover its short-term liabilities, raising liquidity concerns further highlighted by auditor doubts about its viability as a going concern. However, debt levels have improved over time and management is considered experienced with an average tenure of 2.3 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiangsu Huifeng Bio Agriculture.

- Understand Jiangsu Huifeng Bio Agriculture's track record by examining our performance history report.

Make It Happen

- Jump into our full catalog of 1,162 Asian Penny Stocks here.

- Ready For A Different Approach? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002496

Jiangsu Huifeng Bio Agriculture

Jiangsu Huifeng Bio Agriculture Co., Ltd.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives