Global Market Insights: CM Energy Tech And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have shown resilience recently, with small-cap stocks outperforming their larger counterparts and technology shares rebounding amid optimism for growth potential. In the context of this evolving market landscape, understanding what makes a good investment is crucial. While the term "penny stock" may seem outdated, it still refers to smaller or less-established companies that can offer substantial value when they possess robust financials and a clear path to growth.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.51 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.095 | £467M | ✅ 4 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$439.55M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.43 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €228.7M | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.06 | SGD429.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.67 | $389.49M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.21 | MYR323.58M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,574 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

CM Energy Tech (SEHK:206)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CM Energy Tech Co., Ltd. is an investment holding company involved in the design, manufacture, installation, and commissioning of land and offshore drilling rigs and equipment globally, with a market cap of HK$908.16 million.

Operations: CM Energy Tech generates its revenue from three main segments: Equipment manufacturing and packages ($98.59 million), Supply chain and integration services ($25.25 million), and Assets management and engineering services ($54.63 million).

Market Cap: HK$908.16M

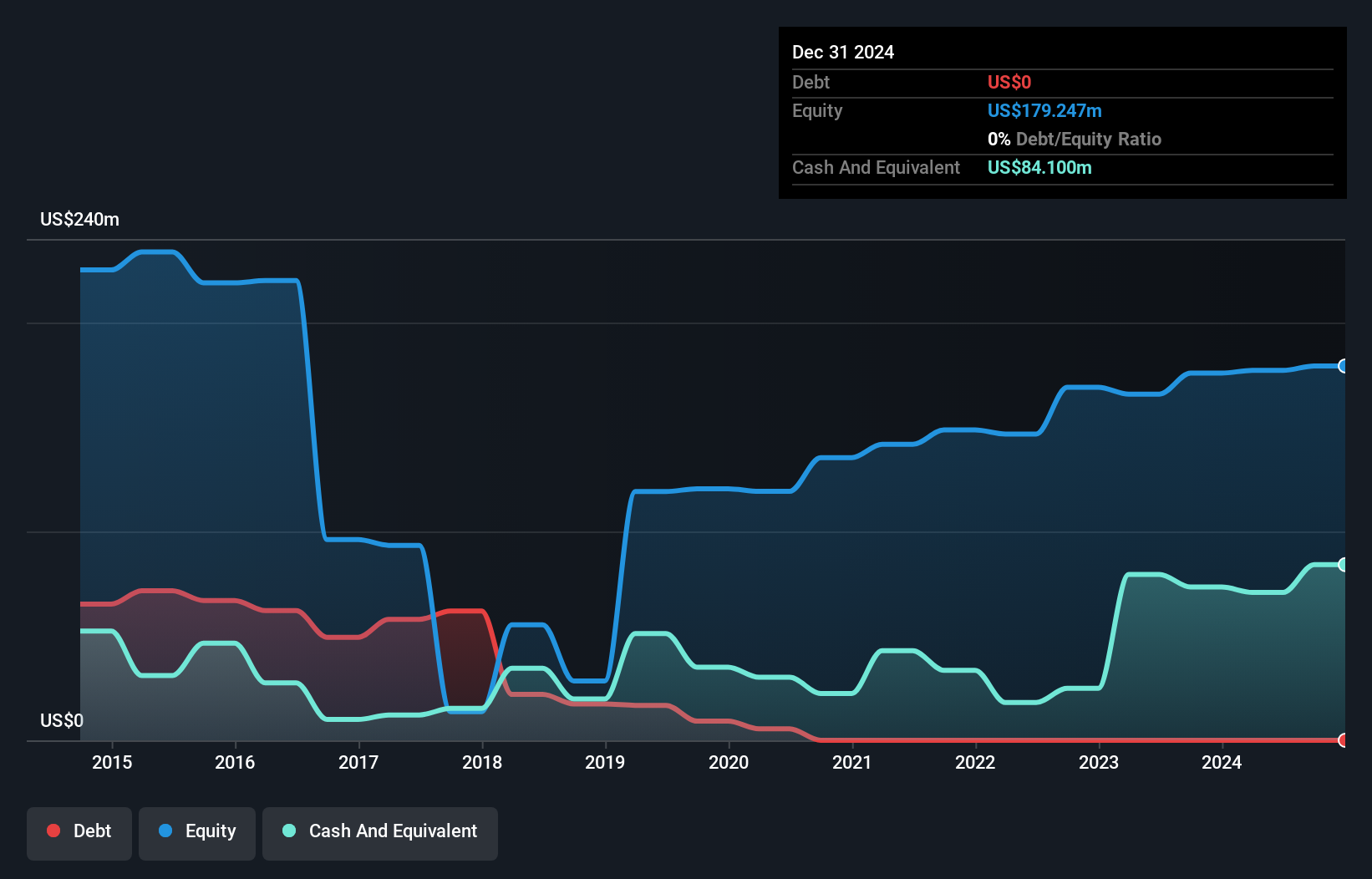

CM Energy Tech Co., Ltd. is navigating the penny stock landscape with a diversified revenue stream across equipment manufacturing, supply chain services, and asset management. Despite recent negative earnings growth and low return on equity at 3.9%, the company remains debt-free with stable weekly volatility of 6%. Its short-term assets significantly cover both short- and long-term liabilities, suggesting financial resilience. A new agreement with China Merchants Industry Holdings for vessel chartering could bolster future operations, pending shareholder approval. However, its board's inexperience may pose challenges in strategic execution as it continues to trade below estimated fair value.

- Navigate through the intricacies of CM Energy Tech with our comprehensive balance sheet health report here.

- Understand CM Energy Tech's track record by examining our performance history report.

Boustead Singapore (SGX:F9D)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boustead Singapore Limited is an investment holding company offering energy engineering, real estate, geospatial, and healthcare technology solutions across various regions including Singapore, Australia, and the United States with a market cap of SGD858.03 million.

Operations: The company's revenue is primarily derived from its Geospatial segment at SGD231.68 million, followed by Energy Engineering at SGD158.40 million, Real Estate Solutions at SGD124.97 million, and Healthcare technology solutions contributing SGD10.46 million.

Market Cap: SGD858.03M

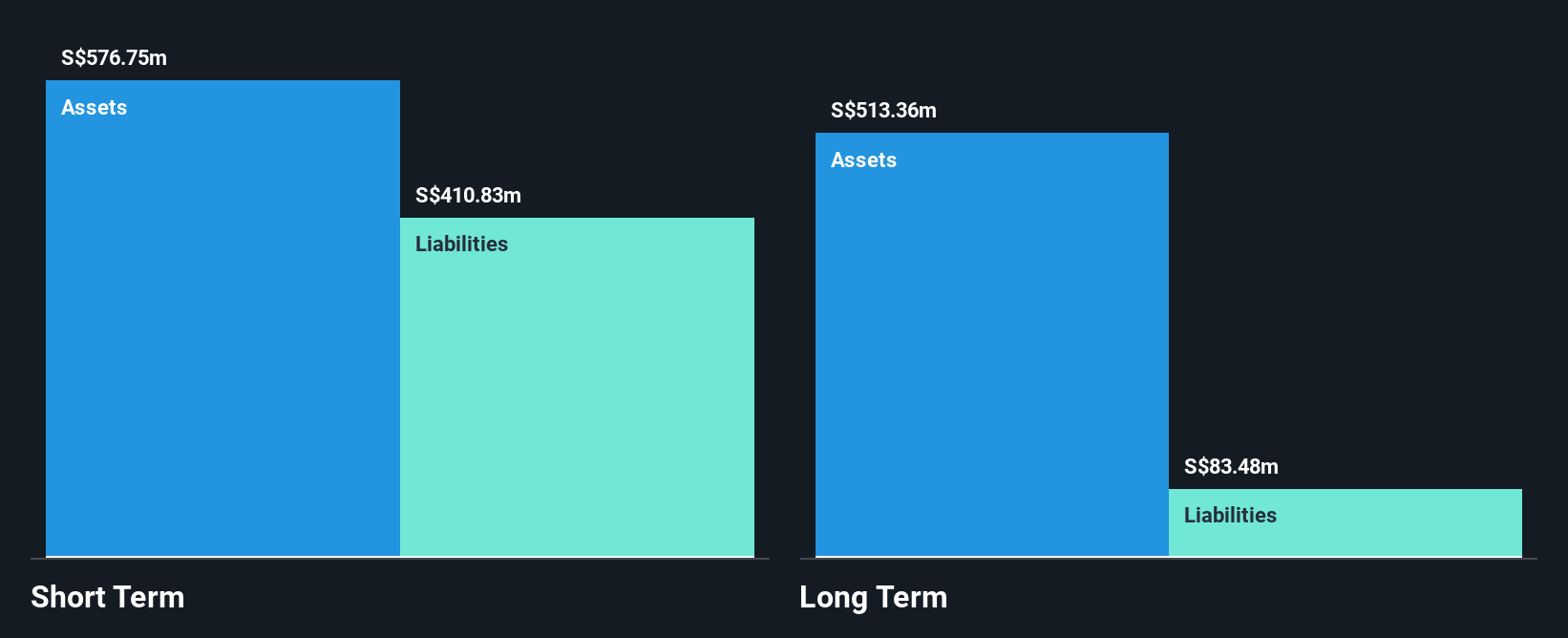

Boustead Singapore Limited demonstrates financial resilience with its short-term assets of SGD607.2 million exceeding both short- and long-term liabilities, highlighting strong liquidity. The company has reduced its debt-to-equity ratio significantly over five years, now holding more cash than total debt. Despite a low return on equity at 16.2%, Boustead's earnings growth of 28.2% surpasses the industry average, indicating robust operational performance. However, the dividend yield of 3.24% is not well covered by free cash flows, suggesting potential sustainability concerns. Recent executive changes may impact strategic direction but could also bring fresh perspectives to management decisions.

- Unlock comprehensive insights into our analysis of Boustead Singapore stock in this financial health report.

- Explore historical data to track Boustead Singapore's performance over time in our past results report.

Qinghai Spring Medicinal Resources Technology (SHSE:600381)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Qinghai Spring Medicinal Resources Technology Co., Ltd. operates in the medicinal resources sector and has a market cap of approximately CN¥2.66 billion.

Operations: Qinghai Spring Medicinal Resources Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.66B

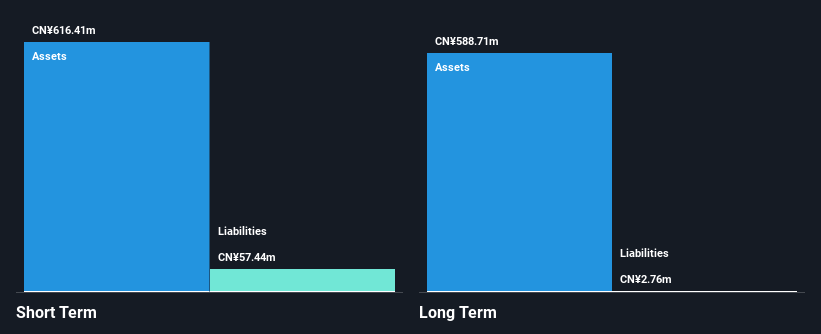

Qinghai Spring Medicinal Resources Technology shows financial stability with short-term assets of CN¥555.3 million surpassing its liabilities, and the company is debt-free. Despite being unprofitable, it has reduced losses significantly over five years and reported a net loss of CN¥2.83 million for the recent nine-month period, an improvement from the prior year's larger loss. The management team and board are experienced, with tenures averaging over six years. With a cash runway exceeding three years based on current free cash flow trends, Qinghai Spring is positioned to sustain operations while seeking profitability improvements.

- Dive into the specifics of Qinghai Spring Medicinal Resources Technology here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Qinghai Spring Medicinal Resources Technology's track record.

Taking Advantage

- Navigate through the entire inventory of 3,574 Global Penny Stocks here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qinghai Spring Medicinal Resources Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600381

Qinghai Spring Medicinal Resources Technology

Qinghai Spring Medicinal Resources Technology Co., Ltd.

Flawless balance sheet with weak fundamentals.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026