- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1138

COSCO SHIPPING Energy Transportation (HKG:1138) Has A Pretty Healthy Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that COSCO SHIPPING Energy Transportation Co., Ltd. (HKG:1138) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for COSCO SHIPPING Energy Transportation

What Is COSCO SHIPPING Energy Transportation's Net Debt?

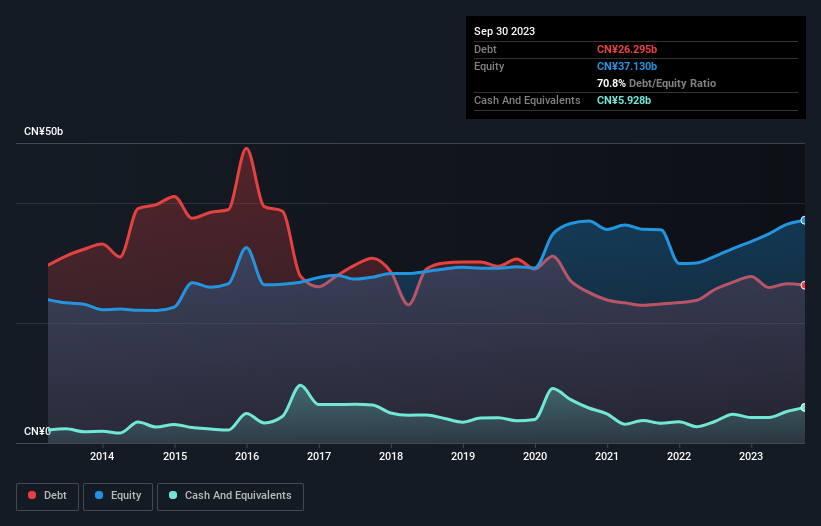

The chart below, which you can click on for greater detail, shows that COSCO SHIPPING Energy Transportation had CN¥26.3b in debt in September 2023; about the same as the year before. On the flip side, it has CN¥5.93b in cash leading to net debt of about CN¥20.4b.

A Look At COSCO SHIPPING Energy Transportation's Liabilities

The latest balance sheet data shows that COSCO SHIPPING Energy Transportation had liabilities of CN¥7.55b due within a year, and liabilities of CN¥27.7b falling due after that. Offsetting this, it had CN¥5.93b in cash and CN¥2.49b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥26.8b.

COSCO SHIPPING Energy Transportation has a market capitalization of CN¥56.6b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

COSCO SHIPPING Energy Transportation's net debt to EBITDA ratio of about 2.3 suggests only moderate use of debt. And its strong interest cover of 57.2 times, makes us even more comfortable. Pleasingly, COSCO SHIPPING Energy Transportation is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 1,757% gain in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if COSCO SHIPPING Energy Transportation can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, COSCO SHIPPING Energy Transportation recorded free cash flow worth 63% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

COSCO SHIPPING Energy Transportation's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its level of total liabilities does undermine this impression a bit. When we consider the range of factors above, it looks like COSCO SHIPPING Energy Transportation is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for COSCO SHIPPING Energy Transportation you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1138

COSCO SHIPPING Energy Transportation

An investment holding company, engages in the transportation of oil and liquefied natural gas (LNG) in People’s Republic of China and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives