Did You Manage To Avoid Titan Petrochemicals Group's (HKG:1192) Devastating 94% Share Price Drop?

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Titan Petrochemicals Group Limited (HKG:1192), who have seen the share price tank a massive 94% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. Furthermore, it's down 33% in about a quarter. That's not much fun for holders.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Titan Petrochemicals Group

Titan Petrochemicals Group isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

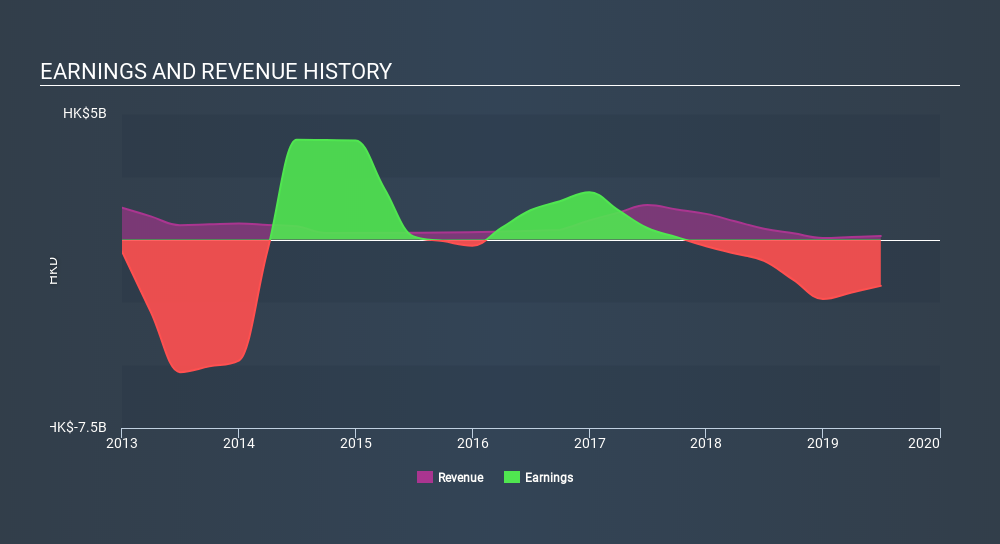

In the last three years Titan Petrochemicals Group saw its revenue shrink by 53% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 61% per year. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Titan Petrochemicals Group shareholders are down 13% for the year, but the broader market is up 2.7%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. However, the loss over the last year isn't as bad as the 61% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: Titan Petrochemicals Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives