- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1277

Three Top Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

In the midst of a volatile global market, with key indices like the S&P 500 nearing correction territory and economic signals offering mixed messages, small-cap stocks have faced their own set of challenges. Despite these headwinds, certain undervalued small-cap companies are drawing attention due to insider buying—a potential indicator of confidence in their future prospects. Identifying a good stock often involves looking for companies that demonstrate strong fundamentals and have insiders who are willing to invest their own money. In today's uncertain market conditions, such indicators can offer valuable insights into which small-cap stocks might be poised for growth.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.3x | 0.9x | 44.22% | ★★★★★★ |

| Russel Metals | 10.5x | 0.5x | 49.70% | ★★★★★☆ |

| PCB Bancorp | 10.4x | 2.6x | 45.72% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 29.54% | ★★★★★☆ |

| Lindblad Expeditions Holdings | NA | 0.7x | 48.75% | ★★★★★☆ |

| Citizens & Northern | 12.3x | 2.7x | 46.30% | ★★★★☆☆ |

| Hemisphere Energy | 6.8x | 2.4x | 14.72% | ★★★☆☆☆ |

| Sopharma AD | 11.4x | 0.5x | 4.50% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -99.17% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

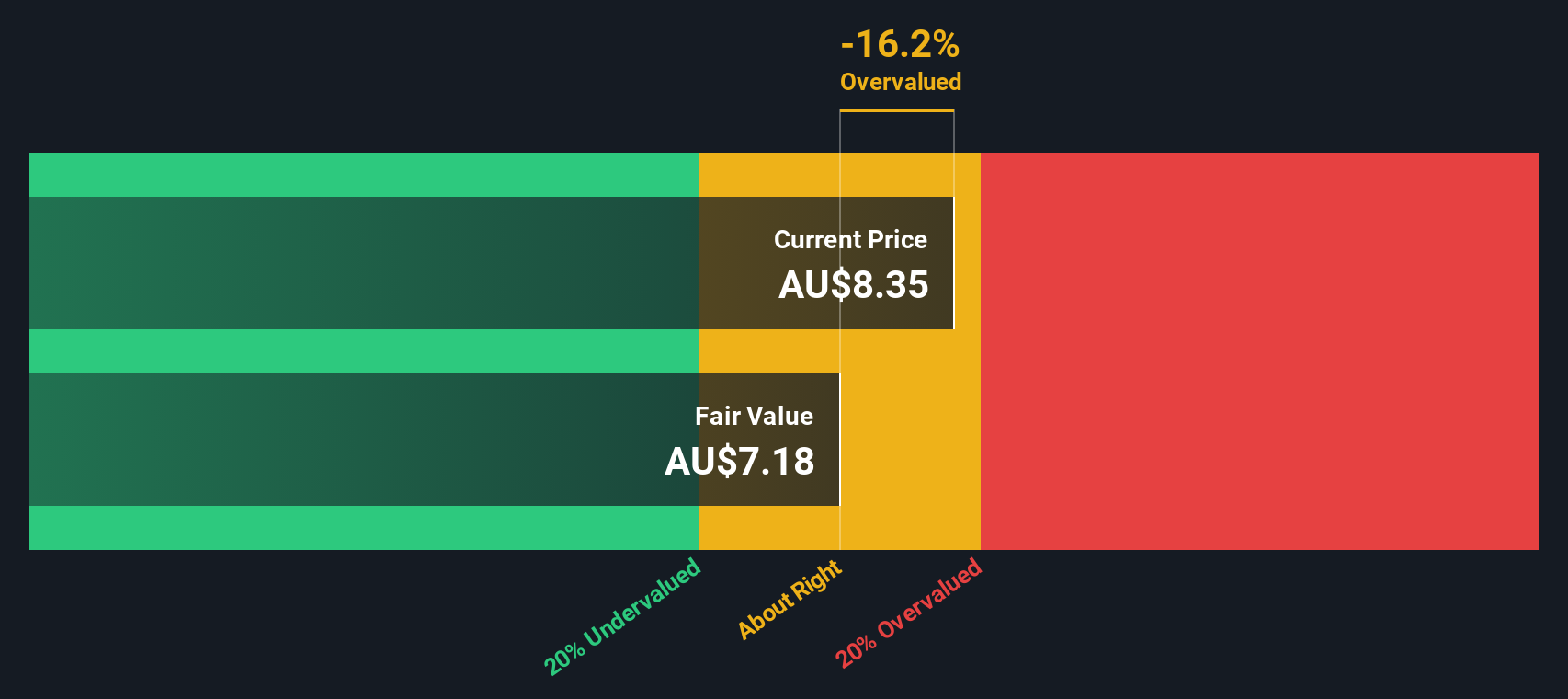

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is an Australian wholesale distributor specializing in computer peripherals with a market cap of A$1.76 billion.

Operations: Dicker Data's revenue primarily comes from wholesale sales of computer peripherals, amounting to A$2.27 billion. The company's cost of goods sold (COGS) is A$1.94 billion, leading to a gross profit of A$322.61 million with a gross profit margin of 14.23%. Operating expenses are A$186.77 million, and the net income stands at A$82.15 million with a net income margin of 3.62%.

PE: 22.7x

Dicker Data, a small cap tech distributor, shows potential as an undervalued stock. Recent insider confidence is evident with share purchases by executives in the past six months. The company repurchased shares worth A$10 million this quarter. Despite high debt levels and reliance on external borrowing, earnings are projected to grow 7.83% annually. This growth forecast suggests Dicker Data could offer significant upside for investors seeking opportunities in smaller companies with strong insider support and growth prospects.

- Delve into the full analysis valuation report here for a deeper understanding of Dicker Data.

Gain insights into Dicker Data's past trends and performance with our Past report.

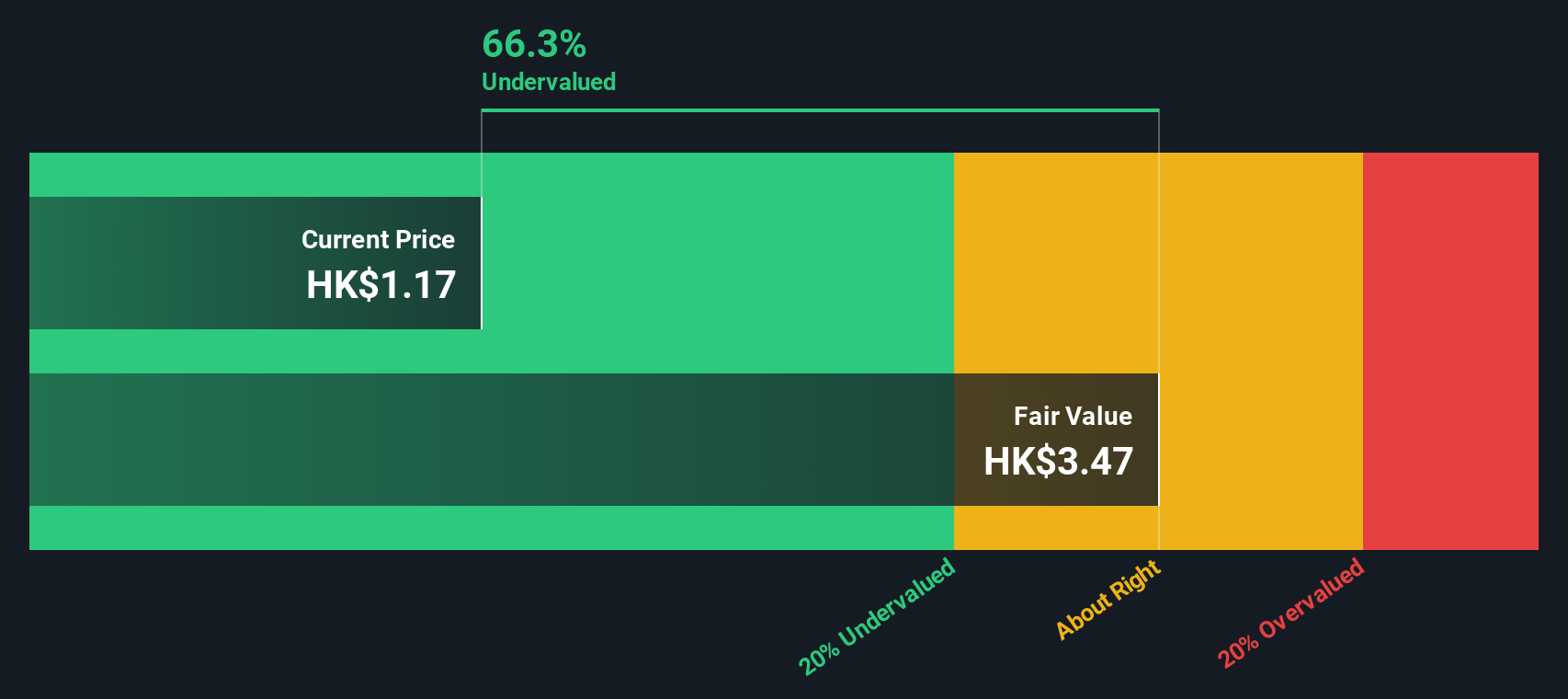

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kinetic Development Group is engaged in property development and investment, with a market cap of approximately CN¥3.45 billion.

Operations: Kinetic Development Group generates revenue primarily from its core business operations, with the latest reported revenue being CN¥4745.07 million. The company has shown a notable trend in its gross profit margin, reaching 59.07% as of December 31, 2023.

PE: 4.4x

Kinetic Development Group, a small-cap company, recently saw insider confidence with board members purchasing shares in June 2024. Their funding is entirely from external borrowing, which carries higher risk compared to customer deposits. In a recent board meeting on August 12, 2024, the agenda included approving a special dividend payment. Despite the funding risks, insider buying suggests potential growth and value recognition from those closely involved with the company’s operations.

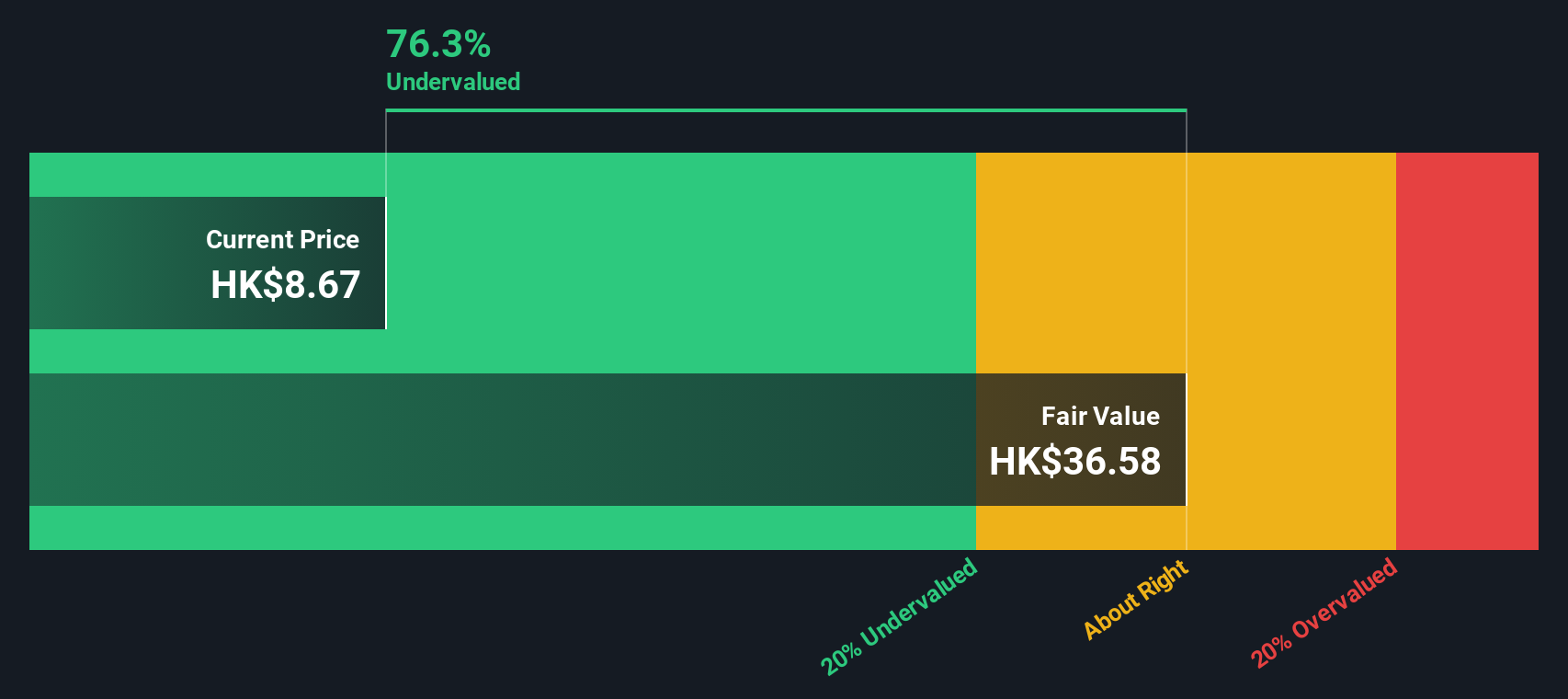

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wasion Holdings is a company specializing in advanced metering infrastructure and distribution operations with a market cap of approximately CN¥3.64 billion.

Operations: The company generates revenue primarily from Advanced Distribution Operations, Power Advanced Metering Infrastructure, and Communication and Fluid Advanced Metering Infrastructure. For the period ending 2023-12-31, it reported a gross profit margin of 35.59% on a revenue of CN¥7.25 billion. Operating expenses for the same period were CN¥1.73 billion, with notable allocations to sales and marketing (CN¥649.48 million) and R&D (CN¥681.38 million).

PE: 11.5x

Wasion Holdings has recently secured significant smart meter contracts, including a €31.62 million deal in Hungary and additional contracts worth US$9.42 million and US$5.74 million in Singapore and Malaysia, respectively, showcasing its international reach. Founder & Executive Chairman Wei Ji's recent purchase of 500,000 shares for HKD3.17 million indicates strong insider confidence. Despite relying solely on external borrowing for funding, the company’s earnings are projected to grow by 25.8% annually, highlighting its growth potential amidst undervalued peers in the industry.

- Click here and access our complete valuation analysis report to understand the dynamics of Wasion Holdings.

Understand Wasion Holdings' track record by examining our Past report.

Where To Now?

- Unlock more gems! Our Undervalued Small Caps With Insider Buying screener has unearthed 205 more companies for you to explore.Click here to unveil our expertly curated list of 208 Undervalued Small Caps With Insider Buying.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetic Development Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1277

Kinetic Development Group

An investment holding company, engages in the extraction and sale of coal products in the People’s Republic of China.

Outstanding track record with excellent balance sheet and pays a dividend.