- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1898

What China Coal Energy Company Limited's (HKG:1898) 28% Share Price Gain Is Not Telling You

China Coal Energy Company Limited (HKG:1898) shares have continued their recent momentum with a 28% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

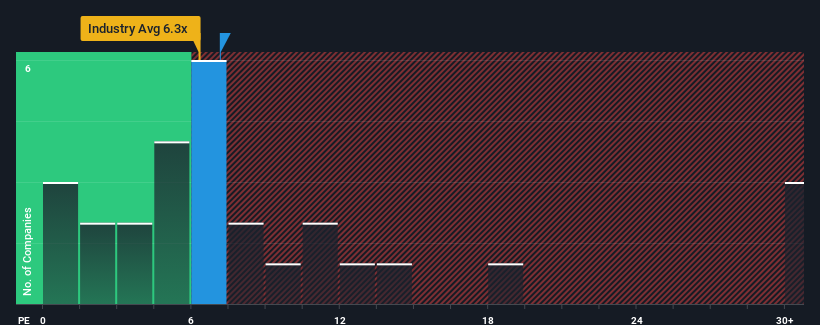

Even after such a large jump in price, there still wouldn't be many who think China Coal Energy's price-to-earnings (or "P/E") ratio of 7.1x is worth a mention when the median P/E in Hong Kong is similar at about 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings that are retreating more than the market's of late, China Coal Energy has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for China Coal Energy

What Are Growth Metrics Telling Us About The P/E?

China Coal Energy's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 26%. Even so, admirably EPS has lifted 288% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 6.0% per annum during the coming three years according to the ten analysts following the company. That's shaping up to be materially lower than the 15% per year growth forecast for the broader market.

In light of this, it's curious that China Coal Energy's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

China Coal Energy's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of China Coal Energy's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with China Coal Energy, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on China Coal Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1898

China Coal Energy

China Coal Energy Company Limited mines, produces, processes, trades in, and sells coal in the People’s Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives