- Hong Kong

- /

- Energy Services

- /

- SEHK:1960

Some TBK & Sons Holdings Limited (HKG:1960) Shareholders Look For Exit As Shares Take 45% Pounding

TBK & Sons Holdings Limited (HKG:1960) shareholders that were waiting for something to happen have been dealt a blow with a 45% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

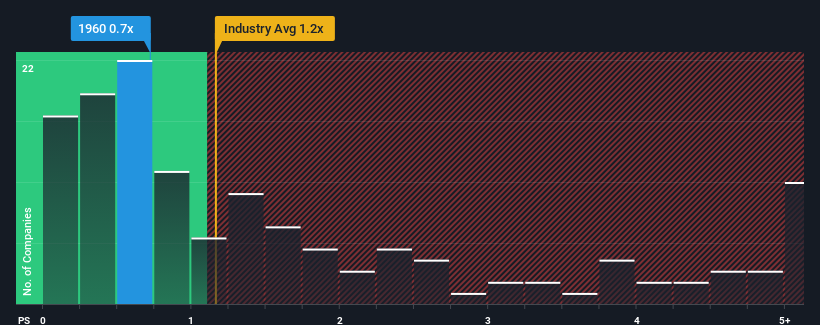

Even after such a large drop in price, it's still not a stretch to say that TBK & Sons Holdings' price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Energy Services industry in Hong Kong, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for TBK & Sons Holdings

What Does TBK & Sons Holdings' Recent Performance Look Like?

For instance, TBK & Sons Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on TBK & Sons Holdings will help you shine a light on its historical performance.How Is TBK & Sons Holdings' Revenue Growth Trending?

TBK & Sons Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 84% decrease to the company's top line. Even so, admirably revenue has lifted 39% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 14% shows it's noticeably less attractive.

In light of this, it's curious that TBK & Sons Holdings' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From TBK & Sons Holdings' P/S?

With its share price dropping off a cliff, the P/S for TBK & Sons Holdings looks to be in line with the rest of the Energy Services industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that TBK & Sons Holdings' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Before you settle on your opinion, we've discovered 3 warning signs for TBK & Sons Holdings (1 is potentially serious!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if TBK & Sons Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1960

TBK & Sons Holdings

An investment holding company, undertakes civil and structural works in the oil and gas industry in Malaysia and the People’s Republic of China.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026